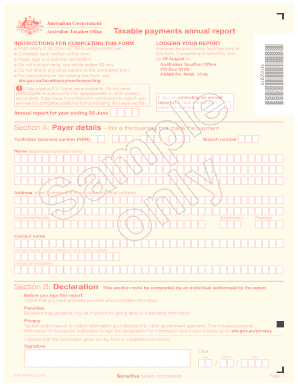

Taxable Payments Annual Report Form PDF

What is the Taxable Payments Annual Report Form PDF

The Taxable Payments Annual Report Form PDF, commonly referred to as the TPAR form, is a crucial document used by businesses in the United States to report certain payments made to contractors and suppliers. This form is essential for ensuring compliance with tax regulations and helps the Internal Revenue Service (IRS) track taxable payments. The TPAR form provides detailed information about the nature of the payments, the recipients, and the total amounts disbursed during the reporting period.

How to use the Taxable Payments Annual Report Form PDF

Using the Taxable Payments Annual Report Form PDF involves several steps to ensure accurate reporting. First, download the form from a reliable source. Once downloaded, gather all necessary information, including the names, addresses, and taxpayer identification numbers of the recipients. Fill in the required fields, ensuring that all amounts are accurate and correspond to your records. After completing the form, review it for any errors before submission. This careful process helps maintain compliance and avoid potential penalties.

Steps to complete the Taxable Payments Annual Report Form PDF

Completing the Taxable Payments Annual Report Form PDF requires attention to detail. Follow these steps:

- Download the TPAR form from a trusted source.

- Collect all relevant payment information, including recipient details and payment amounts.

- Fill in the form, ensuring accuracy in all entries.

- Double-check the information for any discrepancies.

- Submit the completed form to the appropriate tax authority by the designated deadline.

Legal use of the Taxable Payments Annual Report Form PDF

The Taxable Payments Annual Report Form PDF is legally binding when completed correctly and submitted on time. It must adhere to IRS guidelines and comply with relevant tax laws. Accurate reporting of payments ensures that businesses fulfill their legal obligations and avoid potential audits or penalties. Additionally, the form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Taxable Payments Annual Report Form PDF are critical for compliance. Typically, the form must be submitted by January 31 of the year following the reporting period. It is important to stay informed about any changes to deadlines, as they can vary from year to year. Missing the deadline may result in penalties, so timely submission is essential for all businesses.

Who Issues the Form

The Taxable Payments Annual Report Form PDF is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. The IRS provides guidelines on how to complete the form and the necessary information required for accurate reporting. Businesses should refer to IRS resources for the most current information regarding the TPAR form.

Quick guide on how to complete taxable payments annual report form pdf

Effortlessly Prepare Taxable Payments Annual Report Form Pdf on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Taxable Payments Annual Report Form Pdf on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Taxable Payments Annual Report Form Pdf with Ease

- Find Taxable Payments Annual Report Form Pdf and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Taxable Payments Annual Report Form Pdf and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxable payments annual report form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tpar form pdf and how can I use it?

A tpar form pdf is a standardized document format that can be easily shared and filled out electronically. By using airSlate SignNow, you can securely create, send, and eSign your tpar form pdf, streamlining your document management process.

-

How does airSlate SignNow enhance the use of tpar form pdfs?

airSlate SignNow allows users to customize and edit their tpar form pdfs. With features such as eSignature, real-time tracking, and automated workflows, managing your tpar form pdf becomes efficient and hassle-free.

-

Is there a cost associated with using tpar form pdfs on airSlate SignNow?

While the ability to create and manage tpar form pdfs is included in airSlate SignNow's subscription plans, specific pricing may vary. We recommend checking our pricing page for details on plans that include comprehensive features tailored for your needs.

-

Can I integrate my existing systems with airSlate SignNow for tpar form pdf?

Yes, airSlate SignNow offers various integrations with popular applications. This allows you to seamlessly connect your existing systems to streamline the process of sending and managing tpar form pdfs.

-

What are the key benefits of using airSlate SignNow for tpar form pdf?

The primary benefits of using airSlate SignNow for tpar form pdf include improved efficiency, reduced errors, and enhanced security. Our solutions are designed to simplify the signing process, allowing you to focus on other important tasks.

-

Is it possible to track the status of my tpar form pdf?

Absolutely! airSlate SignNow includes features that allow you to track the status of your tpar form pdf in real-time. You can receive notifications when your document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

How can airSlate SignNow help ensure the security of my tpar form pdf?

airSlate SignNow employs advanced security measures, including encryption and secure access protocols, to protect your tpar form pdf and sensitive information. We prioritize your data security, providing peace of mind while you manage essential documents.

Get more for Taxable Payments Annual Report Form Pdf

Find out other Taxable Payments Annual Report Form Pdf

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online