Form W 2 VI Internal Revenue Service

What is the Form W-2 VI Internal Revenue Service

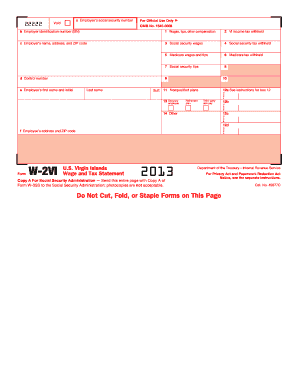

The Form W-2 VI, issued by the Internal Revenue Service (IRS), is a tax document that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for employees in the U.S. Virgin Islands, as it helps them accurately file their federal income tax returns. Employers are required to provide this form to their employees by January 31 of each year, ensuring that individuals have the necessary information to report their income and withholdings to the IRS.

How to use the Form W-2 VI Internal Revenue Service

To use the Form W-2 VI effectively, employees should first review the information provided on the form, including their total wages, federal income tax withheld, and any other relevant deductions. This form is primarily used when filing federal income tax returns, allowing individuals to report their earnings accurately. It is important to keep the W-2 VI on hand when completing tax forms, as the details will be needed to ensure compliance with tax laws.

Steps to complete the Form W-2 VI Internal Revenue Service

Completing the Form W-2 VI involves several key steps:

- Gather all necessary information, including your Social Security number, employer details, and total earnings for the year.

- Fill out the form accurately, ensuring that all figures are correct and match your pay stubs.

- Double-check for any errors or omissions before submitting the form.

- Keep a copy of the completed form for your records, as it may be needed for future reference.

Legal use of the Form W-2 VI Internal Revenue Service

The legal use of the Form W-2 VI is governed by IRS regulations, which require employers to provide accurate and timely information regarding employee wages and tax withholdings. The form serves as a legal document that employees can use to verify their income and tax contributions. It is crucial for both employers and employees to adhere to the guidelines set forth by the IRS to avoid potential penalties or issues during tax filing.

Filing Deadlines / Important Dates

For the Form W-2 VI, employers must provide the completed forms to employees by January 31 of each year. Additionally, employers are required to submit copies of the W-2 VI to the IRS by the same date. Employees should ensure they receive their W-2 VI in a timely manner to meet their personal tax filing deadlines, which typically fall on April 15 for federal income tax returns.

Who Issues the Form

The Form W-2 VI is issued by employers in the U.S. Virgin Islands. It is the responsibility of the employer to accurately complete and distribute this form to their employees. Employers must ensure that all information is correct and that the form is provided by the IRS deadline to facilitate proper tax reporting for their employees.

Quick guide on how to complete form w 2 vi internal revenue service

Prepare Form W 2 VI Internal Revenue Service effortlessly on any device

Digital document management has gained widespread acceptance among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form W 2 VI Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest method to edit and eSign Form W 2 VI Internal Revenue Service without hassle

- Find Form W 2 VI Internal Revenue Service and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form W 2 VI Internal Revenue Service and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 2 vi internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 2 VI Internal Revenue Service?

Form W 2 VI Internal Revenue Service is a tax form used by employers in the U.S. Virgin Islands to report wages paid and taxes withheld from employees. It is essential for both employers and employees to accurately document earnings for tax purposes. This form is crucial for employees when filing their annual tax returns.

-

How does airSlate SignNow simplify the signing of Form W 2 VI Internal Revenue Service?

airSlate SignNow provides a streamlined process for electronic signatures on Form W 2 VI Internal Revenue Service, allowing users to sign documents securely from any device. This not only saves time but also reduces the hassle of dealing with paperwork. With airSlate SignNow, you can ensure compliance while efficiently managing your tax forms.

-

Is there a cost to use airSlate SignNow for Form W 2 VI Internal Revenue Service?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective solution for handling Form W 2 VI Internal Revenue Service. You can choose from various subscription options, ensuring that you only pay for what you use. Additionally, there are often free trials available to help you get started.

-

Are there any integration options with airSlate SignNow for managing Form W 2 VI Internal Revenue Service?

Yes, airSlate SignNow seamlessly integrates with various software platforms, enhancing your workflow for managing Form W 2 VI Internal Revenue Service. With integrations to applications like Google Drive, Dropbox, and more, you can easily access and store your tax forms. This boosts productivity and ensures all your documents are in one place.

-

What security measures does airSlate SignNow have in place for Form W 2 VI Internal Revenue Service?

airSlate SignNow prioritizes security, implementing advanced encryption to protect documents like Form W 2 VI Internal Revenue Service. Users can rest assured that their sensitive information is secure throughout the signing process. Additionally, the platform complies with industry regulations, further ensuring the confidentiality of your data.

-

Can I customize templates for Form W 2 VI Internal Revenue Service in airSlate SignNow?

Absolutely! airSlate SignNow allows users to create and customize templates for Form W 2 VI Internal Revenue Service. This feature helps you save time on repetitive tasks and ensures consistency across all your documents. Tailoring templates to fit your specific needs can streamline your tax preparation process signNowly.

-

What benefits do I gain by using airSlate SignNow for Form W 2 VI Internal Revenue Service?

By using airSlate SignNow for Form W 2 VI Internal Revenue Service, you gain increased efficiency in document management. The platform empowers you to track signatures in real-time, reducing delays often associated with traditional paperwork. Furthermore, it enhances collaboration among team members, ensuring that tax forms are processed smoothly and promptly.

Get more for Form W 2 VI Internal Revenue Service

- Hiv perinatal exposure report form

- Facility use request form clover sites

- Upon completion please send this form to in regards to

- Authorization for release of protected health information kdhe kdheks

- General prior authorization request kmap state ksus form

- Hepatitis c agents prior authorization form new

- Chronic wasting disease cwd kansas department of agriculture form

- Deep chronic wasting disease ctgov form

Find out other Form W 2 VI Internal Revenue Service

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile