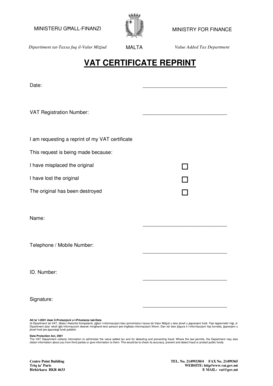

Vat Certificate Malta Form

What is the VAT Certificate Malta

The VAT certificate is an official document issued by the tax authority in Malta, confirming that a business is registered for Value Added Tax (VAT). This certificate is essential for businesses that engage in taxable activities, as it allows them to charge VAT on their sales and reclaim VAT on their purchases. The VAT certificate serves as proof of registration and is often required for various business transactions, including invoicing and compliance with tax regulations.

How to Obtain the VAT Certificate Malta

To obtain a VAT certificate in Malta, a business must first register with the Maltese tax authorities. This process typically involves submitting an application form along with supporting documentation, such as proof of business registration and identification details of the business owners. Once the application is reviewed and approved, the tax authority will issue the VAT certificate. It is advisable to ensure that all information provided is accurate to avoid delays in processing.

Key Elements of the VAT Certificate Malta

A VAT certificate in Malta includes several critical elements that validate its authenticity. These elements typically consist of:

- VAT Registration Number: A unique identifier assigned to the business.

- Business Name: The official name under which the business operates.

- Date of Issue: The date when the certificate was issued.

- Tax Authority Details: Information about the issuing tax authority.

These components are essential for ensuring compliance with VAT regulations and for facilitating business transactions.

Legal Use of the VAT Certificate Malta

The VAT certificate is legally binding and must be used in accordance with Maltese tax laws. Businesses are required to display their VAT registration number on invoices and other relevant documents. This ensures transparency in transactions and compliance with tax obligations. Failure to use the VAT certificate correctly can result in penalties or fines from the tax authorities.

Examples of Using the VAT Certificate Malta

There are various scenarios where a VAT certificate is utilized in Malta. For instance:

- A business selling goods or services must include its VAT registration number on invoices to customers.

- When purchasing goods from suppliers, businesses may need to present their VAT certificate to reclaim VAT paid on purchases.

- In case of audits, the VAT certificate serves as proof of registration and compliance with tax regulations.

These examples highlight the importance of the VAT certificate in everyday business operations.

Steps to Complete the VAT Certificate Malta

Completing the VAT certificate involves several steps to ensure that all necessary information is accurately provided. These steps include:

- Gather Required Information: Collect all necessary documents and details about the business.

- Fill Out the Application Form: Complete the VAT registration application form accurately.

- Submit the Application: Send the completed form along with supporting documents to the tax authority.

- Receive Confirmation: Wait for the tax authority to process the application and issue the VAT certificate.

Following these steps can help streamline the registration process and ensure timely receipt of the VAT certificate.

Quick guide on how to complete vat certificate malta

Complete Vat Certificate Malta with ease on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without hassles. Manage Vat Certificate Malta on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and eSign Vat Certificate Malta effortlessly

- Locate Vat Certificate Malta and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize signNow parts of the documents or obscure sensitive information using tools that airSlate SignNow uniquely provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Vat Certificate Malta and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat certificate malta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT certificate and why do I need one?

A VAT certificate is an official document that verifies a business's registration for Value Added Tax (VAT). Understanding what is VAT certificate is crucial for businesses engaged in trade, as it allows for the reclaiming of VAT on goods and services. Without it, companies may face additional costs that could impact their financial operations.

-

How does airSlate SignNow help with VAT certificate management?

airSlate SignNow simplifies the process of managing and storing your VAT certificates by providing a secure digital solution. This platform enables users to easily access, send, and eSign essential documents, including VAT certificates. Knowing what is VAT certificate management can streamline your compliance processes signNowly.

-

Is there a cost associated with obtaining a VAT certificate through airSlate SignNow?

While there is no direct fee for obtaining a VAT certificate itself, airSlate SignNow offers competitively priced plans for its eSigning services. Understanding what is VAT certificate support within our platform will help you evaluate the overall savings it provides for document processing and compliance management.

-

What features does airSlate SignNow offer for handling VAT certificates?

airSlate SignNow provides features such as template creation, bulk sending, and secure storage specifically designed to handle important documents like VAT certificates. The eSignature functionality ensures that your certificates are signed quickly and legally. Familiarizing yourself with what is VAT certificate capabilities on our platform can enhance operational efficiency.

-

Are there integrations available for managing VAT certificates?

Yes, airSlate SignNow seamlessly integrates with various business applications, allowing for efficient handling of VAT certificates along with other documents. Platforms like CRM and accounting software can synchronize with your airSlate SignNow account. Understanding what is VAT certificate integration allows businesses to streamline their workflows and enhance productivity.

-

Can I track the status of my VAT certificate requests?

Absolutely! With airSlate SignNow, you can easily track the status of your VAT certificate requests in real-time. Users are notified throughout the signing process, making it simple to manage multiple certificates efficiently. Knowing what is VAT certificate tracking can help ensure your documents are always in order.

-

How can airSlate SignNow enhance compliance with VAT certificate requirements?

By using airSlate SignNow, businesses can ensure that their VAT certificates are correctly managed and stored in compliance with regulations. Our platform's security features protect sensitive information while enabling quick access and audit trails. This understanding of what is VAT certificate compliance can signNowly reduce your risk exposure.

Get more for Vat Certificate Malta

- Chapter 23 01 state department of health form

- Final range wide environmental impact statement form

- Application for body art operator form

- Claim verification formpages hf k12 mn

- Eligibility and restrictions arizona tuition organization form

- Parade participant application twin falls western days form

- Participant application salinas police activities league form

- Pre application meeting request form state of pdffiller

Find out other Vat Certificate Malta

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple