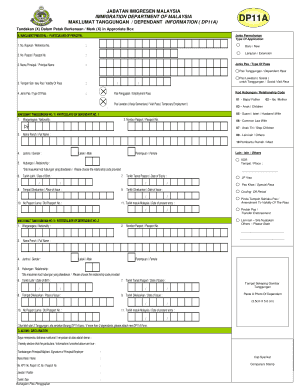

Dp11a Form

What is the DP11A?

The DP11A form is a specific document used primarily in the context of tax and financial reporting. It serves as a declaration for certain tax-related purposes, ensuring that individuals and businesses comply with federal regulations. Understanding the purpose and requirements of the DP11A is crucial for accurate filing and compliance with the Internal Revenue Service (IRS).

How to Use the DP11A

Using the DP11A form involves several key steps. First, gather all necessary information, including personal identification details and financial data relevant to the form. Next, carefully fill out each section of the form, ensuring accuracy to avoid potential issues with the IRS. After completing the form, review it for any errors before submission. Depending on your situation, you may need to submit the form electronically or via traditional mail.

Steps to Complete the DP11A

Completing the DP11A form requires a systematic approach. Follow these steps:

- Collect all required documents, such as identification and financial records.

- Access the DP11A form through the appropriate channels.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any mistakes.

- Submit the form according to the specified guidelines, either online or by mail.

Legal Use of the DP11A

The DP11A form is legally binding when completed correctly and submitted according to IRS regulations. It is essential to adhere to all legal requirements to ensure the form's validity. Utilizing a reliable electronic signature solution can enhance the form's legal standing, as it provides an electronic certificate and maintains compliance with relevant eSignature laws.

Required Documents

To successfully complete the DP11A form, certain documents are necessary. These typically include:

- Proof of identity, such as a driver's license or passport.

- Financial statements or records relevant to the information being reported.

- Any previous tax documents that may be pertinent to the current filing.

Form Submission Methods

The DP11A form can be submitted through various methods, depending on the preferences of the filer and the requirements set by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Eligibility Criteria

Eligibility for using the DP11A form varies based on individual circumstances. Generally, individuals or entities must meet specific criteria related to their tax status, income levels, and the nature of the financial transactions being reported. It is advisable to review the eligibility guidelines provided by the IRS to ensure compliance before attempting to file.

Quick guide on how to complete dp11a

Complete Dp11a effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly without any delays. Manage Dp11a on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Dp11a with minimal effort

- Obtain Dp11a and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Dp11a to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dp11a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a dp11 form and why do I need it?

The dp11 form is a legal document used to authorize and verify actions taken on behalf of a business or individual. It is essential for creating binding agreements and ensuring compliance with legal requirements. By using airSlate SignNow, you can easily prepare, send, and eSign dp11 forms, streamlining your document management process.

-

How much does it cost to use airSlate SignNow for dp11 forms?

airSlate SignNow offers a variety of pricing plans designed to fit different business needs. Whether you need basic features for occasional use or advanced functionalities for high-volume document transactions, our plans are cost-effective. You can also enjoy a free trial to explore how airSlate SignNow simplifies the signing process for dp11 forms.

-

What features does airSlate SignNow provide for managing dp11 forms?

With airSlate SignNow, you can create, send, and eSign dp11 forms quickly and securely. Key features include customizable templates, real-time tracking of document status, and automated reminders for recipients. These functionalities enhance efficiency and ensure that your dp11 forms are processed smoothly.

-

Can I integrate airSlate SignNow with other software to manage dp11 forms?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Dropbox. These integrations make it easier to manage all your documents, including dp11 forms, in one centralized location. This streamlines workflows and enhances productivity for your business.

-

Is airSlate SignNow secure for signing dp11 forms?

Yes, airSlate SignNow prioritizes the security of your documents, including dp11 forms. We use industry-standard encryption and comply with HIPAA and GDPR regulations to protect sensitive information. You can confidently eSign and manage your dp11 forms, knowing your data is safe.

-

How can I track the status of my dp11 forms with airSlate SignNow?

airSlate SignNow offers real-time tracking for all your documents, including dp11 forms. You can easily monitor when your form is sent, opened, and signed by recipients. This feature ensures that you stay informed about the progress of your dp11 forms and can follow up when necessary.

-

Can I use airSlate SignNow to create a dp11 form template?

Definitely! airSlate SignNow allows you to create reusable dp11 form templates that can be customized to fit your specific needs. This saves time and ensures consistency across all your documents. With our user-friendly platform, creating and managing templates for dp11 forms is straightforward and efficient.

Get more for Dp11a

Find out other Dp11a

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors