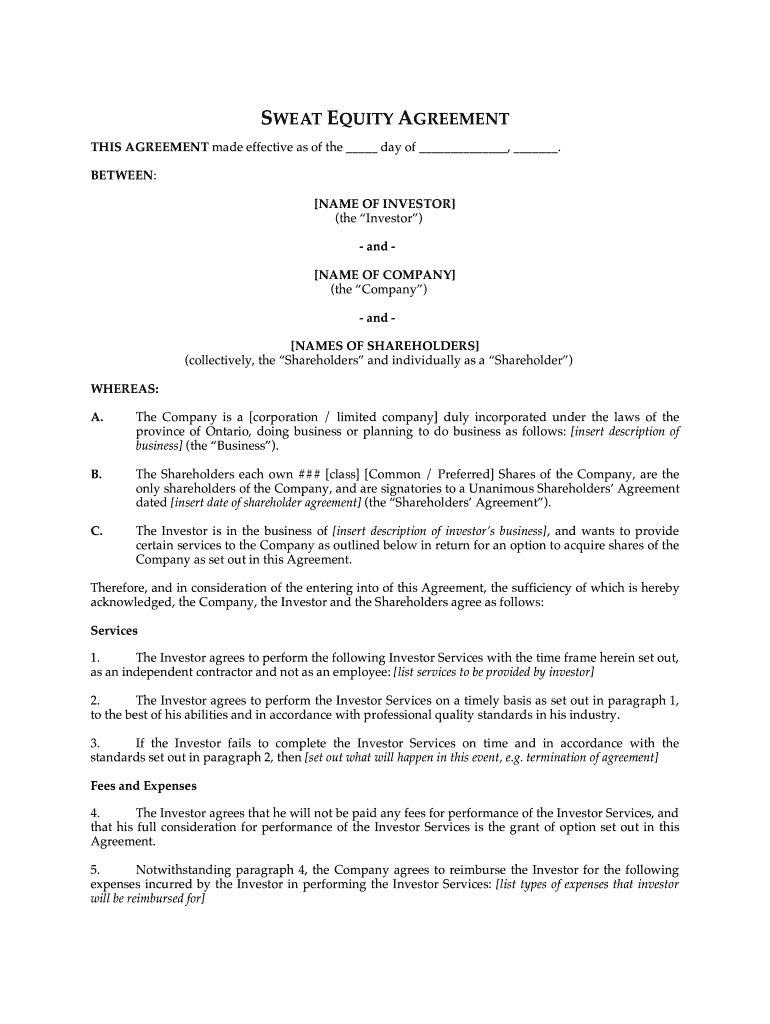

Sweat Equity Agreement Form

What is the Sweat Equity Agreement

A sweat equity agreement is a legal document that outlines the terms under which an individual or group contributes their labor and expertise to a business in exchange for equity ownership. This type of agreement is especially common in startups and small businesses where cash resources may be limited. The document specifies the value of the work performed, the percentage of equity granted, and any conditions attached to the equity ownership. It serves as a formal recognition of the contributions made by individuals who may not have the financial means to invest in the business but are willing to invest their time and skills.

Key elements of the Sweat Equity Agreement

Understanding the key elements of a sweat equity agreement is essential for both parties involved. Important components typically include:

- Parties involved: Clearly identify the individuals or entities participating in the agreement.

- Scope of work: Outline the specific tasks, responsibilities, and contributions expected from the individual providing sweat equity.

- Valuation: State how the value of the sweat equity is determined, including any metrics or benchmarks used.

- Equity percentage: Specify the percentage of ownership granted in exchange for the contributions made.

- Vesting schedule: Detail any vesting periods or conditions that must be met for the equity to be fully granted.

- Termination conditions: Outline the circumstances under which the agreement may be terminated and the implications for equity ownership.

Steps to complete the Sweat Equity Agreement

Completing a sweat equity agreement involves several key steps to ensure clarity and legality. The process typically includes:

- Drafting the agreement: Begin by creating a draft that includes all necessary elements, ensuring that both parties understand their rights and obligations.

- Reviewing legal requirements: Consult with a legal professional to ensure compliance with state laws and regulations that may affect the agreement.

- Negotiating terms: Engage in discussions to negotiate terms that are fair and acceptable to both parties.

- Signing the agreement: Once both parties agree on the terms, sign the document to make it legally binding.

- Storing the agreement: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the Sweat Equity Agreement

The legal use of a sweat equity agreement hinges on its ability to clearly define the relationship between the parties involved. It must comply with applicable laws, including contract law and any specific regulations related to equity ownership. The agreement should be detailed enough to prevent misunderstandings and disputes. It is advisable to have the document reviewed by a legal expert to ensure that it meets all legal requirements and adequately protects the interests of both parties.

Examples of using the Sweat Equity Agreement

There are various scenarios in which a sweat equity agreement can be beneficial. Common examples include:

- Startups: Entrepreneurs may offer sweat equity to co-founders or early employees who contribute significant work to launch the business.

- Non-profits: Organizations may use sweat equity agreements to formalize the contributions of volunteers who bring valuable skills to the mission.

- Real estate projects: Investors may grant equity to contractors or developers who provide labor and expertise in exchange for a share of the profits.

Quick guide on how to complete sweat equity agreement megadoxcom

The simplest method to locate and endorse Sweat Equity Agreement

Across your entire organization, ineffective workflows related to paper approvals can drain signNow work hours. Approving documents like Sweat Equity Agreement is a standard aspect of business in every sector, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall efficiency of the company. With airSlate SignNow, endorsing your Sweat Equity Agreement can be as straightforward and quick as possible. This platform provides you access to the latest version of nearly any form. Even better, you can endorse it instantly without having to install external applications on your computer or printing out hard copies.

Steps to obtain and endorse your Sweat Equity Agreement

- Browse our library by category or utilize the search box to locate the document you require.

- Check the form preview by clicking on Learn more to confirm it is the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and incorporate any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Sweat Equity Agreement.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options if needed.

With airSlate SignNow, you possess everything required to manage your documentation efficiently. You can discover, complete, edit, and even distribute your Sweat Equity Agreement all in one tab with no complications. Streamline your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

When someone is working for sweat equity what type of legal forms need to be filled out so that it can be paid later?

My recommendations for a Sweat Equity deal done right would be as follows:Background - Read all about what Sweat Equity is and the various types of Sweat Equity at Sweat Equity 101The Terms - Most Sweat Equity arrangements get off to a bad start without full clarity on exactly what the deliverables are going to be by the person contributing sweat equity (the “Consultant”), the value of that contribution by the Consultant, and how that value will be compensated by the Company (there are many different forms of paying for sweat equity). Once the Terms are clarified, then we can move on to the Documentation.The Documentation - The proper documentation in terms of the legal forms should include the following:Sweat Equity Agreement - The core consulting agreement between the Company and the Consultant that spells out the overall arrangement and refers to each individual Statement of WorkStatement of Work - The agreement that clearly outlines the specific work to be done by the Consultant in exchange for the Sweat Equity or a combination of Cash and Sweat Equity. This should be very clear on the deliverables and the specific value of those deliverables in very small chunks of work to avoid the vague “I’ll build the app in exchange for owning 25% of the company”Proprietary Information and Inventions Agreement - The detailed confidentiality agreement that also makes clear that the Consultant’s work is owned by the CompanyThe proper form of agreement that covers the specific type of Sweat Equity, which may be one of many forms:Amendment to the Organization Documents - If issuing additional founder’s equity, then the Operating Agreement or Charter should be amended to cover the issuance of additional equity and adding a shareholder or memberStock Warrant - If issuing equity under a warrant with an agreed upon strike priceSAFE Agreement - If the sweat equity will be granted in a SAFE (Simple Agreement for Future Equity) whereby the Consultant gets the equity as part of the next investment roundConvertible Note Agreement - If the sweat equity will be granted in a Convertible Note whereby the Consultant holds a note that converts into equity as part of the next investment roundRoyalty Agreement - If the sweat equity will be paid through a Royalty or revenue share agreement where the Consultant gets paid via a revenue royaltyStock Purchase Agreement - If the sweat equity will be paid through a stock purchase agreement and Bill of Sale (be careful of the notion of just “granting equity” in exchange for sweat equity as it creates a taxable event)I would generally recommend avoiding stock options or unit appreciation rights at the sweat equity stage since the Consultant is usually an independent contractor and not an employee. (That’s why I recommend a Warrant as one of the forms of payment instead of Options.)Here’s an easy-to-use app to quickly put together an iron-clad Sweat Equity agreement at SweatEquity.com

-

How do I treat unrealized losses in equity for ITR? Which form should I fill out?

There is no procedure for set of unrealized losses in equity from other profit. The actual losses can be set of against the profit of other equities. For the purpose of profit or losses in the transaction of equity, the form no.3 should be filed.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the sweat equity agreement megadoxcom

How to create an electronic signature for the Sweat Equity Agreement Megadoxcom online

How to make an electronic signature for your Sweat Equity Agreement Megadoxcom in Google Chrome

How to make an eSignature for putting it on the Sweat Equity Agreement Megadoxcom in Gmail

How to make an eSignature for the Sweat Equity Agreement Megadoxcom straight from your smartphone

How to make an eSignature for the Sweat Equity Agreement Megadoxcom on iOS devices

How to make an eSignature for the Sweat Equity Agreement Megadoxcom on Android

People also ask

-

What is a Sweat Equity Agreement?

A Sweat Equity Agreement is a legal document that outlines the terms under which an individual contributes their time and effort to a business in exchange for equity or ownership. This agreement helps clarify expectations between founders and investors, ensuring that all parties understand the value of non-monetary contributions. Using airSlate SignNow, you can easily create and manage your Sweat Equity Agreement digitally.

-

How does airSlate SignNow help with creating a Sweat Equity Agreement?

airSlate SignNow provides an intuitive platform that allows you to create, edit, and eSign your Sweat Equity Agreement quickly and efficiently. With customizable templates and a user-friendly interface, you can ensure your agreement meets all legal requirements while streamlining the signing process. This enhances collaboration among team members and investors.

-

What features does airSlate SignNow offer for managing Sweat Equity Agreements?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure document storage, all of which are essential for managing your Sweat Equity Agreement. Additionally, you can track the status of your agreements and receive notifications when they are signed, making it easier to stay organized and efficient.

-

Is airSlate SignNow cost-effective for startups needing a Sweat Equity Agreement?

Yes, airSlate SignNow is designed to be a cost-effective solution for startups looking to draft and manage a Sweat Equity Agreement. With flexible pricing plans, you can select the one that best fits your business needs, ensuring that you have access to the tools necessary for effective document management without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for my Sweat Equity Agreement?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications such as Google Drive, Dropbox, and CRM systems. This means you can easily incorporate your Sweat Equity Agreement into your existing workflow, enhancing productivity and ensuring all your documents are easily accessible.

-

How secure is my Sweat Equity Agreement when using airSlate SignNow?

Security is a top priority for airSlate SignNow. Your Sweat Equity Agreement is protected with advanced encryption protocols and secure data storage, ensuring that all sensitive information remains confidential. Additionally, user authentication and audit trails provide extra layers of security for your documents.

-

What are the benefits of using airSlate SignNow for my Sweat Equity Agreement?

Using airSlate SignNow for your Sweat Equity Agreement offers numerous benefits, including time savings, reduced paperwork, and improved collaboration. The digital platform allows for quick edits and instant eSignatures, making it easier to finalize agreements and keep your business moving forward efficiently.

Get more for Sweat Equity Agreement

Find out other Sweat Equity Agreement

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template