Stock Write off Template Form

What is the Stock Write Off Template

The stock write off template is a structured document used by businesses to formally record the removal of inventory from their financial statements. This process typically occurs when stock is deemed unsellable due to damage, obsolescence, or theft. By utilizing this template, companies can ensure accurate accounting practices and maintain compliance with financial reporting standards.

How to Use the Stock Write Off Template

To effectively use the stock write off template, businesses should follow these steps:

- Gather all necessary information regarding the inventory being written off, including item descriptions, quantities, and reasons for the write-off.

- Fill in the template with accurate data, ensuring all required fields are completed.

- Review the document for accuracy and completeness before submission.

- Obtain necessary approvals from management or relevant stakeholders to validate the write-off.

Steps to Complete the Stock Write Off Template

Completing the stock write off template involves several key steps:

- Identify the inventory items to be written off.

- Document the reasons for the write-off, which may include damage, expiration, or loss.

- Enter the relevant details into the template, such as item codes, descriptions, and quantities.

- Calculate the total value of the write-off and include it in the appropriate section of the form.

- Sign and date the document to finalize the write-off process.

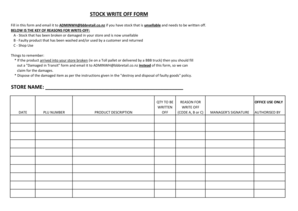

Key Elements of the Stock Write Off Template

The stock write off template typically includes several essential elements:

- Item Description: A clear description of each item being written off.

- Quantity: The number of units being removed from inventory.

- Reason for Write-Off: A brief explanation of why the stock is being written off.

- Date of Write-Off: The date when the decision to write off the stock was made.

- Approval Signatures: Spaces for signatures from management or authorized personnel.

Legal Use of the Stock Write Off Template

The stock write off template is legally binding when completed and signed according to applicable regulations. It is essential for businesses to ensure compliance with the relevant accounting standards and legal requirements, which may include maintaining accurate records for tax purposes. By using a reliable digital solution, organizations can enhance the legal validity of their write-off documents.

Examples of Using the Stock Write Off Template

Examples of scenarios where the stock write off template may be utilized include:

- A retail store needing to write off damaged merchandise after a shipment mishap.

- A manufacturer identifying obsolete parts that are no longer in production.

- A restaurant removing expired food items from inventory records.

Quick guide on how to complete stock write off template

Complete Stock Write Off Template effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Stock Write Off Template on any device using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The simplest way to modify and eSign Stock Write Off Template with ease

- Locate Stock Write Off Template and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), an invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in several clicks from any device of your choice. Modify and eSign Stock Write Off Template and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stock write off template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a stock write off form?

A stock write off form is a document used to record the reduction of the value of inventory that is no longer sellable or is considered a loss. It allows businesses to effectively manage their stock and financial reporting. By using airSlate SignNow for this form, you can streamline your process with eSignature capabilities.

-

How can airSlate SignNow help with stock write off forms?

airSlate SignNow simplifies the creation and signing of stock write off forms by providing a user-friendly platform for eSigning. This not only saves time but also enhances the accuracy of your documentation. With access to templates, you can easily customize your stock write off forms to suit your business needs.

-

Is there a cost associated with using airSlate SignNow for stock write off forms?

Yes, using airSlate SignNow comes with various pricing plans designed to fit different business sizes and needs. Each plan gives you access to features such as unlimited eSigning, which is particularly useful for handling stock write off forms. You can review our pricing page for detailed information on each option.

-

What features does airSlate SignNow offer for stock write off forms?

airSlate SignNow provides several features for stock write off forms including template creation, cloud storage, and eSignature tracking. These features enhance security and organization for your stock documentation. Moreover, integration with popular tools makes managing your stock write off forms even more efficient.

-

Can I integrate airSlate SignNow with other software for my stock write off forms?

Absolutely! airSlate SignNow offers integrations with numerous applications, allowing you to seamlessly include stock write off forms into your existing workflows. Whether it's accounting software or inventory management systems, integrations enhance the functionality and streamline your processes.

-

How secure is my data when using airSlate SignNow for stock write off forms?

Your data is highly secure when using airSlate SignNow for stock write off forms. The platform uses advanced encryption and complies with industry security standards to protect sensitive information. This ensures that your stock write off forms remain confidential and secure throughout the signing process.

-

Can I use airSlate SignNow for mobile stock write off forms?

Yes, airSlate SignNow is mobile-friendly, enabling you to create and eSign stock write off forms from any device. This flexibility allows for quick approvals and documentation even when you're on the go. Experience efficient handling of stock write off forms without being tied to a desk.

Get more for Stock Write Off Template

- Apkpurecom downloaddownload i love pdf latest 10 android apk apkpurecom form

- Application for provisional registration apro 76 form

- Ecm273748v14832 fmx 002 application for a residential parking permit 32 fmx 002 application for a residential parking permit form

- Mental health referral form

- B370 movement permission application b370 movement permission application form

- Fillable online abridged crash report application form authorised

- Certificate of currency form

- Confirmation of identity verification for aboriginal andconfirmation of aboriginality application formconfirmation of

Find out other Stock Write Off Template

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure