Sro How to Create a Digital Duties Form within the Enhanced Duties Online 2015-2026

Understanding the SRO and Its Role

The State Revenue Office (SRO) plays a crucial role in managing revenue collection and compliance for various duties in Victoria. It oversees the administration of taxes and duties, ensuring that businesses and individuals meet their obligations. The SRO provides guidance on legal requirements and facilitates the submission of necessary forms, such as the duties form, which is essential for various transactions.

Steps to Complete the Digital Duties Form

Filling out the digital duties form through the Enhanced Duties Online system is a straightforward process. Begin by accessing the online portal provided by the SRO. You will need to create an account or log in if you already have one. Once logged in, follow these steps:

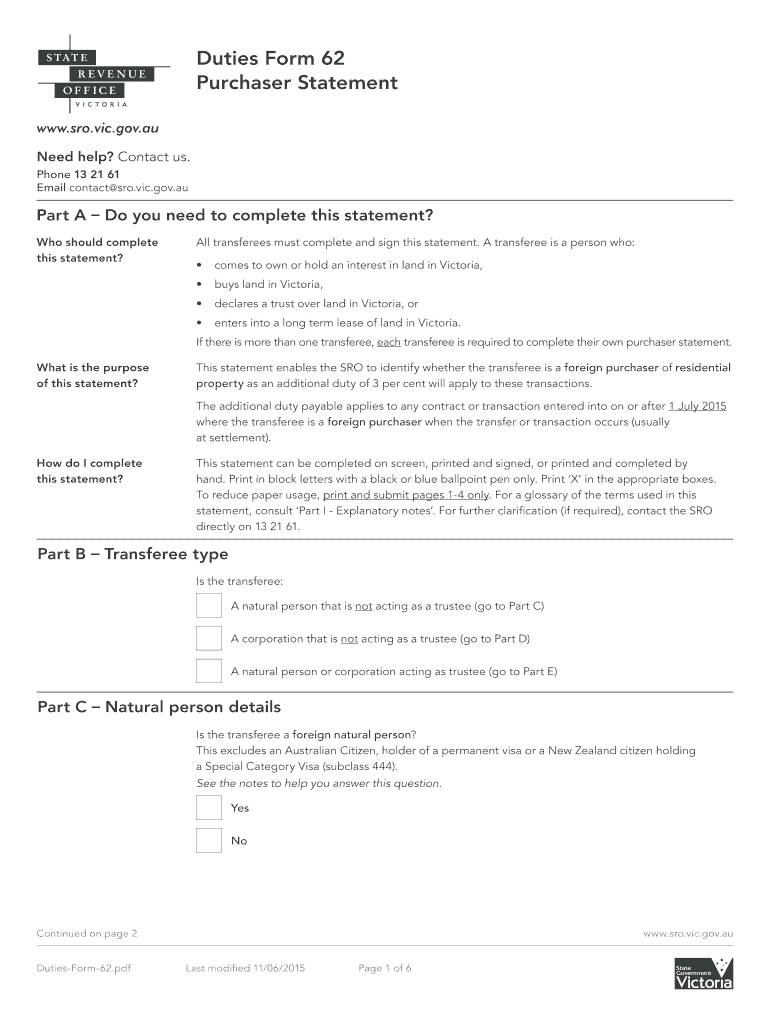

- Choose the appropriate duties form, such as Form 62, based on your transaction type.

- Fill in all required fields accurately, ensuring that all information matches official documents.

- Review your entries for completeness and correctness to avoid any delays or penalties.

- Submit the form electronically through the portal.

Legal Use of the Digital Duties Form

Using the digital duties form is legally valid as long as it complies with the relevant regulations set forth by the SRO. The electronic signature provided through the Enhanced Duties Online system is recognized as valid under U.S. law, ensuring that your submission holds the same weight as a handwritten signature. It is essential to ensure that all information is accurate to avoid any legal complications.

Required Documents for Submission

When preparing to submit the digital duties form, certain documents may be required to support your application. These may include:

- Proof of identity, such as a driver's license or passport.

- Documentation related to the transaction, such as purchase agreements or contracts.

- Any previous correspondence with the SRO regarding your duties.

Having these documents ready will streamline the submission process and help ensure compliance with all requirements.

Penalties for Non-Compliance

Failure to submit the duties form correctly or on time can result in significant penalties. The SRO may impose fines or additional charges for late submissions or inaccuracies. It is crucial to adhere to all deadlines and ensure that the information provided is complete and truthful to avoid these consequences.

Form Submission Methods

The digital duties form can be submitted online through the Enhanced Duties Online portal. This method is efficient and allows for immediate processing. Alternatively, forms can be submitted via mail or in person at designated SRO offices, though these methods may take longer for processing. Online submission is generally recommended for its speed and convenience.

Quick guide on how to complete duties form 62 purchaser statement state revenue office victoria sro vic gov

A concise guide on how to complete your Sro How To Create A Digital Duties Form Within The Enhanced Duties Online

Locating the appropriate template can be a dilemma when you need to submit official international documentation. Even when you possess the necessary form, it may be challenging to swiftly prepare it according to all the specifications if you rely on physical copies instead of handling everything digitally. airSlate SignNow is the web-based eSignature tool that assists you in overcoming all of that. It enables you to select your Sro How To Create A Digital Duties Form Within The Enhanced Duties Online and rapidly fill it out and sign it on the spot without needing to reprint documents in case of any typographical errors.

Here are the actions you must follow to prepare your Sro How To Create A Digital Duties Form Within The Enhanced Duties Online using airSlate SignNow:

- Hit the Get Form button to instantly add your document to our editor.

- Commence with the first blank section, input your information, and proceed with the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to signify the most crucial information.

- Select Image and upload one if your Sro How To Create A Digital Duties Form Within The Enhanced Duties Online requires it.

- Utilize the right-side panel to add additional fields for you or others to complete if necessary.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the form by clicking the Done button and selecting your file-sharing preferences.

Once your Sro How To Create A Digital Duties Form Within The Enhanced Duties Online is prepared, you can distribute it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely archive all your completed documents in your account, organized into folders based on your choices. Don’t spend time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct duties form 62 purchaser statement state revenue office victoria sro vic gov

Create this form in 5 minutes!

How to create an eSignature for the duties form 62 purchaser statement state revenue office victoria sro vic gov

How to create an eSignature for the Duties Form 62 Purchaser Statement State Revenue Office Victoria Sro Vic Gov in the online mode

How to generate an eSignature for your Duties Form 62 Purchaser Statement State Revenue Office Victoria Sro Vic Gov in Google Chrome

How to generate an electronic signature for putting it on the Duties Form 62 Purchaser Statement State Revenue Office Victoria Sro Vic Gov in Gmail

How to generate an eSignature for the Duties Form 62 Purchaser Statement State Revenue Office Victoria Sro Vic Gov right from your smartphone

How to generate an eSignature for the Duties Form 62 Purchaser Statement State Revenue Office Victoria Sro Vic Gov on iOS devices

How to create an eSignature for the Duties Form 62 Purchaser Statement State Revenue Office Victoria Sro Vic Gov on Android OS

People also ask

-

What is the role of airSlate SignNow in managing victoria state revenue documents?

airSlate SignNow provides a streamlined platform for businesses to manage documents related to victoria state revenue efficiently. With features like eSignature and document templates, users can ensure compliance and save time on administrative tasks.

-

How does airSlate SignNow help in reducing costs associated with victoria state revenue management?

By utilizing airSlate SignNow, businesses can signNowly cut down on paper usage and traditional mailing costs related to victoria state revenue documentation. This cost-effective solution enhances operational efficiency while ensuring compliance with state regulations.

-

What features of airSlate SignNow support victoria state revenue tracking?

airSlate SignNow offers features such as document tracking and status notifications that are crucial for managing victoria state revenue requirements effectively. This allows users to monitor their documents and ensure timely submissions.

-

Is airSlate SignNow compliant with victoria state revenue regulations?

Yes, airSlate SignNow is designed with compliance in mind, including adherence to victoria state revenue requirements. Users can confidently create, send, and sign documents while ensuring they meet necessary state guidelines.

-

What integrations does airSlate SignNow offer that benefit victoria state revenue processes?

airSlate SignNow integrates seamlessly with various platforms like Google Workspace and Salesforce, enhancing its utility for managing victoria state revenue documentation. These integrations facilitate easy access and collaboration on important documents.

-

Can I customize templates for victoria state revenue submissions in airSlate SignNow?

Absolutely! airSlate SignNow allows users to create and customize templates specifically tailored for victoria state revenue submissions. This feature ensures that all required fields and information are consistently included in documents.

-

What are the pricing options available for airSlate SignNow regarding victoria state revenue documentation?

airSlate SignNow offers flexible pricing plans suitable for various business sizes looking to streamline their victoria state revenue processes. Users can choose from tiered plans based on their specific needs for features and document volume.

Get more for Sro How To Create A Digital Duties Form Within The Enhanced Duties Online

Find out other Sro How To Create A Digital Duties Form Within The Enhanced Duties Online

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed