Duties under Duress Form

What is the duties under duress form?

The duties under duress form is a legal document that outlines obligations or responsibilities that were agreed upon under pressure or threat. This form is often used in situations where an individual may not have freely consented to the terms, which can include contracts or agreements made under coercive circumstances. It serves to protect individuals by documenting the context in which the agreement was made, ensuring that any obligations acknowledged are recognized as potentially invalid due to the duress involved.

How to use the duties under duress form

Using the duties under duress form involves several steps to ensure that it accurately reflects the situation. First, gather all relevant information regarding the circumstances that led to the agreement. This includes details about the parties involved, the specific duties agreed upon, and the nature of the duress experienced. Next, fill out the form with this information, ensuring clarity and accuracy. Once completed, the form should be signed by all parties involved, preferably in the presence of a witness, to enhance its validity.

Key elements of the duties under duress form

Several key elements must be included in the duties under duress form to ensure its effectiveness. These elements typically include:

- Identification of Parties: Names and contact information of all individuals involved.

- Description of Duties: A clear outline of the duties or obligations being agreed upon.

- Details of Duress: A description of the circumstances that constituted duress, including any threats or coercive actions.

- Signatures: Signatures of all parties, indicating their acknowledgment of the form's content.

- Date: The date on which the form was completed and signed.

Steps to complete the duties under duress form

Completing the duties under duress form involves a series of methodical steps:

- Gather Information: Collect all necessary details about the agreement and the duress experienced.

- Fill Out the Form: Accurately input the gathered information into the form.

- Review: Carefully review the completed form to ensure all information is correct and complete.

- Sign the Form: Have all parties sign the form, ideally in the presence of a witness.

- Store Safely: Keep a copy of the signed form in a secure location for future reference.

Legal use of the duties under duress form

The duties under duress form can be critical in legal contexts, particularly in disputes regarding the validity of contracts. Courts may consider the form as evidence of the circumstances surrounding the agreement. It is important to understand that while this form can document the duress, its acceptance as a legal defense may vary based on jurisdiction and the specific details of the case. Therefore, consulting with a legal professional before using this form in any legal proceedings is advisable.

Examples of using the duties under duress form

Examples of situations where the duties under duress form may be applicable include:

- Contracts signed under threat of violence.

- Agreements made under extreme pressure from an employer or superior.

- Situations where one party is coerced into signing documents due to financial threats.

These examples illustrate the form's importance in documenting the context of agreements that may not reflect the true intent of the parties involved.

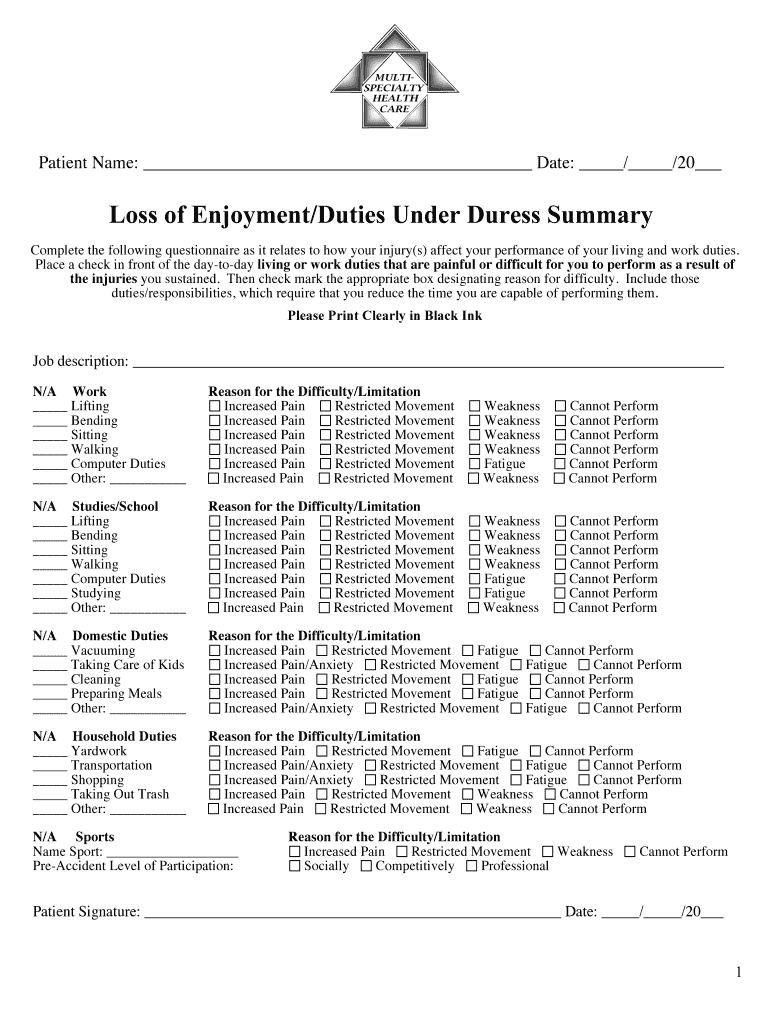

Quick guide on how to complete loss of enjoymentduties under duress summary multi specialty

The simplest method to discover and authorize Duties Under Duress

Within the scope of a whole organization, inefficient procedures concerning document approval can consume a signNow amount of productive time. Signing papers like Duties Under Duress is an inherent aspect of operations across any sector, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall efficiency of the company. With airSlate SignNow, executing your Duties Under Duress is as straightforward and rapid as possible. This platform offers the most current version of almost any form. Even better, you can sign it instantly without the necessity of installing external software on your device or printing any physical copies.

How to obtain and endorse your Duties Under Duress

- Browse our collection by category or use the search box to find the document you require.

- View the form preview by clicking Learn more to confirm it's the correct one.

- Click Get form to begin modifying immediately.

- Fill out your form and input any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Duties Under Duress.

- Choose the signature option that suits you best: Draw, Create initials, or upload an image of your written signature.

- Click Done to finish editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything necessary to handle your documents effectively. You can find, complete, modify, and even dispatch your Duties Under Duress all in one tab effortlessly. Enhance your processes by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the loss of enjoymentduties under duress summary multi specialty

How to create an eSignature for the Loss Of Enjoymentduties Under Duress Summary Multi Specialty online

How to create an electronic signature for the Loss Of Enjoymentduties Under Duress Summary Multi Specialty in Google Chrome

How to generate an electronic signature for putting it on the Loss Of Enjoymentduties Under Duress Summary Multi Specialty in Gmail

How to generate an electronic signature for the Loss Of Enjoymentduties Under Duress Summary Multi Specialty straight from your smart phone

How to make an eSignature for the Loss Of Enjoymentduties Under Duress Summary Multi Specialty on iOS devices

How to create an eSignature for the Loss Of Enjoymentduties Under Duress Summary Multi Specialty on Android

People also ask

-

What is a duties under duress form?

A duties under duress form is a legal document used to articulate the circumstances under which an individual was compelled to perform certain actions. This form is critical in scenarios where consent or agreement is questioned, ensuring that any implications of coercion are documented.

-

How can airSlate SignNow help me with a duties under duress form?

AirSlate SignNow allows you to create, send, and electronically sign a duties under duress form with ease. Our platform ensures that your documents are secure and legally binding, giving you confidence in the validity of your agreements.

-

Is there a cost associated with using airSlate SignNow for duties under duress forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit your business needs for handling duties under duress forms. Each plan includes robust features for document management and e-signatures, making it a cost-effective solution for your business.

-

What features does airSlate SignNow provide for managing duties under duress forms?

AirSlate SignNow offers features like customizable templates for duties under duress forms, real-time tracking of document status, and automatic reminders for recipients. These tools streamline the signing process and help ensure timely completion.

-

Can I integrate airSlate SignNow with other applications for duties under duress forms?

Absolutely! AirSlate SignNow integrates seamlessly with various applications to enhance the management of your duties under duress forms. You can connect it with CRM systems, cloud storage, and productivity tools for a more efficient workflow.

-

What benefits does using airSlate SignNow provide for creating duties under duress forms?

Using airSlate SignNow for your duties under duress forms saves time and improves accuracy. The platform eliminates the need for physical paperwork and enables quick electronic signatures, reducing delays in finalizing important documents.

-

Is it legally binding to use airSlate SignNow for a duties under duress form?

Yes, documents signed through airSlate SignNow, including duties under duress forms, are legally binding as per e-signature laws. Our platform complies with all required regulations, ensuring that your agreements hold up in legal contexts.

Get more for Duties Under Duress

Find out other Duties Under Duress

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe