Form No 16a See Rule 31 1 B

What is the Form No 16a See Rule 31 1 B

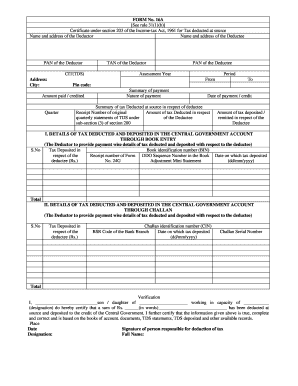

The Form No 16a See Rule 31 1 B is a crucial document used in the context of taxation. It serves as a certificate of tax deduction at source (TDS) for various payments, including salaries and professional fees. This form is particularly relevant for individuals and entities that receive income subject to TDS, ensuring compliance with tax regulations. The form outlines the details of the income received, the amount of tax deducted, and the particulars of the deductor, which is essential for accurate tax filing and record-keeping.

Steps to Complete the Form No 16a See Rule 31 1 B

Completing the Form No 16a See Rule 31 1 B involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details, income sources, and TDS amounts. Next, accurately fill in the form with the required data, ensuring that all entries are correct and complete. After filling out the form, review it for any errors or omissions. Finally, submit the form to the relevant tax authorities or keep it for your records, depending on your specific situation.

Legal Use of the Form No 16a See Rule 31 1 B

The legal use of Form No 16a See Rule 31 1 B is governed by tax laws that stipulate its necessity for documenting TDS. This form is legally binding and must be issued by the deductor to the recipient of the income. It serves as proof of tax compliance and is essential during tax assessments or audits. Utilizing this form correctly helps ensure that both the deductor and recipient fulfill their tax obligations, thereby reducing the risk of penalties or legal issues.

How to Obtain the Form No 16a See Rule 31 1 B

Obtaining the Form No 16a See Rule 31 1 B can be done through various channels. Typically, the deductor issues this form directly to the recipient after deducting TDS. If you need a copy of the form for your records, you can request it from the deductor. Additionally, some tax authorities may provide downloadable versions of the form on their official websites, making it accessible for individuals who need to fill it out independently.

Filing Deadlines / Important Dates

Filing deadlines for the Form No 16a See Rule 31 1 B are critical for compliance with tax regulations. The deductor is required to issue this form to the recipient by a specified date, typically at the end of the financial year. Recipients should ensure they receive the form in a timely manner to incorporate the information into their tax returns. Missing these deadlines can lead to complications, including penalties or delays in tax processing.

Examples of Using the Form No 16a See Rule 31 1 B

Examples of using the Form No 16a See Rule 31 1 B include scenarios where individuals receive salaries or professional fees that are subject to TDS. For instance, a freelancer providing services to a corporation may receive a Form No 16a after the company deducts TDS from their payment. This form would then be used by the freelancer when filing their annual tax return, ensuring that they accurately report their income and the taxes already paid.

Quick guide on how to complete form no 16a see rule 31 1 b

Effortlessly Prepare Form No 16a See Rule 31 1 B on Any Gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed files, allowing you to access the needed template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without any delays. Manage Form No 16a See Rule 31 1 B on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Form No 16a See Rule 31 1 B effortlessly

- Obtain Form No 16a See Rule 31 1 B and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of your documents or obscure sensitive information with tools specifically designed for this task by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from a device of your choice. Modify and eSign Form No 16a See Rule 31 1 B and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16a see rule 31 1 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 16a see rule 31 1 b and how does it relate to eSigning?

Form no 16a see rule 31 1 b is a specific document required for tax purposes in India. airSlate SignNow allows you to eSign this document efficiently, ensuring compliance and legality. By using our platform, you can easily send, receive, and store your signed form no 16a see rule 31 1 b.

-

What pricing plans does airSlate SignNow offer for eSigning documents like form no 16a see rule 31 1 b?

airSlate SignNow offers flexible pricing plans to suit various business needs, starting from a budget-friendly option to advanced enterprise solutions. All plans include features that support the efficient eSigning of documents, including form no 16a see rule 31 1 b. You can evaluate the best plan based on your volume of transactions and features required.

-

Can I customize the signing process for form no 16a see rule 31 1 b using airSlate SignNow?

Yes, airSlate SignNow provides customization options for the signing process, enabling you to tailor it for form no 16a see rule 31 1 b. You can include specific fields for signers, set signing orders, and even add reminders. This flexibility ensures a more streamlined experience for both you and your clients.

-

What features does airSlate SignNow provide for managing documents like form no 16a see rule 31 1 b?

airSlate SignNow offers robust document management features including tracking, templates, and cloud storage. You can easily manage form no 16a see rule 31 1 b with real-time status updates on who has signed and who is still pending. This helps you stay organized and compliant throughout the signing process.

-

Is airSlate SignNow compliant with legal standards for signing form no 16a see rule 31 1 b?

Yes, airSlate SignNow conforms to the necessary legal standards for electronic signatures, making it a secure choice for signing documents such as form no 16a see rule 31 1 b. We use strong encryption methods to protect your data and ensure that your eSignatures are valid in a court of law.

-

What integrations does airSlate SignNow support for documents like form no 16a see rule 31 1 b?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This makes it easy to manage your files, including form no 16a see rule 31 1 b, from one central location. The integration capabilities enhance your workflow and increase productivity.

-

How can airSlate SignNow benefit my business while handling form no 16a see rule 31 1 b?

By using airSlate SignNow, your business will save time and money when handling documents like form no 16a see rule 31 1 b. The platform allows for quick eSigning, reducing turnaround times and eliminating paper waste. Additionally, it improves the overall efficiency and productivity of your document management processes.

Get more for Form No 16a See Rule 31 1 B

- Satisfactory academic progress appeals application for form

- Student grievance form

- Sexual misconduct complaint form

- Application for admission nutrition ampampamp dietetic technician form

- 2019 2020 dependent verification worksheet dv1 form

- Resistant profile form submitter client information sample

- 2016 2017 standard verification worksheet delta college delta form

- Uil waiver form

Find out other Form No 16a See Rule 31 1 B

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation