Form

What is the Form 2002?

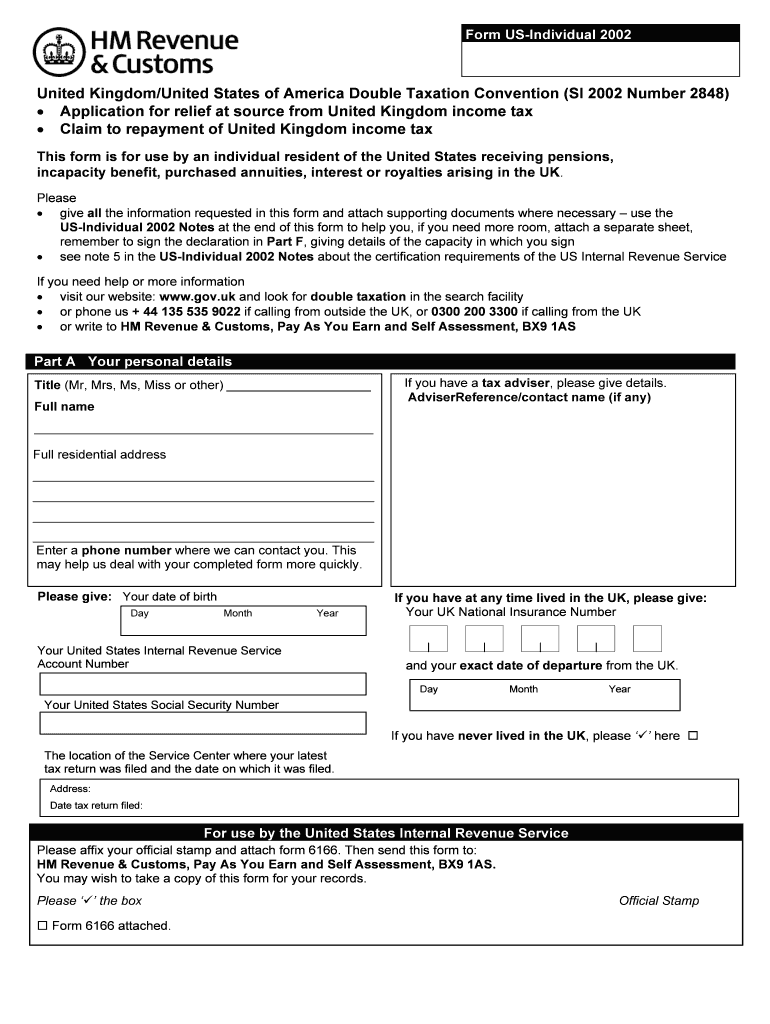

The Form 2002, also known as the US Individual 2002, is a tax form used by individuals in the United States to report their income and calculate their tax liabilities. This form is essential for taxpayers who need to provide detailed information about their earnings, deductions, and credits. Understanding the purpose of Form 2002 is crucial for ensuring compliance with IRS regulations and accurately reporting financial information.

How to Obtain the Form 2002

To obtain the Form 2002, individuals can visit the official IRS website, where the form is available for download in PDF format. It is also possible to request a physical copy by contacting the IRS directly. Tax professionals and accountants may also have access to the form and can provide guidance on its use. Ensuring you have the correct version of the form is important, as updates may occur annually.

Steps to Complete the Form 2002

Completing the Form 2002 involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim applicable deductions and credits to reduce taxable income.

- Review the completed form for errors before submission.

Legal Use of the Form 2002

The Form 2002 is legally binding when completed accurately and submitted to the IRS. It is important for taxpayers to understand that providing false information can lead to penalties, including fines and potential legal action. To ensure the form is legally valid, it must be signed, and all required fields must be filled out correctly. Utilizing a trusted eSignature solution can enhance the security and legality of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2002 typically align with the annual tax season. Generally, individuals must submit their forms by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to stay informed about any changes to deadlines and to file early to avoid last-minute complications.

Form Submission Methods

The Form 2002 can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which allows for quicker processing.

- Mailing a paper copy to the appropriate IRS address, depending on the taxpayer's state of residence.

- In-person submission at designated IRS offices, which may provide additional assistance.

Quick guide on how to complete form 55637562

Complete Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form without hassle

- Locate Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device of your selection. Edit and eSign Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 55637562

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2002 and how does it benefit my business?

Form 2002 is a crucial document used in various business transactions and compliance processes. airSlate SignNow allows you to easily create, send, and eSign form 2002, streamlining your workflow. Utilizing this feature ensures that your documents are processed efficiently, saving time and resources.

-

How much does it cost to use airSlate SignNow for form 2002?

The pricing for airSlate SignNow varies based on the plan selected. Each plan offers different features that cater to your needs, including specific support for form 2002. You can start with a free trial to explore how efficiently you can manage and eSign your form 2002 before committing to a paid plan.

-

What features does airSlate SignNow provide for handling form 2002?

airSlate SignNow offers a range of features for managing form 2002, including customizable templates, automated workflows, and secure eSignature capabilities. These features simplify the process of creating and sending form 2002, while enhancing document security and compliance. Users can also track the status of their documents in real-time.

-

Can I integrate airSlate SignNow with other applications when using form 2002?

Yes, airSlate SignNow provides seamless integrations with various applications such as Google Drive, Salesforce, and Dropbox, which facilitates easy access when working with form 2002. This connectivity enhances the flexibility of your workflow. You can easily import and export documents related to form 2002 between platforms to maximize efficiency.

-

Is airSlate SignNow compliant with eSignature laws for form 2002?

Absolutely, airSlate SignNow complies with major eSignature laws, including ESIGN and UETA, ensuring that all eSignatures on form 2002 are legally binding. This compliance gives you peace of mind when sending out form 2002, knowing that your documents meet all necessary legal requirements. Utilize airSlate SignNow for secure and compliant document handling.

-

How can airSlate SignNow improve my team's workflow when dealing with form 2002?

By using airSlate SignNow, your team can streamline their workflow for form 2002 through features like automated reminders and bulk sending capabilities. This minimizes delays and boosts productivity by ensuring that everyone involved in the approval process stays informed. In turn, this leads to faster turnaround times for essential documents.

-

What support options are available for users working with form 2002 in airSlate SignNow?

airSlate SignNow offers comprehensive support for users handling form 2002, including a help center with articles, tutorials, and FAQs. Additionally, users can access customer support via email or live chat for immediate assistance. Whether you need help with eSigning or document management, our support team is ready to assist you.

Get more for Form

- Report of adoption for a child born in a foreing country form

- Important things about programs and services form

- Po box 30721 form

- Instructions for completing a health benefits nycgov form

- Substance use disorder credentialing form

- Fa 100 appeal request form

- Get the free custodyvisitation general form 17 nycourts

- Wsu tuition waiver form

Find out other Form

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online