Idor 6 Setr 2016

What is the Idor 6 Setr

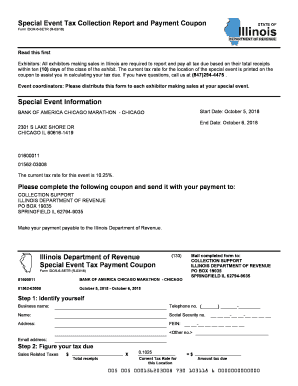

The Idor 6 Setr is a specific form used in Illinois for reporting special event tax obligations. This form is essential for businesses and individuals who organize special events that require tax collection and remittance to the state. The Idor 6 Setr captures details about the event, including the type of event, location, and the total revenue generated, ensuring compliance with state tax regulations.

How to use the Idor 6 Setr

Using the Idor 6 Setr involves several key steps. First, gather all necessary information related to the special event, such as the event date, location, and revenue details. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Once completed, the form can be submitted electronically or via mail, depending on your preference. It is important to retain a copy of the submitted form for your records.

Steps to complete the Idor 6 Setr

Completing the Idor 6 Setr requires careful attention to detail. Follow these steps:

- Collect all relevant information about your event, including dates and financial details.

- Download the Idor 6 Setr form from the official Illinois Department of Revenue website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form either electronically through an eSignature platform or by mailing it to the appropriate state office.

Legal use of the Idor 6 Setr

The Idor 6 Setr is legally binding when filled out correctly and submitted on time. Compliance with state tax laws is crucial, as failure to submit the form can result in penalties. The form must be completed in accordance with the Illinois Department of Revenue guidelines to ensure that it meets all legal requirements. Using a reliable eSignature platform can enhance the legal validity of the submission.

Required Documents

To complete the Idor 6 Setr, you may need to provide supporting documentation. This can include:

- Proof of event location.

- Financial records detailing revenue generated from the event.

- Any prior correspondence with the Illinois Department of Revenue regarding the event.

Having these documents ready can streamline the completion process and ensure compliance with all requirements.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Idor 6 Setr. Typically, the form must be submitted within a specific timeframe following the conclusion of the event. Check the Illinois Department of Revenue website for the most current deadlines to avoid late fees or penalties. Mark these important dates on your calendar to ensure timely compliance.

Quick guide on how to complete idor 6 setr

Complete Idor 6 Setr effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Idor 6 Setr on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Idor 6 Setr effortlessly

- Locate Idor 6 Setr and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting documents. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Modify and eSign Idor 6 Setr and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct idor 6 setr

Create this form in 5 minutes!

How to create an eSignature for the idor 6 setr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is idor 6 setr and how does it work?

Idor 6 setr is a comprehensive solution provided by airSlate SignNow that allows businesses to send and eSign documents efficiently. It streamlines the signing process, ensuring that documents can be handled electronically with security and ease. This makes document management more efficient and reduces turnaround time.

-

What are the key features of idor 6 setr?

The key features of idor 6 setr include customizable templates, real-time tracking of document status, and robust security measures. Additionally, it offers easy integration with various third-party applications and allows for bulk sending of documents. These features enhance the overall user experience and productivity.

-

How much does idor 6 setr cost?

Pricing for idor 6 setr is competitive and tailored to fit different business needs. airSlate SignNow offers several pricing tiers depending on the number of users and features required. This flexibility ensures that you can find a solution that fits your budget while maximizing value.

-

Can I integrate idor 6 setr with other software?

Yes, idor 6 setr easily integrates with a variety of software applications and business tools. Whether you are using CRM systems, document management software, or other productivity tools, airSlate SignNow supports seamless connectivity. This allows for a streamlined workflow within your existing systems.

-

What benefits does idor 6 setr provide for businesses?

Idor 6 setr provides several benefits for businesses, including increased efficiency in document handling and enhanced security for signed documents. By leveraging this solution, teams can save time and reduce costs associated with traditional paper-based processes. It's perfect for businesses looking to modernize their operations.

-

How secure is idor 6 setr for signing documents?

Security is a top priority with idor 6 setr, which uses advanced encryption protocols to protect your documents. Additionally, it complies with industry standards and regulations to ensure the authenticity of signatures and document integrity. This commitment to security guarantees that your sensitive information remains confidential.

-

Is there a mobile application for idor 6 setr?

Yes, airSlate SignNow offers a mobile application for idor 6 setr, allowing you to manage and sign documents on-the-go. This accessibility ensures that you can handle important paperwork anytime, anywhere, which is ideal for busy professionals. The mobile app supports all the features available on the web version.

Get more for Idor 6 Setr

- Annual fy 2020 limousine certificate renewal form lm 1

- 36th annual adult protective services call for presenters conference call for presenters form

- Fy 20 statement of work tdem 17 a texas emergency form

- Emergency management performance grant application

- Fillable online under general supervision supervises the form

- Httpsapi36ilovepdfcomv1download form

- 2288 editpdf form

- 1 channelcheck testing log sheet test date strip lot testers healthmark form

Find out other Idor 6 Setr

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form