Std 273 Form

What is the Std 273

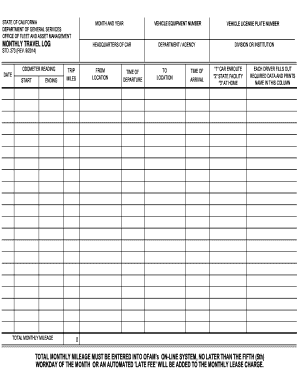

The Std 273 is a form used primarily for reporting and documenting mileage for business purposes. This form is essential for individuals and businesses that need to track their travel expenses accurately. It serves as a record for tax deductions and is often required by various organizations to substantiate mileage claims. The Std 273 form helps ensure compliance with IRS regulations regarding business-related travel expenses.

How to use the Std 273

Using the Std 273 involves several straightforward steps. First, gather all necessary information about your trips, including dates, destinations, and purposes of travel. Next, accurately document the mileage for each trip, ensuring that you distinguish between business and personal travel. Once you have filled out the form, review it for accuracy before submission. This careful approach helps maintain compliance and supports your claims for deductions.

Steps to complete the Std 273

Completing the Std 273 requires attention to detail. Begin by entering your name and contact information at the top of the form. Then, list each trip separately, including the date, starting point, destination, purpose, and total miles driven. Ensure that you differentiate between business and personal mileage. After filling out all required sections, sign and date the form to affirm its accuracy. Finally, keep a copy for your records and submit it as needed.

Legal use of the Std 273

The legal use of the Std 273 is crucial for maintaining compliance with tax laws. When used correctly, this form serves as a legitimate document for claiming mileage deductions. It is essential to keep accurate records and ensure that all information is truthful and complete. Misuse or inaccuracies can lead to penalties or audits by the IRS. Therefore, understanding the legal implications of this form is vital for anyone using it for business purposes.

Examples of using the Std 273

Examples of using the Std 273 include scenarios where a self-employed individual tracks their mileage for client meetings or a small business owner documents travel for business conferences. In these cases, the form provides a clear record that can be submitted for tax deductions. Additionally, employees who use their personal vehicles for work-related tasks may also utilize the Std 273 to claim reimbursement from their employer.

Filing Deadlines / Important Dates

Filing deadlines for the Std 273 may vary depending on the specific tax year and individual circumstances. Generally, it is advisable to complete and submit the form by the end of the tax year to ensure that all expenses are accounted for. Staying informed about any changes in tax laws or deadlines is essential for compliance and maximizing potential deductions.

Form Submission Methods (Online / Mail / In-Person)

The Std 273 can be submitted through various methods, depending on the requirements of the organization or tax authority. Options typically include online submission through secure portals, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method has its own advantages, and choosing the right one can enhance the efficiency of the submission process.

Quick guide on how to complete std 273

Prepare Std 273 easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage Std 273 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Std 273 with ease

- Locate Std 273 and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Std 273 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the std 273

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is std 273 in the context of airSlate SignNow?

std 273 refers to the standardization of electronic signatures and document management processes within airSlate SignNow. This ensures that your documents are legally binding and compliant with industry best practices, providing users with peace of mind when signing important agreements.

-

How does airSlate SignNow utilize std 273 to enhance user experience?

airSlate SignNow incorporates std 273 by providing a user-friendly interface that simplifies the document signing process. This means you can easily send, track, and manage your documents while ensuring they are in line with legal requirements, thus streamlining your workflow.

-

What are the pricing options for airSlate SignNow with std 273 compliance?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs, all while maintaining std 273 compliance. You can choose from monthly or annual subscriptions, allowing businesses to select the best option to fit their budget without sacrificing quality.

-

What features does airSlate SignNow provide that align with std 273?

airSlate SignNow includes various features that comply with std 273, including customizable templates, real-time tracking of document statuses, and secure storage solutions. These features help ensure that your electronic signing processes are efficient, secure, and compliant.

-

How does airSlate SignNow ensure the security of documents under std 273?

To uphold the standards of std 273, airSlate SignNow employs advanced encryption methods and secure access controls to protect your documents. This ensures that sensitive information remains confidential and secure during the document signing process.

-

Can airSlate SignNow integrate with other applications while adhering to std 273?

Yes, airSlate SignNow integrates seamlessly with various applications, such as Google Drive, Salesforce, and more, while fully adhering to std 273 standards. These integrations help businesses streamline their workflows and enhance productivity without compromising on compliance.

-

What are the benefits of using airSlate SignNow alongside the std 273 framework?

Using airSlate SignNow in accordance with the std 273 framework provides numerous benefits, including enhanced document security, improved efficiency in the signing process, and guaranteed legal compliance. This powerful combination simplifies your document workflow, making it easier to manage and complete contracts and agreements.

Get more for Std 273

- New india assurance satisfaction voucher pdf form

- Klerksdorp nursing college requirements form

- Form 202 maryland

- Tpad summary form 2020 pdf

- The great mail race questionnaire form

- Mai mathematics assessment interview pdf form

- Gizmos student exploration human homeostasis answer key form

- Form rp 5850 application for superstorm sandy exemption

Find out other Std 273

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now