Form 720vi Fillable

What is the Form 720vi Fillable

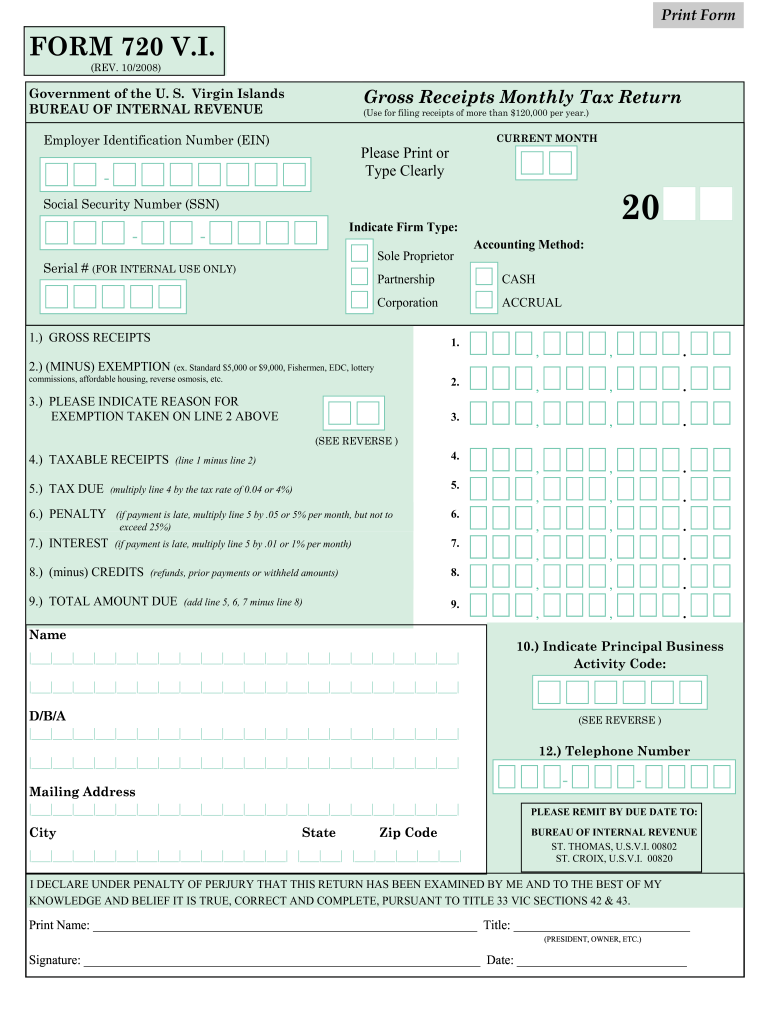

The Form 720vi is a vital document used primarily for reporting gross receipts in the U.S. Virgin Islands. This fillable form allows businesses to accurately declare their earnings, ensuring compliance with local tax regulations. The form is designed to be user-friendly, enabling individuals and organizations to complete it digitally, which simplifies the filing process. The fillable format ensures that users can easily input their information, making it accessible for those who may not be familiar with traditional paper forms.

Steps to Complete the Form 720vi Fillable

Completing the Form 720vi fillable involves several straightforward steps:

- Download the fillable form from an authorized source.

- Open the form using a compatible PDF reader that supports fillable forms.

- Enter your business information, including name, address, and tax identification number.

- Provide details regarding gross receipts, ensuring accuracy to avoid penalties.

- Review all entered information for completeness and correctness.

- Save the completed form to your device.

- Submit the form according to the specified filing methods.

Legal Use of the Form 720vi Fillable

The Form 720vi is legally binding when completed correctly and submitted on time. It is essential for businesses to understand that digital signatures on the form are recognized under U.S. law, provided they comply with regulations such as the ESIGN Act and UETA. This legal framework ensures that electronically signed documents are treated the same as traditional paper documents, provided that the necessary security measures are in place.

Filing Deadlines / Important Dates

Timely filing of the Form 720vi is crucial to avoid penalties. Typically, the form must be submitted by the designated due date, which may vary based on the fiscal year or specific regulations set by the Virgin Islands government. Businesses should keep track of these deadlines to ensure compliance and avoid any late fees. It is advisable to consult the official guidelines or a tax professional for the most current filing dates.

Form Submission Methods

Businesses can submit the Form 720vi through various methods, ensuring flexibility and convenience. The options typically include:

- Online submission through designated government portals.

- Mailing a printed version of the completed form to the appropriate tax authority.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method may depend on the urgency of the filing and the preferences of the business.

Key Elements of the Form 720vi Fillable

Understanding the key elements of the Form 720vi is essential for accurate completion. Important sections include:

- Business identification information, which includes the name and address.

- Gross receipts section, where businesses report their total earnings.

- Signature area, where the authorized representative must sign and date the form.

Each section must be filled out with precision to ensure compliance with local tax laws.

Quick guide on how to complete form 720vi fillable

Effortlessly prepare Form 720vi Fillable on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the proper format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 720vi Fillable on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to modify and electronically sign Form 720vi Fillable with ease

- Find Form 720vi Fillable and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 720vi Fillable and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720vi fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 720vi and how does it relate to airSlate SignNow?

720vi is a powerful electronic signature tool that integrates with airSlate SignNow to streamline the signing process for documents. By utilizing 720vi, users can efficiently send and receive signed documents while ensuring all necessary compliance and security measures are met.

-

What features does airSlate SignNow offer with 720vi?

With 720vi, airSlate SignNow provides features such as customizable templates, secure document storage, and real-time tracking of document status. These features enhance the signing experience and improve workflow efficiency for teams and businesses.

-

How much does airSlate SignNow cost in relation to 720vi?

The pricing for airSlate SignNow, including its 720vi services, is competitive and designed to be cost-effective for businesses of all sizes. Various subscription plans are available, ensuring you can find an option that meets your budget while still benefiting from advanced signing capabilities.

-

Can I integrate 720vi with other applications?

Yes, airSlate SignNow allows seamless integration with various third-party applications alongside 720vi. This compatibility ensures that you can leverage existing tools, enhancing your document management and signing processes.

-

What are the benefits of using 720vi via airSlate SignNow?

Using 720vi with airSlate SignNow provides numerous benefits, including increased efficiency in document handling, enhanced security, and improved collaboration among teams. These benefits contribute to faster turnaround times and higher satisfaction for your clients.

-

Is 720vi suitable for businesses of all sizes?

Absolutely! 720vi within airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises. Whether you need a simple signing solution or a comprehensive document management system, 720vi can scale to meet your needs.

-

How does the signing process work with 720vi in airSlate SignNow?

The signing process with 720vi in airSlate SignNow is user-friendly. Users can upload documents, specify signers, and send requests for signatures via email. Recipients can easily sign the documents from any device, making the process quick and convenient.

Get more for Form 720vi Fillable

- Child and adolescent registration the papillion center form

- Female medical form

- Fillable online worldcare claim form now health

- Cpt code training from the old to the new alameda form

- Biodynamic craniosacral therapy client intake form

- Metabolic monitoring form

- Hmsa facility and ancillary credentialing application form

- Id no military credityesno release know form

Find out other Form 720vi Fillable

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement