Printable E 500 Form

What is the Printable E 500 Form

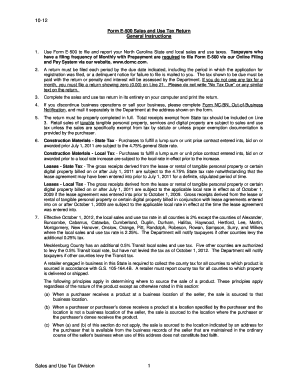

The Printable E 500 Form is a crucial document used for reporting sales and use tax in North Carolina. This form is specifically designed for businesses that need to report and remit sales tax collected from customers. It serves as a means for the state to track taxable sales and ensure compliance with tax regulations. The E 500 form is essential for maintaining accurate records and fulfilling tax obligations, making it a key component in the financial operations of businesses in North Carolina.

How to Use the Printable E 500 Form

Using the Printable E 500 Form involves several steps to ensure accurate reporting of sales tax. First, gather all necessary sales records, including invoices and receipts that detail the sales made during the reporting period. Next, complete the form by entering the total sales amount, tax collected, and any applicable deductions. After filling out the form, review it for accuracy before submitting it to the North Carolina Department of Revenue. This process helps ensure that businesses remain compliant with state tax laws.

Steps to Complete the Printable E 500 Form

Completing the Printable E 500 Form requires careful attention to detail. Follow these steps:

- Gather all sales records for the reporting period.

- Fill in the business information, including name, address, and account number.

- Report total sales and the amount of sales tax collected.

- Include any exemptions or deductions that apply.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal Use of the Printable E 500 Form

The Printable E 500 Form is legally binding when completed accurately and submitted on time. It must comply with the North Carolina sales tax laws to be considered valid. Businesses are required to maintain copies of submitted forms and supporting documents for a specified period, as they may be subject to audits by the state. Proper use of this form helps businesses avoid penalties and ensures compliance with tax regulations.

Key Elements of the Printable E 500 Form

Several key elements must be included on the Printable E 500 Form to ensure its validity. These elements include:

- Business Information: Name, address, and account number.

- Total Sales: The gross amount of sales made during the reporting period.

- Sales Tax Collected: The total amount of sales tax collected from customers.

- Deductions: Any applicable exemptions or deductions that reduce taxable sales.

- Signature: The signature of the person responsible for the accuracy of the form.

Form Submission Methods

The Printable E 500 Form can be submitted through various methods to accommodate different business needs. Businesses may choose to file the form online via the North Carolina Department of Revenue's website, which provides a convenient and efficient option. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated tax offices. Each method has its own processing times and requirements, so businesses should select the one that best suits their operational needs.

Quick guide on how to complete nc e500

Complete nc e500 effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any delays. Handle e500 webfill on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign e 500 web fill with ease

- Find e500 web fill and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign printable e 500 form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to e 500 form 2019

Create this form in 5 minutes!

How to create an eSignature for the form e 500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask nc e500 form

-

What is the e500 webfill feature in airSlate SignNow?

The e500 webfill feature in airSlate SignNow allows users to automate the filling of forms and documents. This feature streamlines the document completion process, enabling businesses to save time and improve efficiency. With e500 webfill, you can easily integrate form fields that auto-populate with client data.

-

How does e500 webfill enhance the document signing process?

e500 webfill enhances the document signing process by reducing manual data entry and minimizing errors. By utilizing this feature, users can create templates that pre-fill information, allowing for a smoother user experience. This leads to quicker sign-offs and improved turnaround times for important documents.

-

Is there a cost associated with using e500 webfill in airSlate SignNow?

The e500 webfill feature is included in various pricing plans of airSlate SignNow, allowing businesses of all sizes to access this powerful tool. Depending on the plan you choose, you can leverage e500 webfill at a competitive rate. For specific pricing details, it's best to visit our pricing page.

-

What types of documents can benefit from e500 webfill?

e500 webfill is versatile and can be applied to a wide range of documents, including contracts, applications, and forms that require client information. This feature is particularly useful for organizations that deal with high volumes of paperwork. By automating data entry, e500 webfill simplifies the documentation process signNowly.

-

Can I integrate e500 webfill with other tools or applications?

Yes, e500 webfill can be integrated with various CRM and workflow systems to enhance productivity. This integration allows data to flow seamlessly between applications, making it easier for businesses to manage their documents. airSlate SignNow supports numerous integrations to fulfill your business needs.

-

How can e500 webfill improve my team's productivity?

By using e500 webfill, your team can automate repetitive tasks associated with document preparation and signing. This reduction in manual work allows employees to focus on more critical tasks, thereby driving overall productivity. The streamlined processes resulting from e500 webfill can lead to faster decision-making and workflow efficiency.

-

Is e500 webfill user-friendly for clients and customers?

Absolutely! The e500 webfill feature is designed with user experience in mind, ensuring that clients and customers can easily fill out forms. The intuitive interface minimizes confusion, making it straightforward for users to navigate through the signing process. This enhances customer satisfaction and increases the likelihood of completing transactions.

Get more for form e500

- Employee pay restitution worksheet form

- State farm authorization for release of information form

- Kentucky limited power of attorney form

- Hsbc dispute form india

- Nu certificate form download pdf

- 365 day penny challenge pdf form

- Raisch creek off road park membership application form

- Form 14 rto 43575700

Find out other nc sales tax form e 500

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online