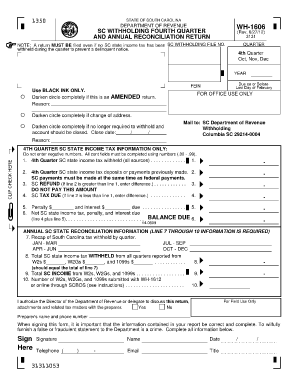

Wh 1606 Form

What is the WH-1606?

The WH-1606 form is a wage and hour compliance document used primarily in the United States. It serves as a request for the Department of Labor to investigate potential violations of wage and hour laws, particularly concerning employee compensation. This form is essential for employees who believe they have not been compensated fairly according to federal and state regulations.

How to Use the WH-1606

Using the WH-1606 form involves several steps to ensure that your complaint is processed correctly. First, gather all relevant information, including details about your employment, the nature of the wage or hour violation, and any supporting documentation. Next, fill out the form accurately, providing specific information about the employer and the issues faced. Finally, submit the completed form to the appropriate local Department of Labor office for review.

Steps to Complete the WH-1606

Completing the WH-1606 form requires careful attention to detail. Follow these steps:

- Provide your personal information, including name, address, and contact details.

- Include details about your employer, such as the company name and address.

- Describe the nature of your complaint, specifying the type of wage or hour violation.

- Attach any supporting documents that substantiate your claim, such as pay stubs or time sheets.

- Review the form for accuracy before submission.

Legal Use of the WH-1606

The WH-1606 form is legally recognized as a formal complaint regarding wage and hour violations. When completed and submitted correctly, it initiates an investigation by the Department of Labor. It is important to remember that filing this form does not guarantee immediate action; however, it is a critical step in seeking justice for wage discrepancies.

IRS Guidelines

While the WH-1606 form is not directly related to tax filings, understanding IRS guidelines is important for employees. Accurate reporting of wages is essential for tax purposes, and discrepancies may lead to issues with the IRS. Employees should ensure that their reported wages match the amounts reflected on their pay stubs and tax documents.

Filing Deadlines / Important Dates

There are no specific deadlines for submitting the WH-1606 form; however, it is advisable to file as soon as a violation is suspected. Prompt action can help in recovering owed wages more effectively. Additionally, employees should be aware of any state-specific deadlines that may apply to wage complaints.

Penalties for Non-Compliance

Employers who fail to comply with wage and hour laws may face significant penalties. These can include back pay for employees, fines imposed by the Department of Labor, and potential legal action. It is crucial for both employees and employers to understand their rights and responsibilities to avoid non-compliance issues.

Quick guide on how to complete wh 1606

Effortlessly prepare Wh 1606 on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Wh 1606 on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Wh 1606 with ease

- Obtain Wh 1606 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Select your preferred method for submitting your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Wh 1606 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 1606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Wh 1606 in relation to airSlate SignNow?

Wh 1606 refers to a specific feature within airSlate SignNow that enhances the electronic signing process. This feature ensures compliance and security while allowing users to manage their documents seamlessly. Understanding Wh 1606 can help streamline your document workflow.

-

How does pricing for Wh 1606 work?

The pricing for airSlate SignNow, including the Wh 1606 feature, is competitive and based on the plan you choose. Our plans are designed to accommodate businesses of all sizes, providing scalability and flexibility. Explore our pricing page to find the best option that includes Wh 1606 for your needs.

-

What are the key benefits of using Wh 1606?

With Wh 1606, users can experience faster turnaround times for document signing, reduced paper usage, and enhanced security. This feature offers an efficient solution that boosts productivity and compliance. Choosing Wh 1606 means your business can benefit from modern document handling solutions.

-

What features does the Wh 1606 offer?

The Wh 1606 feature includes customizable templates, advanced reporting tools, and multi-user capabilities. These functionalities enhance the user experience and enable businesses to tailor their document processes. Leveraging Wh 1606 can transform how you manage and sign documents.

-

Can Wh 1606 integrate with other tools?

Yes, Wh 1606 integrates seamlessly with various tools and platforms, including CRM systems and document management software. This ensures that your existing workflows remain intact while enhancing your electronic signing process. Utilize Wh 1606 to connect your favorite applications.

-

How secure is the Wh 1606 feature?

Security is paramount with airSlate SignNow, and the Wh 1606 feature adheres to the highest industry standards. This ensures that all signed documents are encrypted and stored securely. Your sensitive information remains protected when using Wh 1606 for electronic signatures.

-

Is there a mobile app for Wh 1606?

Absolutely! Wh 1606 is fully accessible through our mobile app, allowing you to manage and sign documents on the go. This mobility ensures that you never miss an important document, no matter where you are. Take advantage of the flexibility offered by Wh 1606.

Get more for Wh 1606

Find out other Wh 1606

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure