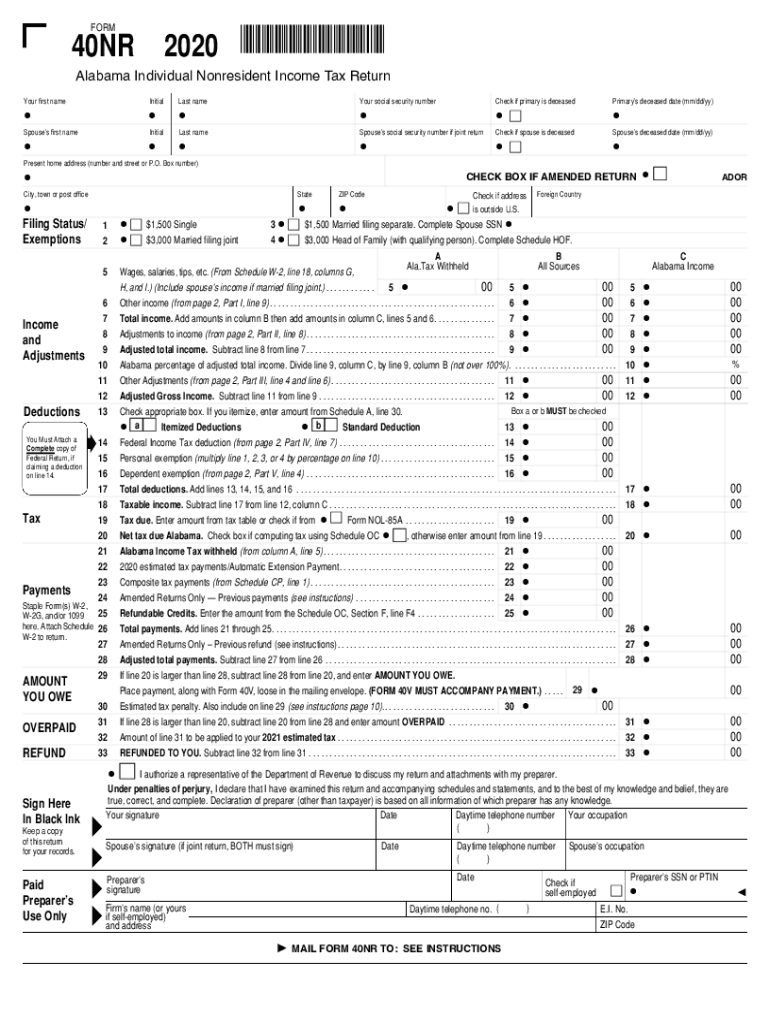

40NR Alabama Department of Revenue 2020

What is the 40NR Alabama Department Of Revenue

The 40NR form is a tax document used by non-residents in Alabama to report income earned within the state. This form is essential for individuals who are not permanent residents but have taxable income sourced from Alabama. The Alabama Department of Revenue requires this form to ensure that all income generated within the state is properly reported and taxed according to state laws. Understanding the purpose of the 40NR is crucial for compliance and accurate tax reporting.

Steps to complete the 40NR Alabama Department Of Revenue

Completing the 40NR form involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements relevant to your earnings in Alabama. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Be sure to report all income earned in Alabama accurately. After completing the form, review it for any errors before submitting it to the Alabama Department of Revenue.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the 40NR form to avoid penalties. Generally, the deadline for filing the 40NR for the tax year is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you are unable to file by the deadline, you may request an extension, but it is essential to pay any owed taxes to avoid interest and penalties.

Required Documents

To successfully complete the 40NR form, you will need to gather several documents. These typically include:

- W-2 forms from employers for income earned in Alabama

- 1099 forms for any freelance or contract work

- Records of any other income sources within the state

- Identification documents, such as your Social Security number

Having these documents ready will streamline the process of filling out the 40NR and ensure accurate reporting of your income.

Legal use of the 40NR Alabama Department Of Revenue

The 40NR form is legally binding and must be used correctly to comply with Alabama tax laws. Non-residents are required to file this form to report any income earned in Alabama, which may include wages, rental income, or business income. Failure to file the 40NR can result in penalties, including fines and interest on unpaid taxes. It is vital to understand the legal implications of this form and ensure that it is completed and submitted accurately and on time.

Who Issues the Form

The 40NR form is issued by the Alabama Department of Revenue, which is responsible for administering the state's tax laws. This department provides the necessary forms and guidelines for non-residents to report their income accurately. It is important to refer to the Alabama Department of Revenue's official resources for the most current version of the form and any updates to filing requirements.

Quick guide on how to complete 40nr 2016 alabama department of revenue

Easily Prepare 40NR Alabama Department Of Revenue on Any Device

Digital document management has gained momentum among businesses and individuals alike. It serves as a fantastic eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage 40NR Alabama Department Of Revenue from any device using the airSlate SignNow apps available for Android or iOS and streamline your document-related processes today.

The Optimal Method to Edit and Electronically Sign 40NR Alabama Department Of Revenue Effortlessly

- Find 40NR Alabama Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 40NR Alabama Department Of Revenue, ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 40nr 2016 alabama department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 40nr 2016 alabama department of revenue

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What is airSlate SignNow's role in managing 2020 Alabama income tax forms?

airSlate SignNow is an online solution that enables businesses to efficiently manage, send, and eSign their 2020 Alabama income tax documents. By utilizing our platform, users can streamline the process of tax form completion and signatures, ensuring that all documents are compliant and securely stored. This simplifies the complexities associated with 2020 Alabama income tax submissions.

-

How can airSlate SignNow help with filing 2020 Alabama income taxes on time?

With airSlate SignNow, you can expedite the signing process by allowing clients to eSign their tax forms directly online, which helps meet filing deadlines for 2020 Alabama income taxes. Our notification features remind users of important deadlines, ensuring that all necessary signatures are gathered in a timely manner. This contributes to a hassle-free tax filing experience.

-

Are there any costs associated with using airSlate SignNow for 2020 Alabama income tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans include features that cater specifically to the management of forms related to 2020 Alabama income, such as document templates and secure signing. For users focused on tax documentation, our cost-effective solutions deliver value without compromising on quality.

-

What features does airSlate SignNow provide for handling 2020 Alabama income forms?

Our platform offers diverse features like document templates, eSignatures, and real-time tracking specifically designed for managing 2020 Alabama income forms. Users can customize their workflows, making it easy to gather all necessary signatures and approvals. Additionally, our user-friendly interface ensures a seamless experience for both businesses and clients.

-

Is airSlate SignNow compatible with accounting software for 2020 Alabama income taxes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, which makes it easier to manage 2020 Alabama income tax documents. This integration helps in transferring data from tax management systems directly into our signing platform, ensuring that your documents are accurate and up to date.

-

How does airSlate SignNow ensure the security of 2020 Alabama income documents?

airSlate SignNow takes security very seriously. We utilize advanced encryption methods and comply with data protection regulations to ensure that all 2020 Alabama income documents are secure. Our platform provides audit trails and authentication options, allowing users to maintain control over their sensitive information while ensuring compliance.

-

What are the benefits of using airSlate SignNow for 2020 Alabama income document management?

Using airSlate SignNow for your 2020 Alabama income document management provides businesses with enhanced efficiency, reduced costs, and improved document tracking. Our platform simplifies the process of gathering signatures and approvals, thus allowing for a quicker turnaround on tax filings. This results in less stress during tax season and a more organized workflow.

Get more for 40NR Alabama Department Of Revenue

- Warranty deed from individual to individual alaska form

- Warranty deed trust to an individual alaska form

- Alaska procedures 497293776 form

- Anatomical gift form alaska

- Alaska trust act form

- Alaska trust act 497293780 form

- Alaska trustee form

- Transfer under the alaska uniform transfers to minors alaska

Find out other 40NR Alabama Department Of Revenue

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast