592v Form

What is the 592v

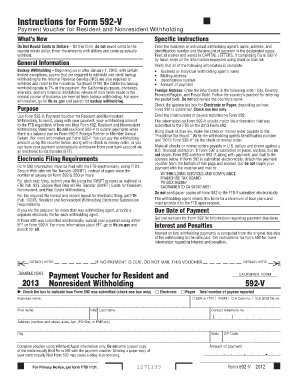

The 592v form is a tax document used primarily for reporting withholding on California source income. It is essential for non-resident individuals and entities receiving income from California sources, ensuring compliance with state tax laws. By using the 592v, taxpayers can accurately report the amount of California income that is subject to withholding, which helps prevent underreporting and potential penalties.

How to use the 592v

Utilizing the 592v form involves several critical steps. First, determine if you are required to file this form based on your residency status and the nature of your income. Next, gather all necessary information, including the details of the income received and the amount withheld. Complete the form by accurately filling in all required fields, ensuring that you provide the correct taxpayer identification number and other pertinent information. Finally, submit the completed form to the appropriate tax authority by the specified deadline.

Steps to complete the 592v

Completing the 592v form requires careful attention to detail. Follow these steps:

- Gather all relevant income documentation, including pay stubs or statements showing California source income.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Detail the income received from California sources, specifying the amount and type of income.

- Calculate the total amount of withholding that applies to your income.

- Review the form for accuracy and completeness before submission.

Legal use of the 592v

The legal use of the 592v form is crucial for compliance with California tax regulations. This form serves as an official record of income and withholding, and it must be filed accurately to avoid legal repercussions. The information reported on the 592v is used by the California Franchise Tax Board to ensure that taxpayers fulfill their obligations. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 592v form is essential for compliance. Generally, the form must be submitted by the due date of the income tax return for the year in which the income was received. It is advisable to check the California Franchise Tax Board's official website for specific dates, as they can vary annually. Missing the deadline may result in penalties and interest on any taxes owed.

Required Documents

When preparing to file the 592v form, certain documents are necessary to ensure accurate reporting. These include:

- Income statements or pay stubs showing California source income.

- Previous tax returns, if applicable, to reference withholding amounts.

- Any correspondence from the California Franchise Tax Board regarding withholding requirements.

Who Issues the Form

The 592v form is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's income tax laws and ensuring compliance among taxpayers. It provides the necessary forms and guidelines to assist individuals and businesses in fulfilling their tax obligations related to California source income.

Quick guide on how to complete 592v

Effortlessly complete 592v on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without holdups. Handle 592v on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign 592v without any hassle

- Find 592v and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to receive your form: via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 592v and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 592v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary feature of airSlate SignNow 592v?

The primary feature of airSlate SignNow 592v is its user-friendly interface that allows businesses to send, sign, and manage documents electronically. This platform is designed to streamline the signing process, ensuring that users can complete transactions quickly and efficiently.

-

How does pricing work for airSlate SignNow 592v?

Pricing for airSlate SignNow 592v is competitive and varies based on the plan chosen. We offer flexible subscription options that cater to different business sizes and needs, ensuring you find the right fit for your budget and requirements.

-

What are the benefits of using airSlate SignNow 592v?

Using airSlate SignNow 592v offers numerous benefits, including increased efficiency in document handling, reduced paper usage, and enhanced security for sensitive information. These features not only improve productivity but also help organizations maintain compliance with industry regulations.

-

Can airSlate SignNow 592v integrate with other software?

Yes, airSlate SignNow 592v easily integrates with a variety of popular applications, including CRM and productivity tools. This capability allows for a seamless workflow, enabling businesses to enhance their existing systems and improve overall efficiency.

-

Is airSlate SignNow 592v suitable for small businesses?

Absolutely! airSlate SignNow 592v is designed to cater to businesses of all sizes, including small businesses. Its cost-effective solution and user-friendly features make it an ideal choice for small enterprises looking to streamline their document signing processes.

-

How secure is airSlate SignNow 592v for e-signatures?

AirSlate SignNow 592v prioritizes security with advanced encryption and compliance standards that protect your documents and signatures. This ensures that all transactions are secure and that your data remains confidential.

-

What types of documents can be signed with airSlate SignNow 592v?

With airSlate SignNow 592v, you can sign a wide variety of documents, from contracts and agreements to forms and invoices. The platform supports multiple file formats, making it versatile for any business need.

Get more for 592v

Find out other 592v

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now