Irs 1040 Worksheet 2018-2026

What is the IRS 1040 Worksheet?

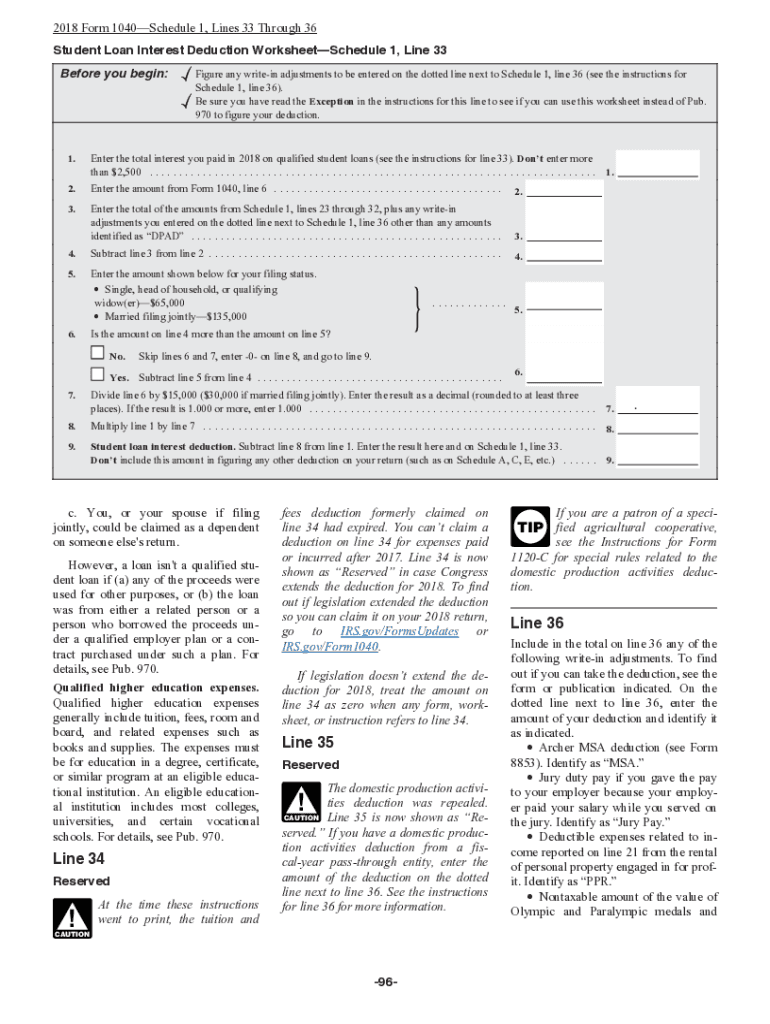

The IRS 1040 Worksheet is a crucial document used by taxpayers in the United States to calculate their taxable income and determine the amount of tax owed or refund due. This worksheet assists in organizing financial information, including wages, interest, dividends, and other sources of income. It is specifically designed to simplify the process of completing the IRS Form 1040, which is the standard individual income tax return form. By using the worksheet, taxpayers can ensure that all necessary calculations are performed accurately, reducing the risk of errors that could lead to penalties or delays in processing.

Steps to Complete the IRS 1040 Worksheet

Completing the IRS 1040 Worksheet involves several straightforward steps. First, gather all relevant financial documents, such as W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Begin by entering your personal information, including your name, Social Security number, and filing status.

- List all sources of income, including wages, self-employment income, and investment earnings.

- Deduct any applicable adjustments to income, such as contributions to retirement accounts or student loan interest.

- Calculate your total income by adding all sources together and subtracting adjustments.

- Apply any standard or itemized deductions to determine your taxable income.

- Finally, calculate your tax liability based on the applicable tax rates and credits.

Legal Use of the IRS 1040 Worksheet

The IRS 1040 Worksheet is legally recognized as a tool for taxpayers to prepare their income tax returns. When completed accurately, it serves as a reliable record of income and deductions, which can be referenced in case of an audit or inquiry by the IRS. It is important to ensure that the information entered is truthful and complete, as discrepancies can lead to legal consequences, including fines or penalties. Utilizing the worksheet in conjunction with the official IRS Form 1040 helps maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when using the IRS 1040 Worksheet. The primary filing deadline for individual tax returns is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension to file, which generally grants an additional six months, but any taxes owed must still be paid by the original deadline to avoid penalties. Staying informed about these dates is essential for timely and accurate tax filing.

Required Documents

To effectively complete the IRS 1040 Worksheet, certain documents are necessary. These include:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, as well as interest and dividend income.

- Records of other income sources, such as rental income or unemployment benefits.

- Documentation for deductions, including mortgage interest statements and receipts for charitable contributions.

- Any relevant tax credit information, such as education credits or child tax credits.

Examples of Using the IRS 1040 Worksheet

Using the IRS 1040 Worksheet can vary based on individual circumstances. For instance, a self-employed individual would include different income sources and deductions compared to a salaried employee. An example might involve a taxpayer who has both W-2 income and freelance income. They would combine these amounts on the worksheet, ensuring all income is reported accurately. Another example is a taxpayer claiming the student loan interest deduction, who would need to include the relevant information on the worksheet to ensure they receive the appropriate tax benefits.

Quick guide on how to complete irs 1040 worksheet

Prepare Irs 1040 Worksheet seamlessly on any platform

Digital document management has become more prevalent among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Irs 1040 Worksheet on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Irs 1040 Worksheet effortlessly

- Obtain Irs 1040 Worksheet and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, through email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from a device of your choice. Modify and eSign Irs 1040 Worksheet and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1040 worksheet

Create this form in 5 minutes!

How to create an eSignature for the irs 1040 worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the taxable social security worksheet 2024 printable?

The taxable social security worksheet 2024 printable is a simple tool designed to help individuals calculate the taxable portion of their social security benefits for the upcoming tax year. It allows users to easily organize their income information and determine tax liabilities associated with social security.

-

How can I access the taxable social security worksheet 2024 printable?

You can access the taxable social security worksheet 2024 printable directly from our website. Simply visit the airSlate SignNow landing page, and you will find a downloadable link that allows you to obtain the worksheet in a quick and efficient manner.

-

Is there a cost associated with the taxable social security worksheet 2024 printable?

The taxable social security worksheet 2024 printable is available for free to our users. At airSlate SignNow, we believe in providing valuable resources without charging our customers, ensuring you can easily access essential financial tools.

-

Can I fill out the taxable social security worksheet 2024 printable electronically?

Yes, the taxable social security worksheet 2024 printable can be filled out electronically when you use airSlate SignNow's eSigning features. Our platform allows you to easily input your information and save your progress, providing a seamless experience in managing your documents.

-

What are the benefits of using the taxable social security worksheet 2024 printable?

Using the taxable social security worksheet 2024 printable helps you accurately calculate your taxable income and prepare for tax seasons. It simplifies the process, reduces errors, and ensures you are aware of your financial obligations related to social security benefits.

-

Does the taxable social security worksheet 2024 printable integrate with other tools?

Yes, the taxable social security worksheet 2024 printable can integrate with various financial tools available on airSlate SignNow. This enhances your workflow by allowing you to synchronize your data with accounting software, making tax preparation more efficient.

-

Who can benefit from the taxable social security worksheet 2024 printable?

Anyone receiving social security benefits, including retirees and disabled individuals, can benefit from the taxable social security worksheet 2024 printable. It's designed to cater to a broad audience looking to manage their finances and ensure they meet their tax obligations.

Get more for Irs 1040 Worksheet

- Form r 390 ampquotannual report of appointment of school bus

- Oregon plan to manage special events download fillable pdf form

- Vhc admission application form fill and sign printable

- Application concealed under form

- Sport coaches anne arundel county maryland form

- Form pwd314 download fillable pdf or fill online affidavit of

- 504 form for students texas

- Maryland voter registration application maryland state form

Find out other Irs 1040 Worksheet

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document