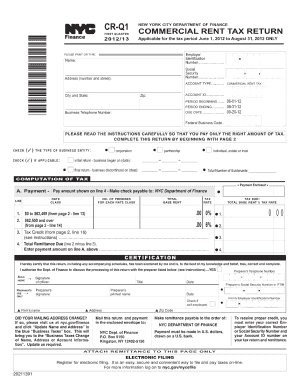

Nyc Commercial Rent Tax Cr Q1 20 Form

What is the NYC Commercial Rent Tax CR Q1 2019?

The NYC Commercial Rent Tax CR Q1 2019 is a tax form that businesses operating in New York City must file if they rent commercial space. This form is specifically for the first quarter of the year, covering the period from January to March. The tax applies to businesses that pay more than a specified amount in rent, and it is crucial for compliance with local tax laws. Understanding the requirements and implications of this form is essential for any business owner to avoid penalties.

Steps to Complete the NYC Commercial Rent Tax CR Q1 2019

Completing the NYC Commercial Rent Tax CR Q1 2019 involves several key steps:

- Gather necessary information, including your business's rental agreements and payment records.

- Calculate the total rent paid during the first quarter.

- Determine if your business meets the threshold for filing based on the total rent amount.

- Fill out the CR Q1 2019 form accurately, ensuring all details are correct.

- Review the completed form for any errors before submission.

- Submit the form by the designated deadline to avoid late fees.

Filing Deadlines / Important Dates

For the NYC Commercial Rent Tax CR Q1 2019, it is essential to be aware of the filing deadlines. Typically, the form must be submitted by the end of the month following the quarter's conclusion. Therefore, the deadline for the Q1 2019 form is usually April 30, 2019. Missing this deadline can result in penalties and interest on the unpaid tax.

Required Documents

When preparing to file the NYC Commercial Rent Tax CR Q1 2019, certain documents are necessary:

- Rental agreements that detail the terms of your lease.

- Records of rent payments made during the first quarter.

- Any previous filings related to the commercial rent tax for reference.

Having these documents ready will streamline the filing process and ensure accuracy.

Penalties for Non-Compliance

Failing to file the NYC Commercial Rent Tax CR Q1 2019 on time can lead to significant penalties. Businesses may incur fines based on the amount of tax owed, and interest may accrue on any unpaid taxes. Additionally, persistent non-compliance can result in further legal actions or restrictions on business operations. It is vital for business owners to prioritize timely filing to avoid these consequences.

Legal Use of the NYC Commercial Rent Tax CR Q1 2019

The NYC Commercial Rent Tax CR Q1 2019 is legally binding once filed. Compliance with the local tax laws is crucial for operating a business within New York City. The form must be completed accurately and submitted within the designated timeframe to ensure that the filing is recognized by the city. Understanding the legal implications of this tax is important for maintaining good standing with tax authorities.

Quick guide on how to complete nyc commercial rent tax cr q1 20

Effortlessly prepare Nyc Commercial Rent Tax Cr Q1 20 on any device

Online document management has become favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Nyc Commercial Rent Tax Cr Q1 20 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

Easily edit and eSign Nyc Commercial Rent Tax Cr Q1 20 with no hassle

- Obtain Nyc Commercial Rent Tax Cr Q1 20 and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device. Edit and eSign Nyc Commercial Rent Tax Cr Q1 20 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc commercial rent tax cr q1 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of cr q1 2019 in eSignature services?

The term cr q1 2019 refers to critical developments in eSignature technologies that emerged during that period. Companies, including airSlate SignNow, adopted innovative features that improved document processing speed and security. Understanding cr q1 2019 helps you assess the evolution of eSignature solutions.

-

How can airSlate SignNow enhance my business operations based on trends from cr q1 2019?

AirSlate SignNow incorporates many advancements highlighted in cr q1 2019, such as automated workflows and improved user interfaces. These features empower businesses to streamline document management, reduce turnaround times, and enhance customer satisfaction. Leveraging these innovations from cr q1 2019 can signNowly optimize your operations.

-

What pricing plans does airSlate SignNow offer?

AirSlate SignNow provides a range of pricing plans tailored to different business needs, reflecting the competitive landscape shaped by cr q1 2019. There are customizable options suitable for small businesses to large enterprises, ensuring you find a plan that fits your budget and requirements. Explore these plans to find the best fit for your organization.

-

Are the features of airSlate SignNow based on cr q1 2019 innovations?

Yes, many features of airSlate SignNow are direct responses to the innovations highlighted in cr q1 2019. This includes advanced security measures, robust mobile functionality, and enhanced user experiences. By adopting these features, airSlate SignNow ensures you stay ahead in the competitive eSignature market.

-

What are the key benefits of using airSlate SignNow?

Using airSlate SignNow offers several key benefits, many of which draw inspiration from developments noted in cr q1 2019. The platform is user-friendly, allows for efficient document tracking, and offers easy collaboration among team members. These advantages contribute to increased productivity and streamlined workflows.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow is designed to integrate seamlessly with a variety of third-party applications, aligning with the integration trends observed in cr q1 2019. This includes CRM systems, cloud storage solutions, and productivity tools. Such integrations enhance your document management capabilities and overall efficiency.

-

How does airSlate SignNow ensure document security?

airSlate SignNow employs several advanced security measures that draw from industry standards established during cr q1 2019. Features include bank-level encryption, secure authentication processes, and compliance with international regulations. These protocols ensure your documents are protected while being electronically signed.

Get more for Nyc Commercial Rent Tax Cr Q1 20

Find out other Nyc Commercial Rent Tax Cr Q1 20

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe