Irs Form 1444

What is the IRS Form 1444?

The IRS Form 1444 is a document used by the Internal Revenue Service to communicate information regarding Economic Impact Payments (EIPs) to taxpayers. This form serves as a notice to individuals who received a payment under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The form provides details about the amount received, which is essential for taxpayers when filing their federal income tax returns. Understanding the specifics of this form can help ensure that taxpayers accurately report their income and claim any eligible credits.

How to Use the IRS Form 1444

Using the IRS Form 1444 involves understanding its purpose and how it relates to your tax filings. Taxpayers should keep this form with their tax records as it contains important information about the Economic Impact Payments received. When filing your taxes, refer to the amount listed on the form to accurately report your income and determine if you qualify for any additional credits. This ensures compliance with IRS regulations and helps avoid potential issues during tax season.

Steps to Complete the IRS Form 1444

Completing the IRS Form 1444 does not require any action from the taxpayer, as the IRS issues this form automatically to individuals who received an Economic Impact Payment. However, it is important to review the form carefully. If there are discrepancies in the amount listed or if you did not receive a payment but believe you are eligible, you should contact the IRS for clarification. Keeping this form accessible during tax preparation is crucial for accurate reporting.

Legal Use of the IRS Form 1444

The IRS Form 1444 is legally binding as it provides official documentation of the Economic Impact Payments received by taxpayers. It is essential for individuals to retain this form as part of their tax records. The information contained within the form must be used in accordance with IRS guidelines to ensure compliance. Misreporting the information from this form can lead to penalties or issues with future tax filings.

Eligibility Criteria for the IRS Form 1444

Eligibility for the IRS Form 1444 is primarily based on the criteria set forth in the CARES Act, which includes factors such as income level, filing status, and citizenship status. Generally, U.S. citizens and qualifying residents who meet specific income thresholds are eligible to receive Economic Impact Payments. It is important for taxpayers to review their eligibility to ensure they receive the correct amount and properly report it on their tax returns.

Filing Deadlines / Important Dates

Understanding the filing deadlines related to the IRS Form 1444 is crucial for taxpayers. The Economic Impact Payments were distributed in multiple phases, and the IRS has set specific deadlines for tax filings that include these payments. Taxpayers should be aware of the tax filing deadline, typically April 15, to ensure they report their Economic Impact Payments accurately. Keeping track of these dates helps avoid penalties and ensures compliance with IRS regulations.

Required Documents for IRS Form 1444

When dealing with the IRS Form 1444, taxpayers should have several documents on hand to support their tax filings. These may include prior year tax returns, proof of income, and any correspondence from the IRS regarding Economic Impact Payments. Having these documents readily available can streamline the tax preparation process and ensure that all information reported is accurate and complete.

Quick guide on how to complete irs form 1444

Complete Irs Form 1444 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, alter, and eSign your documents swiftly without delays. Manage Irs Form 1444 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Irs Form 1444 with minimal effort

- Locate Irs Form 1444 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your device of choice. Alter and eSign Irs Form 1444 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1444

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

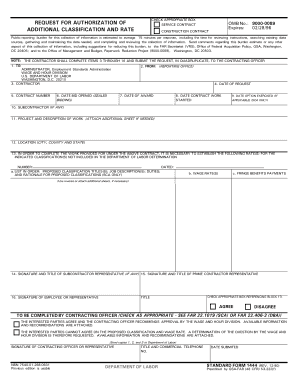

What is sf1444?

The sf1444 refers to a specific form used in various business contexts, particularly for submitting information to federal agencies. By integrating the sf1444 process into your workflow, airSlate SignNow allows you to streamline document handling, ensuring your submissions are efficient and compliant.

-

How does airSlate SignNow simplify the sf1444 process?

airSlate SignNow simplifies the sf1444 process by providing a user-friendly interface for filling and eSigning documents online. With features like reusable templates and automated reminders, businesses can eliminate errors and reduce the time spent on paperwork.

-

Is airSlate SignNow cost-effective for handling sf1444 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing sf1444 forms. With various pricing plans tailored to different business sizes, companies can choose the option that best fits their budget while benefiting from powerful features to enhance their document workflows.

-

Can I integrate other applications with airSlate SignNow for sf1444?

Absolutely! airSlate SignNow allows seamless integration with various applications, making it easier to manage your sf1444 forms alongside your existing systems. Whether it's CRM software or cloud storage solutions, these integrations enhance productivity and keep your workflows smooth.

-

What security measures are in place for handling sf1444 documents?

airSlate SignNow employs advanced security measures, including encryption and secure access protocols, to protect your sf1444 documents. This ensures that your sensitive information remains safe during transmission and storage, giving you peace of mind.

-

How can airSlate SignNow benefit my business with sf1444 submissions?

By using airSlate SignNow for sf1444 submissions, your business can enjoy faster processing times, reduced paperwork, and improved compliance. This efficient handling of documents allows you to focus more on core business operations rather than administrative tasks.

-

Is there customer support available for questions about sf1444?

Yes, airSlate SignNow offers dedicated customer support to assist you with any inquiries regarding sf1444 and other features. Whether you have technical questions or need guidance on using the software, our support team is ready to help you succeed.

Get more for Irs Form 1444

Find out other Irs Form 1444

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast