Pa Tax Return Form

What is the PA Tax Return?

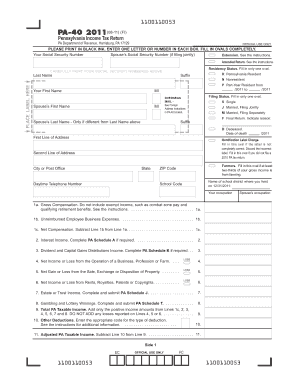

The PA tax return, specifically the PA-40 form for the year 2016, is a document used by residents of Pennsylvania to report their income and calculate their state tax obligations. This form is essential for individuals and businesses operating within the state, as it allows taxpayers to declare their earnings, claim deductions, and determine the amount of tax owed or any refund due. Understanding the PA-40 form is crucial for compliance with state tax laws and ensuring accurate reporting of financial information.

Steps to Complete the PA Tax Return

Completing the PA-40 form involves several important steps that ensure accurate reporting and compliance with state regulations. Here are the key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report income from all sources, ensuring to include wages, interest, dividends, and any other taxable income.

- Claim applicable deductions and credits, which may reduce your taxable income and overall tax liability.

- Calculate the total tax due using the provided tax tables or software tools.

- Review the completed form for accuracy before submission.

Legal Use of the PA Tax Return

The PA-40 form is legally binding when filled out correctly and submitted in accordance with Pennsylvania state tax laws. To ensure its legality, taxpayers must adhere to specific requirements, such as providing accurate information and signing the form. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that e-signatures are recognized as valid. This legal framework supports the use of digital solutions for submitting the PA tax return securely and efficiently.

Form Submission Methods

Taxpayers have several options for submitting the PA-40 form. These methods include:

- Online Submission: Using approved e-filing software or platforms that facilitate digital submissions.

- Mail: Printing the completed form and sending it to the Pennsylvania Department of Revenue via postal service.

- In-Person: Delivering the form directly to a local Department of Revenue office, which may be convenient for those who prefer face-to-face assistance.

Required Documents

To complete the PA-40 form accurately, taxpayers must gather several key documents, including:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investment earnings.

- Documentation for any deductions, such as receipts for charitable contributions or medical expenses.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for avoiding penalties. For the PA-40 form, the typical deadline is April 15 of the year following the tax year. For the 2016 tax return, this means the submission deadline would have been April 15, 2017. Taxpayers should also be mindful of any extensions that may apply, as well as deadlines for making payments to avoid interest and penalties.

Quick guide on how to complete pa tax return

Complete Pa Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage Pa Tax Return on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based task today.

The easiest method to update and digitally sign Pa Tax Return with ease

- Locate Pa Tax Return and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and electronically sign Pa Tax Return to ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 40 2016 fillable form?

The PA 40 2016 fillable form is the official Pennsylvania personal income tax return that allows residents to report their income. This form is designed for easy completion and filing, simplifying the tax process for individuals. Utilizing a fillable format enables taxpayers to efficiently input their information without needing to print and manually fill it out.

-

How can I access the PA 40 2016 fillable form?

You can easily access the PA 40 2016 fillable form through the official Pennsylvania Department of Revenue website. Additionally, airSlate SignNow provides a solution to fill out and eSign this form directly, ensuring a seamless and efficient experience for users. Simply visit our platform to find and complete the form electronically.

-

Is there a cost to use the PA 40 2016 fillable form through airSlate SignNow?

Using the PA 40 2016 fillable form through airSlate SignNow comes at a very reasonable cost, with various pricing plans available that cater to individual users and businesses alike. Our service is designed to be budget-friendly while providing valuable features for document management. You can choose a plan that suits your needs for an easy eSigning experience.

-

What features does airSlate SignNow offer for the PA 40 2016 fillable form?

airSlate SignNow offers numerous features for the PA 40 2016 fillable form, including customizable templates, cloud storage, and secure eSigning capabilities. Users can easily navigate the platform to fill in their tax information and send the document without hassle. This facilitates a quick turnaround in filing your tax return.

-

Can I integrate airSlate SignNow with other software for the PA 40 2016 fillable form?

Yes, airSlate SignNow allows for integration with popular software that enhances your experience with the PA 40 2016 fillable form. Whether you need to connect with accounting software or document management systems, our platform supports various integrations. This ensures a smooth workflow for handling your tax documents.

-

What are the benefits of using airSlate SignNow for the PA 40 2016 fillable form?

Using airSlate SignNow for the PA 40 2016 fillable form provides benefits such as time savings, enhanced accuracy, and a more organized approach to tax filing. The platform enables users to complete forms quickly with built-in validation features. Furthermore, eSigning ensures that your documents are secure and legally binding.

-

Is it safe to eSign the PA 40 2016 fillable form with airSlate SignNow?

Absolutely, it is safe to eSign the PA 40 2016 fillable form with airSlate SignNow. Our platform employs advanced security measures, including encryption and secure authentication processes, to protect your sensitive information. You can confidently complete and send your tax documents knowing they are secure.

Get more for Pa Tax Return

- Tort claim form nevada attorney general state of nevada

- Apartments for rent near procter r hug high school reno nv form

- Submit this form by email to mldinfomld

- File a complaintthe department of business oversight form

- Linear regression worksheet 1 rpdp answer key form

- Hr f104classifiedevaluationrevbb form

- Download an ethics complaint form

- Fccpt fax number form

Find out other Pa Tax Return

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple