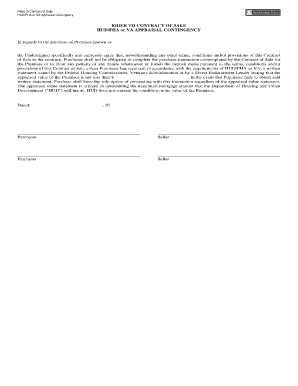

Fha Rider Form

What is the FHA Rider?

The FHA rider is a supplementary document used in real estate transactions involving Federal Housing Administration (FHA) loans. It outlines specific conditions and requirements related to the FHA financing of a property. This form is essential for both buyers and sellers as it ensures compliance with FHA guidelines, which are designed to protect both parties in the transaction. The FHA rider typically includes clauses that address appraisal requirements, mortgage insurance, and the rights of the parties involved.

How to Use the FHA Rider

Using the FHA rider involves including it as part of the purchase agreement when buying or selling a property financed through an FHA loan. It is important to ensure that all parties understand the terms outlined in the rider. The document should be signed by both the buyer and seller, indicating their agreement to the FHA-specific conditions. This rider helps clarify expectations and responsibilities, reducing the likelihood of disputes during the transaction process.

Steps to Complete the FHA Rider

Completing the FHA rider requires careful attention to detail. Here are the steps to follow:

- Obtain the FHA rider form from a reliable source, such as a real estate professional or legal advisor.

- Fill in the necessary information, including the names of the buyer and seller, property details, and loan information.

- Review the specific terms and conditions outlined in the rider, ensuring they align with FHA requirements.

- Both parties should sign and date the document to validate it.

- Keep a copy of the completed FHA rider for your records.

Legal Use of the FHA Rider

The FHA rider is legally binding when properly executed, meaning it must be filled out accurately and signed by all involved parties. Compliance with relevant laws, such as the ESIGN Act and UETA, is crucial to ensure the rider's enforceability. Additionally, the rider should be incorporated into the overall purchase agreement to maintain clarity and legality throughout the transaction. Understanding the legal implications of this document can help protect both buyers and sellers in the real estate process.

Key Elements of the FHA Rider

Several key elements are typically included in the FHA rider, making it an essential component of the FHA loan process. These elements include:

- Appraisal Requirements: Specifies that the property must meet FHA appraisal standards.

- Mortgage Insurance: Outlines the necessity of mortgage insurance premiums for FHA loans.

- Property Condition: Addresses any necessary repairs or conditions that must be met before closing.

- Default and Foreclosure Clauses: Details the consequences of defaulting on the loan.

Examples of Using the FHA Rider

The FHA rider is commonly used in various scenarios within real estate transactions. For instance, when a first-time homebuyer seeks to purchase a home using an FHA loan, the FHA rider is included to ensure compliance with all FHA regulations. Additionally, sellers may use the FHA rider to clarify their obligations regarding property condition and appraisal requirements. This document serves as a safeguard for both parties, ensuring that they adhere to the specific stipulations associated with FHA financing.

Quick guide on how to complete fha rider

Streamline Fha Rider effortlessly on any device

Digital document management has gained signNow traction among enterprises and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any holdups. Manage Fha Rider on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Fha Rider effortlessly

- Obtain Fha Rider and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Fha Rider and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha rider

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FHA rider and how does it work?

An FHA rider is a document that outlines specific terms related to Federal Housing Administration loans. It is typically attached to a primary loan agreement to clarify conditions and obligations tied to FHA financing. Understanding how the FHA rider works is crucial for borrowers to ensure compliance with FHA guidelines.

-

How can airSlate SignNow help with managing FHA riders?

airSlate SignNow provides a seamless platform for electronically signing and managing FHA riders. With its user-friendly interface, you can easily create, send, and store FHA riders securely. This streamline process enhances efficiency and reduces the risk of errors in document handling.

-

What are the benefits of using airSlate SignNow for FHA riders?

Using airSlate SignNow for FHA riders offers numerous benefits, including increased efficiency, cost-effectiveness, and enhanced security. The platform allows for quick signing and processing of documents, ensuring that your FHA rider is executed without delays. Additionally, eSigning provides a digital audit trail, increasing accountability.

-

Is there a cost associated with using airSlate SignNow for FHA riders?

Yes, there is a pricing structure associated with using airSlate SignNow, but it is generally cost-effective compared to traditional methods. With flexible subscription plans, you can choose the option that best fits your business needs for managing FHA riders. The return on investment is signNow when you consider the time and resources saved.

-

Can I integrate airSlate SignNow with other applications for FHA rider management?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your FHA rider management workflows. Popular integrations include CRM tools, document management systems, and cloud storage providers, allowing you to centralize your operations and maintain better organization.

-

What features does airSlate SignNow offer for handling FHA riders?

airSlate SignNow offers a range of features designed for effective handling of FHA riders, including customizable templates, mobile accessibility, and real-time tracking. These features enable you to generate FHA riders quickly and ensure that all parties are informed of the document's status at every stage.

-

Is airSlate SignNow compliant with FHA regulations for riders?

Yes, airSlate SignNow is designed to be compliant with FHA regulations for riders. This compliance helps ensure that the electronic signing process adheres to legal standards, providing peace of mind to users involved in FHA transactions. Utilizing a compliant platform reduces risks associated with non-compliance.

Get more for Fha Rider

- Ap 2 universal application for paad senior gold and other newjersey form

- Part time to full time form

- Registration forms tumwater school district

- Pennsylvania application for the supplemental nutrition form

- 650 8997 10 18 satop comparablle program completion form

- California medical mileage expense form download fillable

- Application for calfresh cash aid andor medi form

- Form 402p

Find out other Fha Rider

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure