Azdor Form

What is the Azdor

The Azdor refers to the Arizona Department of Revenue, which is responsible for administering state tax laws and collecting taxes in Arizona. This department plays a crucial role in ensuring compliance with tax regulations and providing resources for taxpayers. It oversees various forms, including the Form 290 and Form 450, which are essential for different tax-related processes. Understanding the Azdor is vital for anyone engaging in tax activities within the state.

How to use the Azdor

Using the Azdor involves accessing its online portal, where taxpayers can find necessary forms, check their tax status, and manage their accounts. The portal provides a user-friendly interface that simplifies the process of submitting forms and making payments. Additionally, taxpayers can contact the Arizona Department of Revenue for assistance with specific queries or issues regarding their tax obligations.

Steps to complete the Azdor

Completing the Azdor forms typically involves several steps:

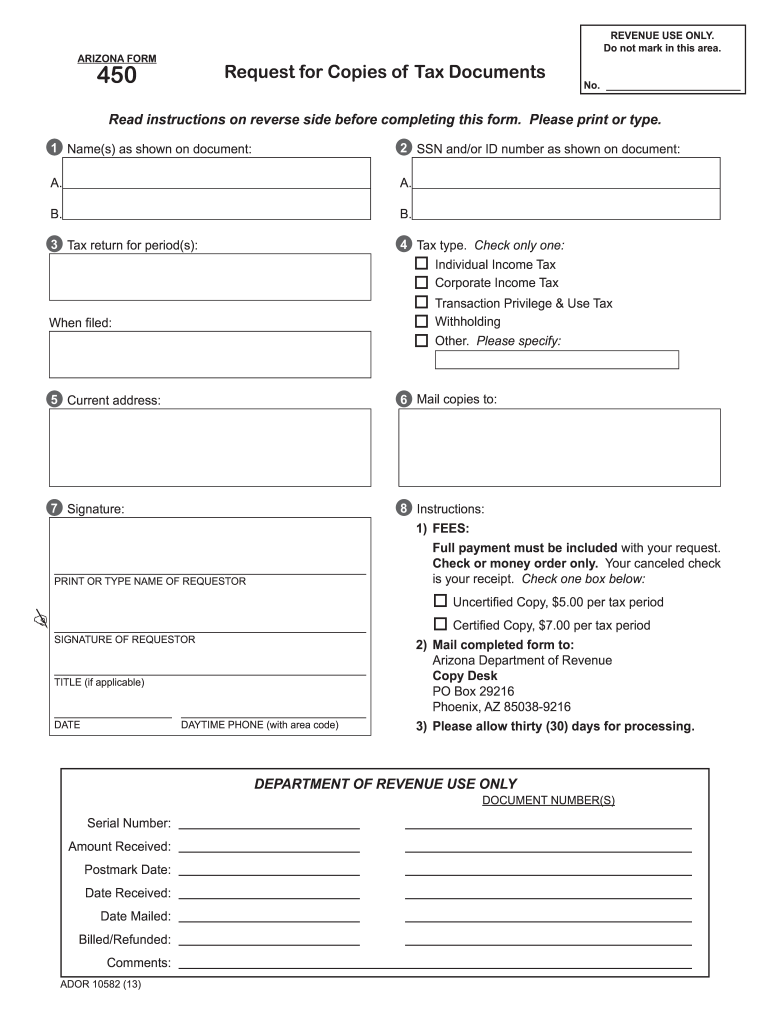

- Identify the correct form needed for your tax situation, such as the Form 290 or Form 450.

- Gather all required documentation, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all information is complete and correct.

- Submit the form electronically through the Azdor online portal or by mailing it to the appropriate address.

- Keep a copy of the submitted form for your records.

Legal use of the Azdor

The legal use of the Azdor is governed by state tax laws, which dictate how forms should be completed and submitted. It is essential for taxpayers to comply with these regulations to avoid penalties. The Azdor provides guidelines on the legal requirements for eSignatures and digital submissions, ensuring that all electronic documents are valid and recognized by the state.

Required Documents

When filling out forms associated with the Azdor, specific documents are often required. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Previous year’s tax return

- Proof of residency in Arizona

- Any relevant deductions or credits documentation

Form Submission Methods

Forms related to the Azdor can be submitted through various methods, ensuring convenience for taxpayers:

- Online: Use the Azdor online portal for electronic submissions.

- Mail: Send completed forms to the designated mailing address provided on the form.

- In-Person: Visit an Arizona Department of Revenue office to submit forms directly.

Penalties for Non-Compliance

Failing to comply with the requirements set forth by the Azdor can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for taxpayers to understand their obligations and ensure timely submission of all required forms to avoid these consequences.

Quick guide on how to complete arizona form 450 arizona department of revenue azdor

Complete Azdor effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with everything needed to create, modify, and eSign your documents swiftly without interruptions. Manage Azdor on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Azdor with ease

- Find Azdor and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Azdor to ensure outstanding communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What form do I need for the Arizona Department of Revenue for a W-2?

The W2 is generic across all jurisdictions but they have supplemental tax data. If you have a Federal W2 use that. The big issue is did you have withholdings for Arizona? The state W2 would contain that data. Did you check the entire form?

-

How many boxes of cereal would it take to fill the Arizona meteor crater?

Here is some data for the volume of the Arizona Meteor crater approximately 37 miles (60 km) east of Flagstaff and 18 miles (29 km) west of Winslow in the northern Arizona desert of the United States.(Wikipedia)1975LPI.....6..680R Page 680(The data in the article above can be found on the second page table 3 under volume, the measurement is in Meters not centimeters, my apologies for my own mistake. In my own haste and excitement over this question, I rushed the gun and didn’t check my units)The volume Not including the ‘over turned flap’ is 126.5 X 10^6 m^3 (correction m, not cm) and a family sized box of fruit loops is around 26oz. Which if I haven’t made any mistakes in my conversion factors is equivalent to (I made a mistake) 0.000709765 m^3(changed cm to m), lol this is the corrected answer after fixing my mistake 178,228,005,044 boxes of fruit loops should do the trick.

-

Is it possible to take Uber out of state? If so how do I find out the cost of say going from California to Arizona?

There are multiple questions here:Is it possible to take a Uber out of state?Yes, this is possible, sort of.Drivers are permitted to take a passenger to any destination, even if it is outside of their working region. (Source)The catch is that there is actually a duration limit as to how long a ride can be. At some point, Uber app will automatically complete the ride. At that point, you can request another Uber, granted they have service there. (Source: Is there a maximum distance the driver will bring you?)How do I find out the cost?I attempted to use a RideGuru calculator, but the trip is too long. (which is fair) Given the above limitation, I think the best is to simply talk to your driver (whether he or she is with Uber or not) and come up with an arrangement.Fare Estimates from California to Arizona. Uber, Lyft, Taxis, Limos, and more

-

How can I send a bottle of wine as a gift from out of state to an adult of over 21 year in Phoenix, Arizona?

Very carefully. First make sure you have proper packaging. There is specialty packaging that must be used for wine bottles. Next, ship by UPS or FedEx. USPS will not transport alcohol in any shape. Then figure the heat factor in Phoenix. The quickest and easiest way to kill a bottle of wine is by heat. For most of the year, AZ is too hot to send wine that is not in climate controlled transport. Wine must be signed for when it is shipped. so figure that the bottle will be riding around in a not ac UPS truck for most of the day.Why not just call a local wine specialty shop and purchase a special bottle for your friend. They will hold it and your friend can just drive over and pick it up. Might be a lot easier.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Has anyone out there moved from Arizona to Seattle? How did you deal with the weather change and the lack of sunlight?

I actually did move “from Phoenix, AZ all the way to Tacoma”, back in 1997. It was an adjustment to say the least. One I rather enjoyed though. I was born and raised in the desert and was ready for a change though. I never knew a place could have so many trees and so much green. Going from the desert where you get two seasons: hot and hotter, I was introduced to real seasonal changes that opened my eyes. Rain is a nearly every day occurrence in Western Washington, but not hard rain, just sprinkles. It made everything so green and lush. There are days in Tacoma/Seattle where there is not much sunlight, but this didn’t bother me personally. Of course there are days when you wish it was more sunny, but the outdoor activities in the woods or near mountains were fantastic. I did a lot of biking, hiking and walking through some of the most beautiful places I’ve ever been too. I lived in various parts of Western Washington for two years and after returning to Phoenix, I really considered moving back long term.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the arizona form 450 arizona department of revenue azdor

How to make an electronic signature for your Arizona Form 450 Arizona Department Of Revenue Azdor online

How to make an electronic signature for your Arizona Form 450 Arizona Department Of Revenue Azdor in Google Chrome

How to generate an electronic signature for signing the Arizona Form 450 Arizona Department Of Revenue Azdor in Gmail

How to generate an electronic signature for the Arizona Form 450 Arizona Department Of Revenue Azdor from your smartphone

How to make an electronic signature for the Arizona Form 450 Arizona Department Of Revenue Azdor on iOS

How to create an electronic signature for the Arizona Form 450 Arizona Department Of Revenue Azdor on Android devices

People also ask

-

What is azdor and how does it relate to document signing?

Azdor is an innovative solution designed to streamline document signing processes. It integrates with airSlate SignNow to provide businesses with a powerful eSignature tool, allowing them to send and eSign documents easily and efficiently.

-

How much does azdor cost for businesses?

Azdor offers competitive pricing plans catering to various business needs. With airSlate SignNow, businesses can choose a plan that fits their budget while accessing a range of features designed to simplify document management and eSigning.

-

What features does azdor offer for enhancing document workflows?

Azdor includes essential features such as customizable templates, real-time tracking, and cloud storage integrations. By leveraging these features alongside airSlate SignNow, businesses can improve their document workflows signNowly.

-

Can azdor integrate with other software tools?

Yes, azdor is designed to seamlessly integrate with various software tools and platforms. This allows businesses using airSlate SignNow to enhance their workflows by connecting to their existing systems, ensuring a smooth transition and better efficiency.

-

What are the benefits of using azdor for eSignatures?

Using azdor for eSignatures provides numerous benefits, including increased turnaround times and improved transaction security. With airSlate SignNow, users can benefit from a user-friendly interface that makes the signing process simpler and more accessible.

-

Is azdor secure for sensitive documents?

Absolutely, azdor prioritizes document security with advanced encryption protocols. When combined with airSlate SignNow, businesses can confidently handle sensitive information, ensuring all eSigned documents remain safe and protected.

-

How does azdor improve team collaboration?

Azdor enhances team collaboration by enabling multiple users to collaborate on documents in real-time. With airSlate SignNow, teams can track changes and comments, ensuring everyone stays aligned and informed through the signing process.

Get more for Azdor

Find out other Azdor

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT