PAYG Payment Summary Withholding Form

What is the PAYG Payment Summary Withholding

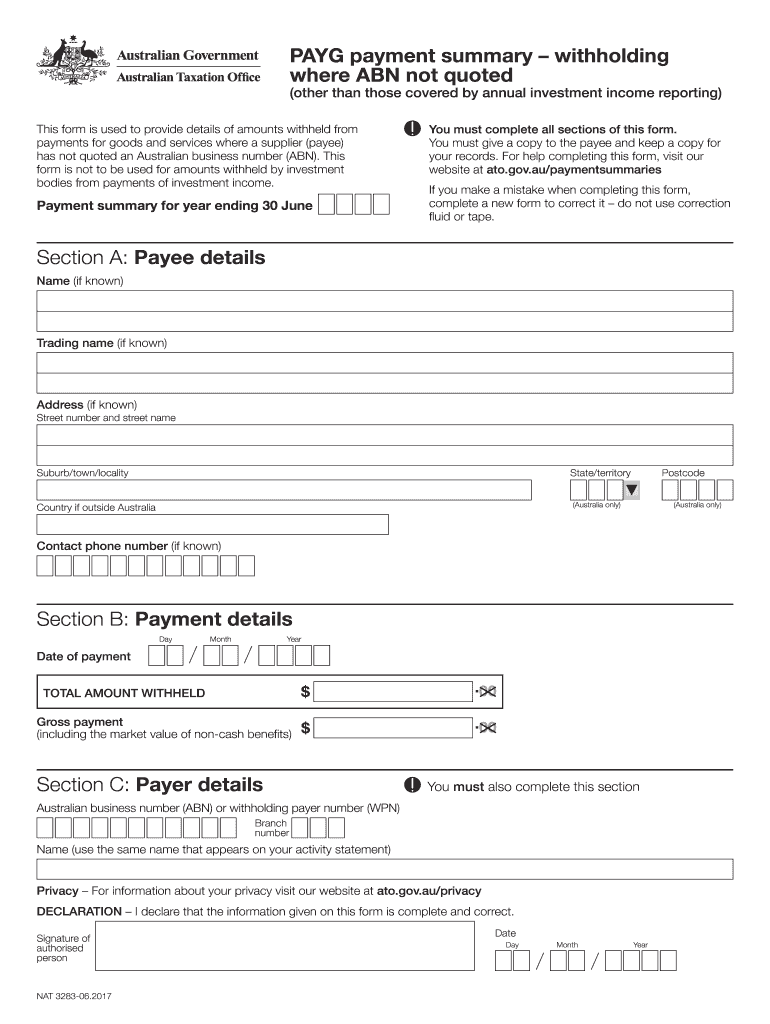

The PAYG Payment Summary Withholding is an essential document used in the United States for reporting income tax withheld from employee wages. This summary provides a detailed account of the total amount of tax withheld by the employer throughout the tax year. It is crucial for employees to accurately report their income and tax obligations when filing their annual tax returns. The PAYG Payment Summary includes information such as the employee's name, address, Social Security number, and the total earnings for the year, along with the amount of tax withheld.

Steps to Complete the PAYG Payment Summary Withholding

Completing the PAYG Payment Summary Withholding involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee details and total earnings. Next, accurately calculate the total tax withheld for the year based on the employee's earnings. It is important to double-check all figures to avoid discrepancies. Once the calculations are complete, fill out the form with the required information, ensuring that all fields are correctly filled. Finally, provide a copy of the completed summary to the employee and retain a copy for your records.

Key Elements of the PAYG Payment Summary Withholding

The PAYG Payment Summary Withholding contains several key elements that are vital for both employers and employees. These elements include:

- Employee Information: Name, address, and Social Security number.

- Total Earnings: The gross income earned by the employee during the tax year.

- Tax Withheld: The total amount of federal income tax withheld from the employee's paychecks.

- Employer Information: Name, address, and Employer Identification Number (EIN).

These components are essential for ensuring that the summary is complete and can be used effectively for tax filing purposes.

Legal Use of the PAYG Payment Summary Withholding

The legal use of the PAYG Payment Summary Withholding is governed by federal tax regulations. Employers are required to provide this summary to employees by a specific deadline, typically by January thirty-first of the following year. This document serves as proof of income and tax withheld, which employees must use when filing their tax returns. Failure to provide accurate summaries can result in penalties for employers, making it crucial to adhere to legal guidelines and ensure compliance with IRS regulations.

Who Issues the Form

The PAYG Payment Summary Withholding is issued by employers to their employees. It is the responsibility of the employer to accurately prepare and distribute this summary at the end of each tax year. Employers must ensure that they have the correct information for each employee and that the summaries are completed in accordance with IRS guidelines. This process helps maintain transparency and ensures that employees have the necessary documentation for their tax filings.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the PAYG Payment Summary Withholding is critical for compliance. Employers must issue the summary to employees by January thirty-first of the year following the tax year in question. Additionally, employers must file the summary with the IRS by the end of February if submitting by mail, or by March thirty-first if filing electronically. Adhering to these deadlines helps avoid penalties and ensures that employees have timely access to their tax information.

Quick guide on how to complete payg payment summary withholding

Effortlessly Prepare PAYG Payment Summary Withholding on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary format and safely store it in the cloud. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without delays. Handle PAYG Payment Summary Withholding on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The easiest way to modify and electronically sign PAYG Payment Summary Withholding effortlessly

- Obtain PAYG Payment Summary Withholding and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, and the hassle of printing new copies due to errors. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and electronically sign PAYG Payment Summary Withholding and ensure optimal communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payg payment summary withholding

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a PAYG summary example?

A PAYG summary example is a document that outlines an employee's earnings and tax withholdings for a tax year. It serves as a valuable reference for tax filing and provides clarity on income received and deductions made. Understanding a PAYG summary example can help users ensure their payroll system aligns with tax regulations.

-

How does airSlate SignNow help with PAYG summaries?

AirSlate SignNow facilitates the easy preparation and distribution of PAYG summaries through its eSigning and document management features. By streamlining the process, users can quickly send PAYG summaries to employees while ensuring compliance and security. This reduces administrative burden, allowing businesses to focus on growth.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes features such as eSigning, customizable templates, and real-time tracking of document status. These tools enable users to create and manage PAYG summaries efficiently. With these capabilities, businesses can ensure timely delivery and accuracy in their PAYG summary documentation.

-

Can I integrate airSlate SignNow with other software for managing PAYG summaries?

Yes, airSlate SignNow offers various integrations with popular accounting and HR software, enhancing the management of PAYG summaries. These integrations streamline the workflow, allowing data to flow between systems seamlessly. This reduces the risk of errors and simplifies the filing process.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow provides competitive pricing plans tailored to suit businesses of all sizes. By choosing the right plan, users can access features that specifically enhance the management of PAYG summaries. A well-priced plan can signNowly reduce overhead costs associated with document handling.

-

How can airSlate SignNow benefit my business in managing PAYG summaries?

By using airSlate SignNow, businesses can experience enhanced efficiency in managing PAYG summaries through automated workflows and electronic signatures. This ensures that documents are processed faster and with fewer errors. Furthermore, users gain the advantage of tracking document progress, ensuring timely compliance with tax requirements.

-

Is there a mobile app for airSlate SignNow to manage PAYG summaries on the go?

Yes, airSlate SignNow offers a mobile app that allows users to manage PAYG summaries anywhere at any time. The app provides the same comprehensive features as the desktop version, including eSigning documents and tracking their status. This flexibility helps businesses remain productive while on the go.

Get more for PAYG Payment Summary Withholding

- Fire certificate completion form

- Real estate transfer tax form city of rolling meadows

- Landlord notice to vacate form

- Driveway approach snow removal form wdundeeorg

- Water and sewage leakage relief application gold coast city goldcoast qld gov form

- Ma payment voucher form

- Certificate of authority form cm 06 final no comas 101512dotx cityofboston

- Special dispensation form california dmv

Find out other PAYG Payment Summary Withholding

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now