Tax and Interest Deduction Worksheet 2014

What is the student loan interest deduction worksheet?

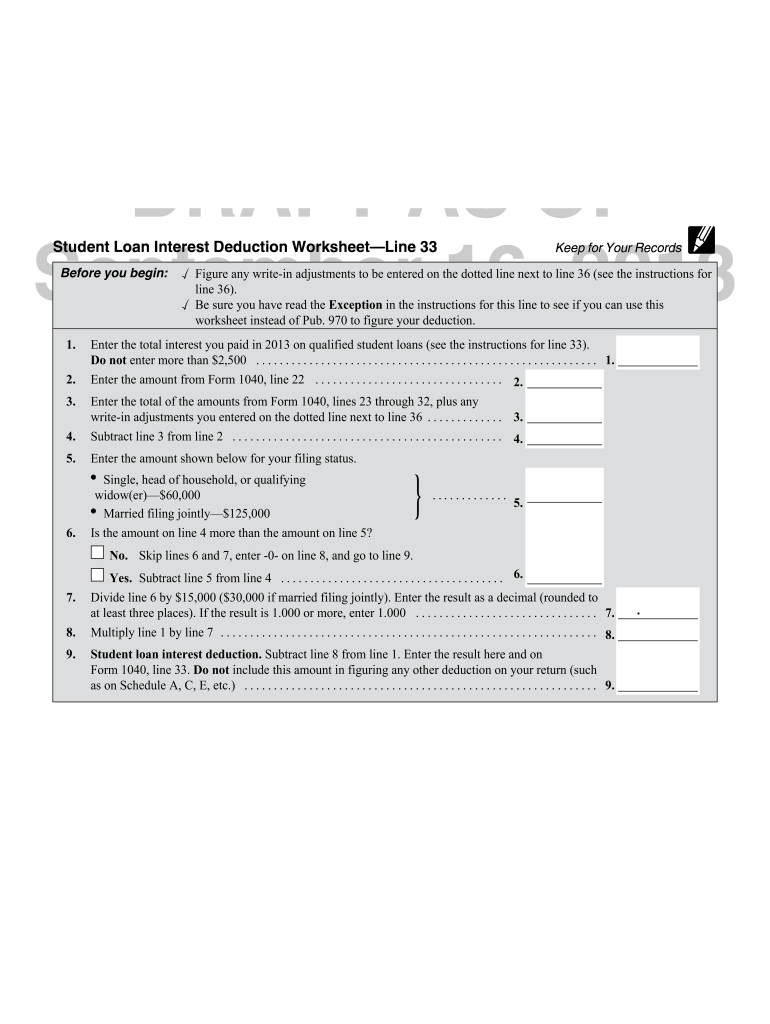

The student loan interest deduction worksheet is a tax form that helps individuals calculate the amount of interest paid on qualified student loans that may be deductible from their taxable income. This deduction can reduce the overall tax liability for eligible taxpayers, making it an important tool for those repaying student loans. The worksheet provides a structured approach to determine the deductible amount, ensuring that taxpayers accurately report their student loan interest on their federal tax returns.

How to use the student loan interest deduction worksheet

Using the student loan interest deduction worksheet involves several straightforward steps. First, gather all relevant documentation, including Form 1098-E, which reports the interest paid on student loans. Next, fill out the worksheet by entering the total interest amount reported on Form 1098-E. The worksheet will guide you through calculations to determine the deductible amount based on your modified adjusted gross income (MAGI) and filing status. It is essential to follow the instructions carefully to ensure accuracy in your tax reporting.

Steps to complete the student loan interest deduction worksheet

Completing the student loan interest deduction worksheet requires a systematic approach:

- Collect necessary documents, including Form 1098-E.

- Identify your modified adjusted gross income (MAGI) from your tax return.

- Enter the total interest paid on qualified student loans as reported on Form 1098-E.

- Follow the worksheet's instructions to calculate the deductible amount based on your income and filing status.

- Transfer the calculated deduction to your federal tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the student loan interest deduction. Taxpayers can deduct up to $2,500 of interest paid on qualified student loans, subject to income limitations. The deduction is available to individuals who are legally obligated to pay interest on a qualified student loan and who meet certain income criteria. It is important to refer to the IRS guidelines to ensure compliance and to understand eligibility requirements for claiming this deduction on your tax return.

Required documents

To complete the student loan interest deduction worksheet, you will need several key documents:

- Form 1098-E: This form is issued by your loan servicer and details the amount of interest paid on your student loans during the tax year.

- Your tax return: This includes your modified adjusted gross income (MAGI) and filing status, which are necessary for determining your eligibility for the deduction.

- Any additional documentation related to your student loans, if applicable.

Eligibility criteria

To qualify for the student loan interest deduction, taxpayers must meet specific eligibility criteria. You must be legally obligated to pay interest on a qualified student loan, and your MAGI must fall below certain thresholds. For single filers, the deduction begins to phase out at a MAGI of $70,000 and is completely phased out at $85,000. For married couples filing jointly, the phase-out range is between $140,000 and $170,000. Additionally, you cannot be claimed as a dependent on someone else's tax return.

Quick guide on how to complete tax and interest deduction worksheet

Complete Tax And Interest Deduction Worksheet effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Tax And Interest Deduction Worksheet on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Tax And Interest Deduction Worksheet effortlessly

- Find Tax And Interest Deduction Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Tax And Interest Deduction Worksheet and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax and interest deduction worksheet

Create this form in 5 minutes!

How to create an eSignature for the tax and interest deduction worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the student loan interest deduction worksheet?

The student loan interest deduction worksheet is a tool used to calculate the amount of student loan interest that can be deducted from your taxable income. It helps borrowers maximize their tax benefits by providing a clear way to report interest paid on qualifying loans, ensuring you get the most out of your educational investments.

-

How can I access the student loan interest deduction worksheet?

You can easily access the student loan interest deduction worksheet through the airSlate SignNow platform. Once you're signed up, you can find various templates, including the worksheet, to efficiently manage your documents and submissions for tax purposes.

-

Is the student loan interest deduction worksheet free to use?

While the student loan interest deduction worksheet can be generated using various free resources, airSlate SignNow offers a comprehensive package that includes this worksheet as part of its subscription model. This ensures that you have a reliable, easy-to-use resource at your disposal, along with additional features for document management.

-

Can I track my student loan interest payments with airSlate SignNow?

Yes, airSlate SignNow enables you to keep track of your student loan interest payments seamlessly. By utilizing our document management features, you can maintain organized records of your payments, which can be referenced in the student loan interest deduction worksheet during tax season.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers a range of features for tax documentation, including customizable templates, electronic signature capabilities, and secure document storage. These features simplify the process of managing your student loan interest deduction worksheet and other essential tax paperwork.

-

How does airSlate SignNow ensure the security of my sensitive data?

Security is a priority at airSlate SignNow. We utilize advanced encryption standards and secure servers to protect your sensitive data, including information related to your student loan interest deduction worksheet, ensuring that your documents are safe and compliant with industry regulations.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow can seamlessly integrate with various financial software, making it easy to keep your records updated. This means you can effortlessly pull data related to your student loan interest deduction worksheet from these systems, streamlining your tax preparation process.

Get more for Tax And Interest Deduction Worksheet

- Claimsinsuranceaffidavit doc dm mytracking form

- Great west life claim form

- Form 2203

- Early learning center toms river form

- Weekly driver report form

- Isahan dalawahan maramihan form

- Linda steyn verhurings aansoek om te huur application to rent eiendom ter sake applicable property vanaf from huurbedrag rental form

- Loan employee agreement template form

Find out other Tax And Interest Deduction Worksheet

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast