Iafba Loan Emi Calculator Form

What is the Iafba Loan Emi Calculator

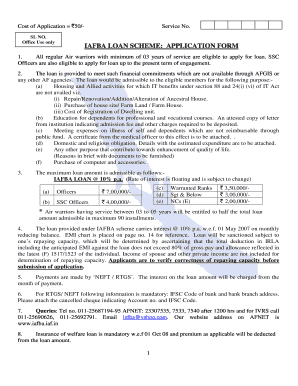

The Iafba loan EMI calculator is a financial tool designed to help users estimate their monthly payments for an Iafba loan. By inputting key variables such as the loan amount, interest rate, and loan tenure, users can gain insights into their repayment obligations. This calculator simplifies the process of budgeting for loan repayments, making it easier for individuals to plan their finances effectively.

How to Use the Iafba Loan Emi Calculator

Using the Iafba loan EMI calculator is straightforward. Begin by entering the total loan amount you wish to borrow. Next, input the applicable interest rate, which can vary based on the lender and your creditworthiness. Finally, specify the loan tenure, typically expressed in months. Once all fields are filled, the calculator will automatically compute the estimated monthly EMI, providing a clear picture of your financial commitment.

Key Elements of the Iafba Loan Emi Calculator

Several key elements contribute to the functionality of the Iafba loan EMI calculator. These include:

- Loan Amount: The total sum you intend to borrow.

- Interest Rate: The percentage charged on the loan amount, which affects the total repayment cost.

- Loan Tenure: The duration over which the loan will be repaid, typically ranging from one to thirty years.

- EMI Calculation: The formula used to determine the monthly payment based on the inputs provided.

Steps to Complete the Iafba Loan Emi Calculator

To effectively complete the Iafba loan EMI calculator, follow these steps:

- Access the calculator on a trusted financial platform.

- Input the desired loan amount in the designated field.

- Enter the applicable interest rate, ensuring it reflects current market conditions.

- Specify the loan tenure in months or years, depending on the calculator's format.

- Review the calculated EMI to understand your monthly payment obligation.

Legal Use of the Iafba Loan Emi Calculator

The Iafba loan EMI calculator is legally compliant as it serves as a financial estimation tool rather than a binding contract. It is essential for users to understand that the calculator provides estimates based on the information entered. Actual loan terms may vary based on lender policies and individual circumstances. Users should consult with financial advisors or loan officers for precise figures before committing to a loan.

Eligibility Criteria for the Iafba Loan

Eligibility for an Iafba loan often includes several criteria that applicants must meet. Common requirements may include:

- Credit Score: A minimum credit score is typically required to qualify for favorable interest rates.

- Income Verification: Proof of stable income to ensure the ability to repay the loan.

- Age and Residency: Applicants must meet age requirements and be U.S. residents or citizens.

- Debt-to-Income Ratio: A manageable ratio is necessary to demonstrate financial stability.

Quick guide on how to complete iafba loan emi calculator

Effortlessly Prepare Iafba Loan Emi Calculator on Any Device

The management of online documents has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and seamlessly. Handle Iafba Loan Emi Calculator on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Modify and Electronically Sign Iafba Loan Emi Calculator with Ease

- Locate Iafba Loan Emi Calculator and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your document, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Iafba Loan Emi Calculator to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iafba loan emi calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an iafba loan and how can it benefit my business?

An iafba loan is a financial product that helps businesses access funds for various needs, such as expansion or operational costs. By utilizing an iafba loan, you can improve cash flow and invest in essential resources to grow your business. This type of loan is designed to be flexible and easy to manage.

-

How does airSlate SignNow integrate with the iafba loan application process?

AirSlate SignNow streamlines the iafba loan application process by enabling you to prepare, send, and eSign necessary documents quickly. Our platform helps ensure that all required forms are completed efficiently, reducing delays in securing your loan. This simplifies the experience signNowly for both you and the lender.

-

What are the pricing options for airSlate SignNow when applying for an iafba loan?

AirSlate SignNow offers competitive pricing options that cater to businesses of various sizes looking to manage their iafba loan documentation. The plans are designed to provide value while ensuring you have access to essential features for document management. You can choose a plan that best fits your budget and requirements.

-

Are there any special features of airSlate SignNow that enhance the iafba loan experience?

Yes, airSlate SignNow offers features such as customizable templates and automated workflows that can enhance your iafba loan experience. These tools allow you to generate documents efficiently and track their status in real-time. This means you can focus on your business operations while we handle the paperwork.

-

Can I use airSlate SignNow to manage multiple iafba loans?

Absolutely! AirSlate SignNow allows you to manage multiple iafba loans by keeping track of different loan applications and associated documents in one secure platform. This organizational capability helps you stay focused and ensures that all necessary steps are followed for each loan. It's a perfect solution for businesses looking to handle various financial options efficiently.

-

What documents do I need to prepare for an iafba loan with airSlate SignNow?

When preparing for an iafba loan, you will need documents such as your business plan, financial statements, and personal identification. AirSlate SignNow simplifies the process by allowing you to create and eSign these documents directly in the platform. This not only saves time but also ensures that your documentation stays organized and secure.

-

What support does airSlate SignNow provide for businesses applying for an iafba loan?

AirSlate SignNow offers dedicated customer support to assist you throughout the iafba loan application process. Our team can help you navigate the platform, answer questions about features, and troubleshoot any issues you may encounter. We aim to provide the best experience possible as you work towards securing your loan.

Get more for Iafba Loan Emi Calculator

Find out other Iafba Loan Emi Calculator

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now