Gateway Health Plan Providers 2015-2026

What is the Gateway Health Plan Providers

The Gateway Health Plan Providers are a network of healthcare professionals and facilities that offer services to members enrolled in the Gateway Health Plan. This program aims to provide accessible and affordable healthcare options to individuals and families. Providers within this network include doctors, specialists, hospitals, and clinics that meet specific quality and service standards. Understanding the network is essential for members to maximize their benefits and receive appropriate care.

How to use the Gateway Health Plan Providers

Using the Gateway Health Plan Providers involves several straightforward steps. First, members should verify their eligibility and coverage details by accessing their member portal. Next, they can search for in-network providers using the online directory or by contacting customer service for assistance. Once a provider is selected, members should schedule an appointment and present their insurance information at the visit. It is important to confirm that the chosen provider is part of the Gateway network to avoid unexpected costs.

Steps to complete the Gateway Health Plan Providers

Completing the necessary steps to utilize the Gateway Health Plan Providers includes the following:

- Review your health plan benefits and coverage details.

- Access the online provider directory to find in-network options.

- Contact the selected provider to confirm acceptance of the Gateway Health Plan.

- Schedule an appointment and prepare any required documentation.

- Attend the appointment and provide your insurance information.

Legal use of the Gateway Health Plan Providers

The legal use of the Gateway Health Plan Providers ensures compliance with healthcare regulations and protects members' rights. Members must utilize in-network providers to receive full benefits as outlined in their plan. Additionally, it is crucial to understand the legal obligations of both providers and members, including privacy protections under HIPAA. Members should also be aware of their rights regarding treatment options and the appeals process for denied claims.

Eligibility Criteria

Eligibility for the Gateway Health Plan Providers is determined by several factors, including residency, income level, and specific health needs. Generally, individuals must reside in the service area and meet income guidelines to qualify for coverage. Certain groups, such as children, pregnant women, and individuals with disabilities, may have additional eligibility considerations. It is advisable for potential members to review the eligibility requirements thoroughly to ensure they qualify for the program.

Required Documents

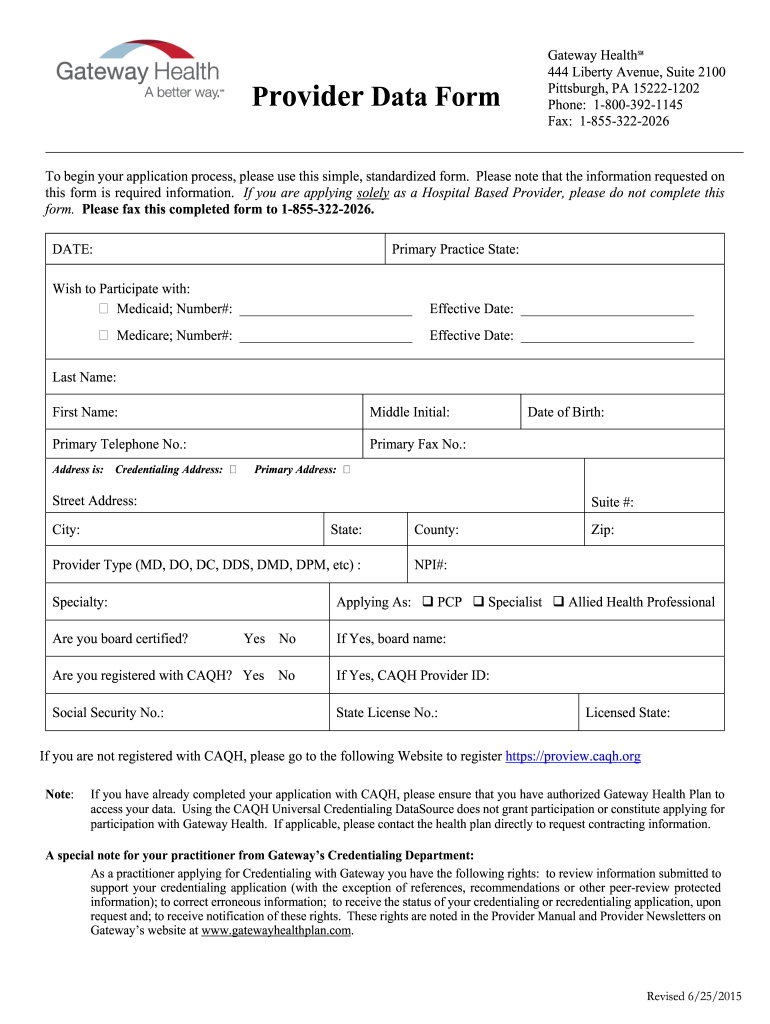

To enroll in the Gateway Health Plan and access its providers, members must prepare specific documentation. Required documents typically include proof of identity, residency, income verification, and any relevant health information. These documents help establish eligibility and ensure that members receive appropriate coverage. It is recommended to gather all necessary paperwork before starting the application process to streamline enrollment.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms for the Gateway Health Plan can be done through various methods to accommodate members' preferences. Forms can typically be submitted online via the member portal, allowing for quick processing. Alternatively, members may choose to mail their completed forms to the designated address or submit them in person at a local office. Each method has its own processing times, so members should select the option that best fits their needs.

Quick guide on how to complete provider data form gateway health plan

The optimal method to acquire and endorse Gateway Health Plan Providers

On the scale of your entire organization, inefficient workflows surrounding document authorization can take up a signNow amount of work hours. Endorsing documents such as Gateway Health Plan Providers is an inherent aspect of operations in every sector, which is why the efficacy of each agreement's lifecycle greatly impacts the company's overall productivity. With airSlate SignNow, endorsing your Gateway Health Plan Providers can be as straightforward and swift as possible. This platform offers you the newest version of nearly any form. Even better, you can endorse it immediately without needing to install external applications on your computer or printing physical copies.

Steps to acquire and endorse your Gateway Health Plan Providers

- Explore our repository by category or use the search bar to locate the document you need.

- View the form preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Gateway Health Plan Providers.

- Select the signing method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can find, fill out, edit, and even send your Gateway Health Plan Providers in one tab with no complications. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What service can I use to have a website visitor fill out a form, put the data in the form into a prewritten PDF, then charge the visitor to download the PDF with the data provided filled in?

You can use signNow to set up PDF templates, which can be filled out with an online form. signNow doesn’t support charging people to download the PDF, but you could use Stripe for this (would require some programming.)

-

If I receive a health care coverage questionnaire from my current provider, am I required to fill it out?

I can't say whether you would be contractually obligated. It's a very good idea to complete the survey and send it in as the carrier may put claims processing on hold for you until it receives your updated information. This means your providers won't get paid and when they don't get paid it's you they will be looking for.The insurance company sends these questionnaires because when someone has more than one form of insurance the different carriers take on roles — primary, secondary, tertiary, etc. The primary carrier pays first according to the terms of the policy. The secondary company will pay second, but they will only consider what's left after the primary pays.For example, let's say your ER visit was $2000. Your deductible is $1000 with the primary carrier and the primary insurance pays $1000.Your deductible with the secondary insurance is only $500. The secondary carrier is now looking at a bill for $1000. They pay $500.In the end, you paid $500, primary paid $1000, and secondary paid $500.If you only gave the provider information on your secondary insurance, they would be billed that while $2000 (as the ER wouldn't know about your other coverage). The secondary carrier, knowing they're second, will insist it's sent to the primary carrier for payment first.If they don't know there's a primary carrier, this becomes a very different financial situation for them — instead of $500, they pay $1500! That's your full bill less the $500 you pay out of pocket.Not knowing about the primary carrier just cost the secondary insurance an additional $1000.It's for this reason that they keep sending you questionnaires, and for this reason that they could hold off on processing your claims if you don't respond. In the end their goal is to save as much money as possible by making sure that they don't pay anything for which they aren't liable.

-

What form does a soldier in the military need to fill out to add someone they are married to in the military data base?

What form does a soldier in the military need to fill out to add someone they are married to in the military data base?The soldier must take a copy of the marriage certificate to his personnel office to get his spouse enrolled in DEERS and fill out a DD 1172. He must update his DD 93 and should (but is not required to) update his SGLI beneficiaries.None of this costs any money at all. Since all of this information is readily available to anyone who is actually in the military, my guess is that you are falling victim to a scammer.Military Romance Scams by Sean Sanders on Posts

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How does one choose the best global health insurance plans for frequent travelers or expatriates?

Best International Health Insurance CompaniesThere are a number of options for international citizens and expatriates. You can buy global plans from an international provider, a local national plan within the country you are living in, or a private plan from a domestic private insurance company. All are good options. Your decision should be made based on your needs and the options available in the country where you are living.The following article describes this decision process in a little more detail: Choosing an Expatriate Health Insurance Plan In short, some countries have great national plans and you will want to sign up for it if you can. Other countries have terrible national plans and you will want a private plan. In that case, Compare International Health Insurance for Expatriates and choose the best option for your needs.What are the Best International Health Insurance ProvidersBelow is a comprehensive list of international insurance companies that offer the best in service, benefits, coverage and rates. As always, review the terms of the policy carefully andCigna was one of the first companies to offer expatriate or global medical insurance plans and they remain a leading international provider. Free Quote / ApplyGeoBlue Global Medical – Designed for US citizens abroad. GeoBlue is an independent licensee of the Blue Cross Blue Shield Association and offers both short term travel medical plans as well as long term international health plans. Blue Cross Blue Shield is a federation of 37 independent health insurance providers in the United States. GeoBlue is a trade name of Worldwide Insurance Services, LLC (Worldwide Services Insurance Agency, LLC in California and New York), an independent licensee of the Blue Cross Blue Shield Association. Free Quote / ApplyInternational Medical Group – IMG offers the widest range of products, from trip cancellation to long term international medical plans (IMG Global Medical). For more than 20 years, IMG has provided international medical insurance, travel insurance and impeccable service to the international community insuring clients in more than 170 countries worldwide. Free Quote / ApplyAllianz – One of the biggest insurance providers in the world, Allianz is a Germany company. Allianz Worldwide is the international health division of Allianz Worldwide Partners and part of the Allianz Group. The company is well known for its international signNow, and for providing international health insurance for employees.Aetna International – With more than 160 years of experience in health care, Aetna has specialized in international health benefits insurance for more than 55 years ― with a growing global footprint to signNow wherever you travel. They have been recognized with such prestigious awards as “Best International Private Health Insurance Provider” and “Health Insurer of the Year.”BUPA International health Plan – Offers over 65 years of medical expertise and dedication to health. They have a global team of advisers and health experts who, between them, speak multiple languages – and a service that exceeds expectations. These are just a few of the things that make Bupa Global different. Explore how we provide you with world-class cover and stand apart from the rest.- See more at: https://www.internationalinsuran...

Create this form in 5 minutes!

How to create an eSignature for the provider data form gateway health plan

How to create an eSignature for the Provider Data Form Gateway Health Plan in the online mode

How to make an electronic signature for the Provider Data Form Gateway Health Plan in Chrome

How to make an electronic signature for signing the Provider Data Form Gateway Health Plan in Gmail

How to create an electronic signature for the Provider Data Form Gateway Health Plan from your smartphone

How to make an eSignature for the Provider Data Form Gateway Health Plan on iOS

How to make an eSignature for the Provider Data Form Gateway Health Plan on Android

People also ask

-

What is a data form gateway?

A data form gateway is a user-friendly interface that allows businesses to create, manage, and automate data collection forms. It integrates with electronic signature solutions like airSlate SignNow, enhancing the document workflow by enabling efficient form submissions and data handling.

-

How does the data form gateway benefit businesses?

The data form gateway streamlines the data collection process, saving time and reducing errors. By leveraging a digital platform, businesses can improve collaboration, enhance data accuracy, and speed up decision-making, all of which contribute to greater operational efficiency.

-

Is the data form gateway secure?

Absolutely! The data form gateway provided by airSlate SignNow includes robust security features such as encryption and secure data storage. This ensures that all information collected through the gateway is protected, giving you peace of mind when handling sensitive documents.

-

What features are included in the data form gateway?

The data form gateway offers various features, including customizable form templates, automated workflows, and seamless integrations with existing tools. These features help businesses create tailored data collection processes that align with their specific needs.

-

Can I integrate the data form gateway with other software?

Yes, the data form gateway can be easily integrated with a wide range of applications and platforms, such as CRM systems and cloud storage solutions. This allows for streamlined data transfer and enhanced functionality, maximizing the value of your existing software ecosystem.

-

What is the pricing model for the data form gateway?

airSlate SignNow offers competitive pricing for the data form gateway, designed to fit businesses of all sizes. You can choose from several subscription plans based on your needs, ensuring you get the best value for the features and services provided.

-

How can the data form gateway improve customer experience?

By using the data form gateway, businesses can provide a smoother and more efficient experience for their customers. Quick and easy access to forms, coupled with electronic signature capabilities, allows customers to complete necessary tasks seamlessly, leading to higher satisfaction rates.

Get more for Gateway Health Plan Providers

Find out other Gateway Health Plan Providers

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile