Form 10f Example

What is the Form 10f Example

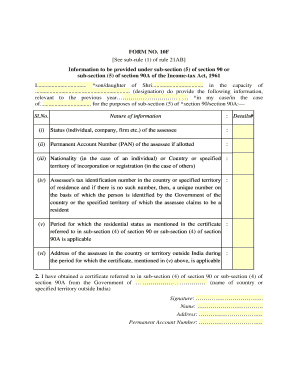

The Form 10f is a document used primarily for tax purposes in India, allowing foreign entities to claim benefits under the Double Taxation Avoidance Agreement (DTAA) with India. This form is essential for non-resident taxpayers who wish to receive tax exemptions or reductions on income earned in India. By providing necessary details, such as the taxpayer's status and the nature of income, the Form 10f facilitates compliance with Indian tax regulations while ensuring that foreign entities are not taxed twice on the same income.

How to Use the Form 10f Example

Using the Form 10f involves several steps to ensure accurate completion and submission. First, gather all required information, including the taxpayer's name, address, and country of residence. Next, fill out the form with precise details regarding the income for which the exemption is being claimed. It is crucial to sign the form and include any necessary supporting documents, such as a tax residency certificate from the home country. Finally, submit the completed form to the relevant Indian tax authorities or the entity from which income is being received.

Steps to Complete the Form 10f Example

Completing the Form 10f requires careful attention to detail. Follow these steps:

- Begin by entering the taxpayer's full name and address in the designated fields.

- Indicate the country of residence and the tax identification number.

- Specify the nature of the income, such as dividends or royalties.

- Provide the relevant details about the Double Taxation Avoidance Agreement.

- Sign and date the form, affirming the accuracy of the information provided.

Legal Use of the Form 10f Example

The legal use of the Form 10f is essential for ensuring compliance with Indian tax laws. This form must be filled out correctly to avoid any legal complications. It serves as proof that the taxpayer is eligible for benefits under the DTAA, thereby preventing double taxation. Failure to submit a properly completed Form 10f may result in higher tax liabilities and potential penalties from the Indian tax authorities.

Required Documents

When submitting the Form 10f, certain documents are required to support the claims made within the form. These typically include:

- A tax residency certificate from the taxpayer's home country.

- Proof of income, such as contracts or invoices.

- Any additional documentation that may be requested by the Indian tax authorities.

Form Submission Methods

The Form 10f can be submitted through various methods, ensuring convenience for taxpayers. Common submission methods include:

- Online submission via the Indian tax department's official portal.

- Mailing the completed form to the relevant tax office.

- In-person submission at designated tax offices or through authorized representatives.

Quick guide on how to complete form 10f example

Effortlessly prepare Form 10f Example on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 10f Example on any platform using airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

The simplest way to edit and electronically sign Form 10f Example with ease

- Locate Form 10f Example and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 10f Example and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10f example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 10F filled sample?

A form 10F filled sample refers to a correctly completed format of the form required for claiming tax treaty benefits by non-residents in India. This sample serves as a valuable reference to ensure that all sections of the form are accurately filled out to avoid processing delays.

-

How can airSlate SignNow help me with a form 10F filled sample?

AirSlate SignNow provides a streamlined platform for creating, signing, and managing documents such as the form 10F filled sample. Our intuitive interface allows users to customize templates and ensure compliance with necessary requirements efficiently.

-

Is there a cost associated with using airSlate SignNow for form 10F filled samples?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Depending on your subscription, you can access features that help create and manage your form 10F filled sample at a competitive rate.

-

What features does airSlate SignNow offer for handling form 10F filled samples?

AirSlate SignNow offers features like document templates, eSignatures, and collaboration tools to simplify the process of preparing a form 10F filled sample. These tools help ensure that all required information is included and properly formatted.

-

Can I create a custom template for the form 10F filled sample in airSlate SignNow?

Yes, you can create a custom template for your form 10F filled sample in airSlate SignNow. Our platform allows you to modify existing templates or design one from scratch to fit your specific business requirements.

-

Does airSlate SignNow integrate with other applications to assist in filling out form 10F samples?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, allowing you to pull in data and populate your form 10F filled sample efficiently. These integrations enhance your workflow and streamline the document preparation process.

-

What benefits can I expect from using airSlate SignNow for form 10F filled samples?

Using airSlate SignNow for your form 10F filled sample provides signNow benefits such as improved efficiency, reduced turnaround times, and enhanced accuracy. Our reliable eSignature solution ensures documents are signed quickly, keeping your operations running smoothly.

Get more for Form 10f Example

- State of new york workers compensation board self insurer s statement of outstanding disability claims name of self insurer w form

- State of new york workers compensation board initial application by employee of licensee under section 50 3 b or 50 3 d to form

- State of new york workers compensation board renewal application by employee of licensee under section 50 3 b or 50 3 d to form

- State of new york workers compensation board claim for volunteer ambulance workers benefits in a death case this claim will be form

- Uct 101 e 20112012 quarterly contribution report to be filed with quarterly wage report this form is used by employers to

- Referencehow to fill out an affidavit of servicechroncominstructions for completing the affidavit of servicehow to write an form

- R0211 pdf form

- Usmle rx express videos download form

Find out other Form 10f Example

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form