Donation Receipt Form

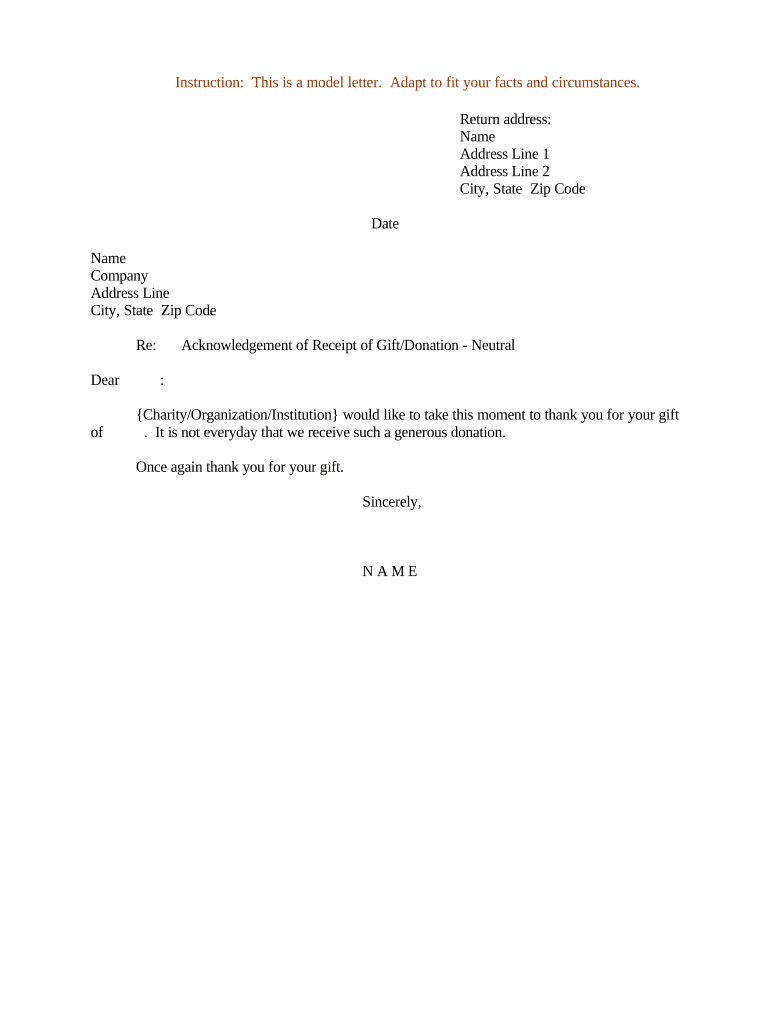

What is the donation receipt?

A donation receipt is a formal document provided by a charitable organization to acknowledge the receipt of a donation. This receipt serves as proof for the donor that a contribution has been made, which is essential for tax purposes. The donation receipt typically includes the name of the charity, the date of the donation, the amount donated, and a statement confirming that no goods or services were provided in exchange for the contribution. This documentation is crucial for individuals or businesses seeking to claim tax deductions for charitable contributions on their tax returns.

Key elements of the donation receipt

To ensure that a donation receipt is valid and meets IRS requirements, it should contain specific key elements:

- Name and address of the charitable organization: This identifies the entity receiving the donation.

- Date of the donation: This marks when the contribution was made.

- Amount of the donation: This specifies how much was donated, whether in cash or non-cash items.

- Description of the donated items: For non-cash contributions, a detailed description is necessary.

- Statement of no goods or services provided: This confirms that the donor did not receive anything in return for their contribution.

- Signature of an authorized representative: This adds legitimacy to the receipt.

How to use the donation receipt

The donation receipt is primarily used for tax purposes. Donors can use the receipt to claim deductions on their federal income tax returns. It is important to keep the receipt in a safe place, as it may be required during tax preparation or in the event of an audit. Donors should also be aware of the specific IRS guidelines regarding the documentation needed for different types of donations, especially for larger contributions or non-cash donations.

Steps to complete the donation receipt

Completing a donation receipt involves several straightforward steps:

- Gather necessary information: Collect details about the donor, the donation amount, and the charity.

- Fill in the receipt: Enter the required information in the appropriate fields, ensuring accuracy.

- Include a statement: Add a statement confirming that no goods or services were exchanged for the donation.

- Obtain a signature: Have an authorized representative of the charity sign the receipt to validate it.

- Provide a copy to the donor: Ensure that the donor receives a copy for their records.

IRS guidelines

The IRS has specific guidelines regarding donation receipts that both donors and charities must follow. For donations over a certain amount, typically $250, the donor must obtain a written acknowledgment from the charity. This acknowledgment must include all the key elements mentioned earlier. Additionally, for non-cash donations valued over $500, donors may need to complete additional forms, such as Form 8283, to report the donation on their tax returns. Understanding these guidelines helps ensure compliance and maximizes the potential tax benefits for donors.

Legal use of the donation receipt

Donation receipts are legally binding documents that serve as proof of a charitable contribution. They must adhere to IRS regulations to be considered valid for tax deduction purposes. Failure to provide a proper receipt can result in the denial of tax deductions for the donor. Charitable organizations are responsible for issuing accurate receipts and maintaining records of all donations received. This legal framework ensures transparency and accountability in charitable giving.

Quick guide on how to complete donation receipt

Complete Donation Receipt effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without holdups. Manage Donation Receipt across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Donation Receipt without any hassle

- Locate Donation Receipt and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize critical sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then hit the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Donation Receipt and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a donation annual receipt for non profits?

A donation annual receipt for non profits is a formal acknowledgment provided to donors, detailing their contributions over the year. This receipt is essential for both record-keeping and tax purposes. It helps non profits maintain transparency and fosters trust with their supporters.

-

How does airSlate SignNow facilitate the issuance of donation annual receipts for non profits?

airSlate SignNow streamlines the process of issuing donation annual receipts for non profits by allowing organizations to create, customize, and send receipts electronically. With our user-friendly interface, non profits can ensure that their donors receive their receipts promptly and efficiently. This saves time and reduces the risk of errors in documentation.

-

What are the pricing options for using airSlate SignNow for donation annual receipts?

airSlate SignNow offers various pricing plans to accommodate the needs of non profits, including a free trial for new users. This flexibility allows organizations to choose a plan that works best for their budget while still providing the features necessary for managing donation annual receipts for non profits effectively. Non profits can also benefit from special discounts on certain plans.

-

Can airSlate SignNow integrate with other platforms to manage donation annual receipts?

Yes, airSlate SignNow integrates seamlessly with several CRM and accounting platforms, enabling non profits to manage their donation annual receipts efficiently. This integration allows for automatic data transfer, reducing manual entry and minimizing the potential for errors. By streamlining these processes, non profits can focus on their mission rather than paperwork.

-

What features does airSlate SignNow provide to ensure security for donation annual receipts?

airSlate SignNow prioritizes security by offering features such as customizable permissions, bank-level encryption, and secure cloud storage for all documents, including donation annual receipts for non profits. These safeguards ensure that sensitive donor information is protected from unauthorized access. Non profits can rest easy knowing their data is secure while maintaining compliance with applicable regulations.

-

How can non profits customize their donation annual receipts with airSlate SignNow?

Non profits can easily customize their donation annual receipts by adding their logo, contact information, and personalized messages using airSlate SignNow’s intuitive template editor. This flexibility ensures that every receipt reflects the organization's branding and maintains a professional appearance. Additionally, custom fields can be added to capture specific donation details.

-

What benefits do non profits gain from using airSlate SignNow for donation annual receipts?

Using airSlate SignNow for donation annual receipts provides non profits with signNow time savings, improved accuracy, and enhanced donor engagement. By automating the process, non profits can issue receipts quickly and keep detailed records with ease. This not only helps with tax compliance but also reinforces a positive relationship with donors.

Get more for Donation Receipt

- Have fully read understand and agree to the terms of this form

- The financial statement disclosures attached as exhibits a and b and form

- Grounds for involuntary termination of parental rights every state the district of columbia american samoa guam the northern form

- Receipt and release personal representative of the form

- Room rental agreement ucsc community rentals form

- Motion for more time to serve other party gn41fpdf form

- Ground lease lessee to construct improvements form

- How does leasing a car workus news ampamp world report form

Find out other Donation Receipt

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement