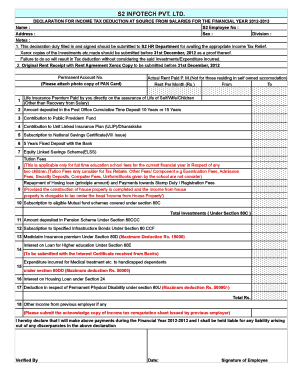

Investment Declaration Form

What is the investment declaration?

The investment declaration is a formal document that individuals or entities submit to report their investment activities, income, and tax obligations. It serves as a record of investments made during a specific period and is essential for tax compliance. This declaration typically includes details about various investment types, such as stocks, bonds, real estate, and other financial instruments. Understanding this document is crucial for accurately reporting income and ensuring adherence to tax regulations.

Steps to complete the investment declaration

Completing the investment declaration involves several key steps to ensure accuracy and compliance. Here is a straightforward process:

- Gather all relevant financial documents, including statements for investments, income records, and any supporting documentation.

- Identify the required forms, such as the specific investment declaration form applicable to your situation.

- Fill out the form with accurate information regarding your investments, including dates, amounts, and types of investments.

- Review the completed form for any errors or omissions to ensure all information is correct.

- Submit the form by the designated deadline, either online, by mail, or in person, depending on the submission methods allowed.

Legal use of the investment declaration

The investment declaration must be completed in accordance with legal requirements to be considered valid. It is essential to comply with relevant tax laws and regulations, such as the Internal Revenue Code, which governs the reporting of investment income. Failure to adhere to these legal standards can result in penalties or audits. Using a reliable electronic signing solution, like signNow, ensures that your declaration is executed securely and in compliance with eSignature laws.

Key elements of the investment declaration

Several critical components must be included in the investment declaration to ensure it meets legal and tax requirements. These elements typically include:

- Personal Information: Name, address, and Social Security number or taxpayer identification number.

- Investment Details: A comprehensive list of all investments, including their types, amounts, and dates of acquisition.

- Income Reporting: Documentation of any income generated from investments, such as dividends or interest.

- Signature: A signature or electronic signature to validate the declaration.

Filing deadlines / important dates

Timely submission of the investment declaration is crucial to avoid penalties. The filing deadlines may vary based on the type of taxpayer and the specific tax year. Generally, individual taxpayers must submit their declarations by April 15 of the following year. It is advisable to check the IRS guidelines for any changes to deadlines or specific requirements that may apply to your situation.

Examples of using the investment declaration

The investment declaration can be utilized in various scenarios, such as:

- Individuals reporting capital gains from stock sales.

- Businesses declaring income from investments in real estate or other ventures.

- Retirees disclosing investment income from retirement accounts.

Each of these examples highlights the importance of accurately completing the investment declaration to ensure compliance with tax obligations.

Quick guide on how to complete investment declaration

Complete Investment Declaration effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Investment Declaration on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Investment Declaration without hassle

- Find Investment Declaration and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Investment Declaration and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the investment declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration sample and why is it important?

A tax declaration sample is a template or example of the documentation required for filing taxes. It helps taxpayers understand how to accurately report their income and deductions, ensuring compliance with tax laws. Using a tax declaration sample can simplify the filing process and reduce the risk of errors.

-

How can airSlate SignNow assist with managing tax declaration samples?

airSlate SignNow provides businesses with a platform to create, send, and eSign tax declaration samples efficiently. By using our easy-to-use solution, you can store documents securely, track their status, and ensure that all necessary signatures are obtained promptly. This streamlines the tax filing process and saves time.

-

Is airSlate SignNow cost-effective for small businesses needing tax declaration samples?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to small businesses looking for affordable options to manage their tax declaration samples and other documents. This ensures that you get the best value without compromising on features.

-

What features does airSlate SignNow offer for handling tax declaration samples?

AirSlate SignNow offers multiple features for handling tax declaration samples, including customizable templates, efficient eSigning, and document tracking. These features help you manage your documents seamlessly, ensuring that you can handle your tax declarations quickly and efficiently. Advanced security measures also protect your sensitive data.

-

Can I integrate airSlate SignNow with other software for tax assistance?

Absolutely! airSlate SignNow integrates with various applications like accounting software and tax preparation platforms, making it easier to manage tax declaration samples. This integration enhances workflow efficiency and ensures that you have a comprehensive solution for your tax needs.

-

What benefits does using a tax declaration sample with airSlate SignNow provide?

Using a tax declaration sample with airSlate SignNow provides several benefits including improved accuracy, reduced filing time, and enhanced organization. Our platform helps you maintain all related documents in one place, making it easier to access and manage your tax information. This ultimately leads to a smoother tax filing process.

-

How does airSlate SignNow ensure the security of my tax declaration samples?

AirSlate SignNow prioritizes the security of your tax declaration samples by employing advanced encryption and compliance protocols. Our platform safeguards all your sensitive information and ensures that only authorized individuals have access to your documents. This level of security gives you peace of mind while managing your tax-related documents.

Get more for Investment Declaration

- Form c 100

- Vs 37 dcbs youth form

- Kentucky general bill of sale form

- Know your rights greater boston legal services 457370846 form

- Cemetery plot purchase form

- Lisa carr owner and founder maryland avian and exotic form

- Dhhs oads event form

- Pdf state of maine ryan white careware user guidance mainegov form

Find out other Investment Declaration

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding