What is a T1 Form

What is a T1 Form?

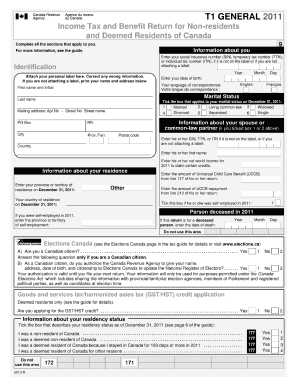

The T1 form, also known as the T1 general, is the primary tax return form used by individuals in Canada to report their income and calculate their taxes owed. It is essential for residents and citizens to file this form annually to comply with tax regulations. The T1 form includes various sections where taxpayers must provide information about their income sources, deductions, and credits. Understanding the components of the T1 form is crucial for accurate completion and submission.

Steps to Complete the T1 Form

Completing the T1 form involves several key steps to ensure accuracy and compliance with tax laws. Here’s a general outline of the process:

- Gather all necessary documents, including T4 slips, receipts for deductions, and any other relevant financial statements.

- Fill out personal information, such as your name, address, and social insurance number.

- Report your income from various sources, including employment, investments, and any other earnings.

- Claim eligible deductions and credits to reduce your taxable income.

- Calculate your total tax owed or refund due based on the information provided.

- Review your completed form for accuracy before submission.

Legal Use of the T1 Form

The T1 form is legally binding when submitted to the Canada Revenue Agency (CRA). It must be completed accurately to avoid penalties or legal issues. The information provided on the T1 form is subject to verification by the CRA, and discrepancies can lead to audits or additional assessments. It is important to maintain records of all submitted forms and supporting documents for at least six years, as required by law.

Required Documents for the T1 Form

Before filling out the T1 form, gather the necessary documents to ensure a smooth filing process. Key documents include:

- T4 slips from employers detailing income earned.

- Receipts for deductible expenses, such as medical costs or charitable donations.

- Information regarding any other income sources, such as rental properties or investments.

- Previous year’s tax return for reference.

Form Submission Methods

The T1 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the CRA's secure portal, which allows for faster processing and confirmation.

- Mailing a paper copy of the completed form to the appropriate CRA address.

- In-person submission at designated CRA offices, although this option may be limited.

Filing Deadlines / Important Dates

Timely filing of the T1 form is essential to avoid penalties. The standard deadline for individual taxpayers is April 30 of each year. If April 30 falls on a weekend or holiday, the deadline is extended to the next business day. Self-employed individuals have until June 15 to file, but any taxes owed must still be paid by April 30 to avoid interest charges.

Quick guide on how to complete what is a t1

Manage What Is A T1 easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Handle What Is A T1 on any device with airSlate SignNow mobile applications for Android or iOS and simplify any document-based workflow today.

The easiest way to modify and eSign What Is A T1 effortlessly

- Find What Is A T1 and click on Access Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow has available specifically for that purpose.

- Create your signature using the Signature feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Finish button to save your changes.

- Select how you want to send your form—via email, SMS, invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign What Is A T1 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is a t1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t1 form document and why is it important?

A t1 form document is a crucial paper used for various administrative purposes, including tax filings and official submissions. Understanding its importance can help you manage documentation effectively, ensuring compliance and accuracy in your business processes.

-

How can airSlate SignNow help with t1 form documents?

airSlate SignNow simplifies the process of creating, sending, and eSigning t1 form documents. With our user-friendly platform, you can easily manage all your document workflows efficiently, saving you time and reducing manual errors.

-

Is there a cost associated with using airSlate SignNow for t1 form documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including affordable options for managing t1 form documents. Each plan is designed to provide value, ensuring you can handle your document needs without breaking the bank.

-

What features does airSlate SignNow provide for managing t1 form documents?

Our platform includes features like customizable templates, real-time tracking, and secure eSigning to handle t1 form documents efficiently. These user-friendly tools enhance your document management capabilities while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other software to manage t1 form documents?

Absolutely! airSlate SignNow offers integrations with popular software solutions to streamline your workflows related to t1 form documents. This means you can use the tools you already love while enhancing your document processes.

-

How secure is the eSigning process for t1 form documents with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our eSigning process for t1 form documents is protected with industry-leading encryption standards, ensuring your documents are safe and compliant with legal regulations.

-

Can I track the status of my t1 form documents sent for signing?

Yes, airSlate SignNow provides a robust tracking system that allows you to monitor the status of your t1 form documents. You will receive notifications and updates on when a document has been viewed, signed, or completed.

Get more for What Is A T1

- Itd 3171 2011 form

- Itd 3405 idaho transportation department idahogov itd idaho form

- Idaho itd 3367 2005 form

- Va form 3542 2009

- Dui fact book illinois secretary of state form

- Vanity license plates form

- Illinois motorist information and vehicle status form epa

- Mobile driver services facility illinois secretary of state form

Find out other What Is A T1

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement