Arms of Hope Donation Receipt Form

What is the Arms Of Hope Donation Receipt

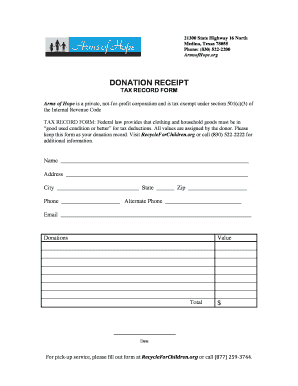

The Arms of Hope donation receipt is an official document provided to donors who contribute to the Arms of Hope organization, which supports families in need. This receipt serves as proof of donation for tax purposes and includes essential details such as the donor's name, the amount donated, and the date of the contribution. It is crucial for individuals seeking to claim tax deductions for charitable contributions, as it meets IRS requirements for documentation.

How to use the Arms Of Hope Donation Receipt

To effectively use the Arms of Hope donation receipt, donors should retain it for their records and include it when filing their taxes. The receipt can be used to substantiate charitable contributions on tax returns, helping to reduce taxable income. It is advisable to store the receipt in a safe place, either physically or digitally, to ensure easy access during tax season. Additionally, donors may want to review IRS guidelines to understand how to report charitable donations accurately.

Steps to complete the Arms Of Hope Donation Receipt

Completing the Arms of Hope donation receipt involves a few straightforward steps:

- Provide the donor's full name and contact information.

- Enter the date of the donation.

- Specify the amount donated.

- Include a description of the donation, such as the type of contribution (monetary or in-kind).

- Sign and date the receipt to validate it.

Once completed, the receipt should be provided to the donor, who can then use it for tax purposes.

Legal use of the Arms Of Hope Donation Receipt

The Arms of Hope donation receipt is legally recognized as a valid document for claiming charitable contributions on tax returns. To ensure its legality, the receipt must include specific information, such as the donor's details and the donation amount. Compliance with IRS regulations is essential, as the receipt serves as proof of the transaction. Donors should be aware that without a proper receipt, they may face challenges in substantiating their claims during tax audits.

Key elements of the Arms Of Hope Donation Receipt

Several key elements must be included in the Arms of Hope donation receipt to ensure it is valid and useful for tax purposes:

- Donor Information: Full name and contact details of the donor.

- Donation Amount: The total amount donated.

- Date of Donation: The date when the donation was made.

- Description of Donation: A brief description of the donation type.

- Signature: The signature of an authorized representative from Arms of Hope.

Including these elements helps ensure that the receipt meets IRS requirements and can be used effectively during tax preparation.

IRS Guidelines

The IRS provides specific guidelines regarding the documentation required for charitable contributions. To qualify for a tax deduction, donors must have a written acknowledgment from the charity for any contribution of $250 or more. The Arms of Hope donation receipt serves as this acknowledgment. Additionally, donors should keep records of any non-cash donations, including appraisals if necessary. Familiarizing oneself with IRS guidelines can help ensure compliance and maximize tax benefits.

Quick guide on how to complete arms of hope donation receipt

Effortlessly Prepare Arms Of Hope Donation Receipt on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Arms Of Hope Donation Receipt on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign Arms Of Hope Donation Receipt Effortlessly

- Find Arms Of Hope Donation Receipt and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mishandled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Arms Of Hope Donation Receipt to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arms of hope donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an arms of hope donation receipt?

An arms of hope donation receipt is a formal document that acknowledges your contribution to the Arms of Hope organization. This receipt serves not only as proof of your donation but can also be used for tax deduction purposes, helping you benefit from your generosity.

-

How can I obtain an arms of hope donation receipt?

You can easily obtain an arms of hope donation receipt by making your contribution through the official Arms of Hope website. Upon completing your donation, you will receive the receipt via email, ensuring that you have the necessary documentation for your records.

-

Are arms of hope donation receipts tax-deductible?

Yes, arms of hope donation receipts are typically tax-deductible as they are issued by a registered nonprofit organization. Be sure to keep the receipt for your records and consult a tax professional to understand how it can impact your tax return.

-

What features does airSlate SignNow offer for managing donation receipts?

AirSlate SignNow provides features that simplify the process of creating and sending arms of hope donation receipts. With its user-friendly interface, you can quickly generate, eSign, and distribute receipts, ensuring your donors receive their documentation promptly.

-

Is airSlate SignNow cost-effective for managing arms of hope donation receipts?

Absolutely! AirSlate SignNow is a cost-effective solution for managing arms of hope donation receipts. Its competitive pricing allows nonprofits to streamline their donation receipt processes without breaking the bank, making it an ideal choice for organizations of all sizes.

-

Can I integrate airSlate SignNow with other donation platforms?

Yes, airSlate SignNow can easily integrate with various donation platforms, allowing for seamless tracking and management of arms of hope donation receipts. This integration helps ensure that your donor data remains consistent and accessible across different systems.

-

What benefits does using airSlate SignNow provide for nonprofits?

Using airSlate SignNow for arms of hope donation receipts offers numerous benefits, including increased efficiency in document management and a more professional appearance for your receipts. Additionally, it enhances donor experience by ensuring timely and secure receipt delivery.

Get more for Arms Of Hope Donation Receipt

Find out other Arms Of Hope Donation Receipt

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement