Tbs Form 330 302e

What is the TBS Form 330 302e

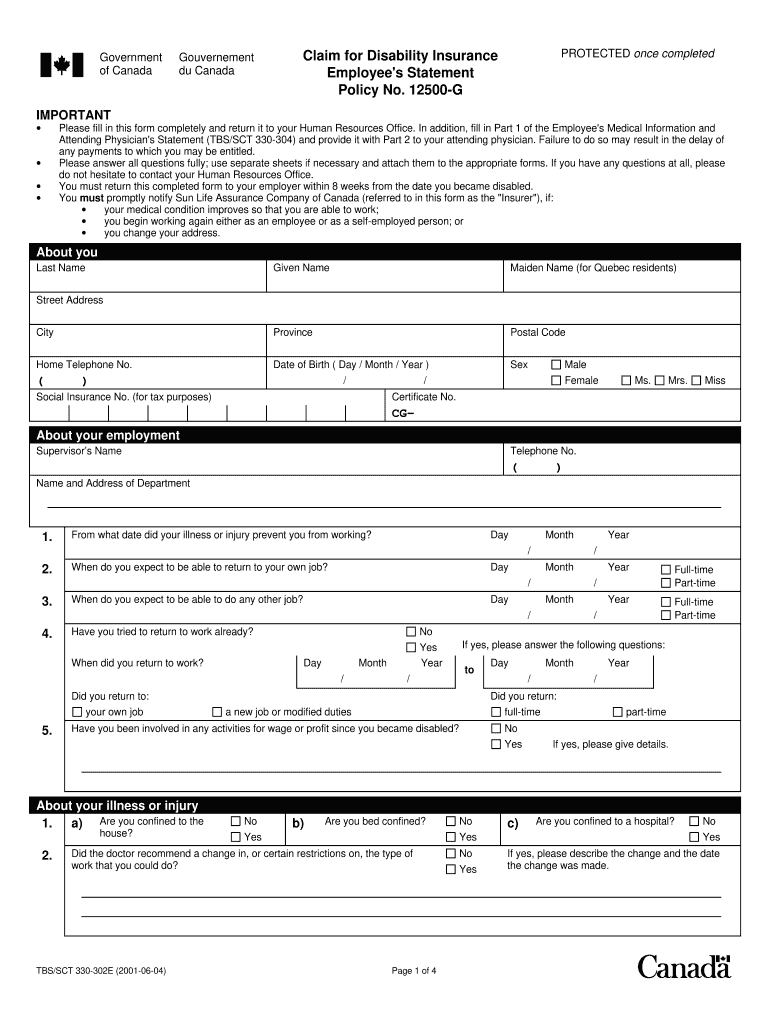

The TBS Form 330 302e is a specific document used in various administrative and legal processes within the United States. This form is essential for individuals or entities that need to provide detailed information for compliance with regulatory requirements. It typically includes sections for personal identification, financial disclosures, and other pertinent data necessary for the processing of applications or requests.

How to use the TBS Form 330 302e

Using the TBS Form 330 302e involves several straightforward steps. First, ensure you have the most recent version of the form, which can often be obtained from official sources. Carefully read the instructions provided with the form to understand the requirements for each section. Fill out the form completely, ensuring all information is accurate and up to date. Once completed, you can submit the form electronically or via traditional mail, depending on the specific guidelines associated with your submission.

Steps to complete the TBS Form 330 302e

Completing the TBS Form 330 302e requires attention to detail. Follow these steps:

- Download the TBS Form 330 302e from an official source.

- Read the instructions carefully to understand what information is required.

- Fill in your personal information, ensuring accuracy.

- Provide any necessary financial information as stipulated in the form.

- Review the completed form for any errors or omissions.

- Submit the form as directed, either online or by mail.

Legal use of the TBS Form 330 302e

The TBS Form 330 302e is legally binding when completed and submitted according to the applicable laws and regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. The form must be signed and dated appropriately, as required, to validate its contents. Compliance with all relevant legal standards is crucial for the form to be accepted by the relevant authorities.

Who Issues the Form

The TBS Form 330 302e is typically issued by a government agency or regulatory body that oversees the specific processes related to the information requested in the form. This could include local, state, or federal agencies, depending on the nature of the form and its intended use. It is advisable to check with the relevant authority to confirm the issuing body and any specific guidelines associated with the form.

Form Submission Methods

Submitting the TBS Form 330 302e can be done through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a designated portal or website.

- Mailing the completed form to the appropriate agency address.

- In-person submission at designated offices or locations.

Quick guide on how to complete tbs form 330 302e

Effortlessly Prepare Tbs Form 330 302e on Any Device

Digital document management has gained traction among organizations and individuals. It presents a perfect environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Tbs Form 330 302e on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Tbs Form 330 302e with Ease

- Find Tbs Form 330 302e and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tbs Form 330 302e and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tbs form 330 302e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tbs form 330 302e?

The tbs form 330 302e is a critical document used for various administrative procedures. Understanding its importance can help streamline your processes and ensure compliance within your organization. Using airSlate SignNow, you can easily send and eSign the tbs form 330 302e, enhancing efficiency.

-

How can I eSign the tbs form 330 302e using airSlate SignNow?

To eSign the tbs form 330 302e with airSlate SignNow, simply upload the document to our platform, add the necessary fields for signatures, and invite signers. Our intuitive interface guides you through each step, ensuring a seamless signing process. Enjoy the simplicity and speed of managing your documents digitally.

-

What pricing options are available for airSlate SignNow's tbs form 330 302e service?

AirSlate SignNow offers various pricing plans to accommodate different needs for managing documents like the tbs form 330 302e. Plans are designed for individuals, small businesses, and enterprises, ensuring cost-effectiveness for all users. Check our website for detailed pricing information and choose a plan that fits your requirements.

-

What features does airSlate SignNow offer for the tbs form 330 302e?

AirSlate SignNow provides numerous features for the tbs form 330 302e, including customizable templates, secure eSigning, and real-time tracking of document status. Our platform enhances collaboration by allowing multiple parties to sign and manage documents efficiently. Explore our features to see how we can improve your document workflow.

-

Are there any benefits to using airSlate SignNow for the tbs form 330 302e?

Yes, using airSlate SignNow for the tbs form 330 302e offers several benefits, including reduced turnaround time, improved accuracy, and enhanced security of sensitive information. Digital signatures provide a legally binding alternative to handwritten signatures while ensuring compliance with laws. Transform your document management with our user-friendly platform.

-

Can airSlate SignNow integrate with other software for managing the tbs form 330 302e?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of software platforms such as CRM, ERP, and productivity tools. This means you can manage the tbs form 330 302e alongside your existing workflows without any hassle. Check our integrations page for more details on compatible tools.

-

Is airSlate SignNow compliant with regulations for the tbs form 330 302e?

Yes, airSlate SignNow is fully compliant with various regulations that govern the use of electronic signatures, including ADA and eIDAS. This compliance ensures that your use of the tbs form 330 302e is legally recognized and secure. Trust our platform to handle your documents with the utmost care and adherence to legal standards.

Get more for Tbs Form 330 302e

- Doh molst form

- Oc 923 workersamp39 compensation board new york state wcb ny form

- Ny state human rights form

- Ny sick leave to form

- Summary of reporting cycle workersamp39 compensation board wcb ny form

- Annual reporting memo workersamp39 compensation board wcb ny form

- C 2f form

- Mg2 medical form ny 2013

Find out other Tbs Form 330 302e

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure