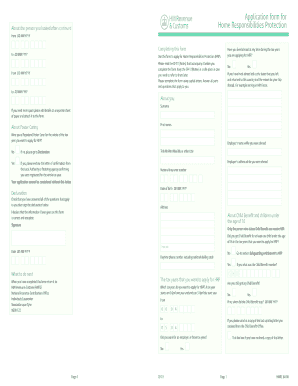

Cf411 Form

What is the Cf411 Form

The Cf411 form is a specific application form used primarily for tax purposes in the United States. It is designed to gather essential information from individuals or entities who are required to report certain financial details to the Internal Revenue Service (IRS). This form is crucial for ensuring compliance with federal tax regulations and may be required for various purposes, including income reporting and tax deductions.

How to Obtain the Cf411 Form

Obtaining the Cf411 form is straightforward. Individuals can download the form directly from the IRS website or through authorized tax preparation software. The form is typically available in PDF format, allowing users to print it for completion. Additionally, some tax professionals may provide the Cf411 form as part of their services, ensuring that clients have the necessary documentation for their tax filings.

Steps to Complete the Cf411 Form

Completing the Cf411 form involves several key steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Provide the specific financial details requested, such as income sources and deductions.

- Review the form for accuracy, ensuring all information is complete and correctly entered.

- Sign and date the form to validate your submission.

- Submit the completed form according to the specified submission methods, either online or by mail.

Legal Use of the Cf411 Form

The Cf411 form serves as a legally binding document when filled out correctly and submitted to the IRS. It complies with federal regulations governing tax reporting and must be completed with accurate information to avoid penalties. Understanding the legal implications of the form is essential, as incorrect submissions can lead to audits or fines.

Required Documents

When completing the Cf411 form, certain documents may be necessary to support the information provided. Commonly required documents include:

- Previous tax returns for reference

- W-2 forms or 1099 forms that report income

- Receipts or documentation for any deductions claimed

- Identification documents, such as a Social Security card

Form Submission Methods

The Cf411 form can be submitted through various methods, ensuring flexibility for users. Options include:

- Online submission through authorized tax software that supports electronic filing

- Mailing a printed copy of the form to the appropriate IRS address

- In-person submission at designated IRS offices, if applicable

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Cf411 form can result in significant penalties. These may include:

- Fines for late submissions or inaccuracies

- Interest charges on unpaid taxes

- Potential audits by the IRS

Quick guide on how to complete cf411 form 22374529

Complete Cf411 Form easily on any device

Digital document management has become increasingly favored by both organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Cf411 Form across any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to edit and eSign Cf411 Form effortlessly

- Obtain Cf411 Form and then click Get Form to begin.

- Use the tools provided to complete your document.

- Select important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details carefully and then click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Cf411 Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cf411 form 22374529

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cf411 form and how does it work?

The cf411 form is a crucial document for organizations that need to collect signatures electronically. Using airSlate SignNow, you can easily create, send, and securely sign the cf411 form, ensuring a streamlined process that speeds up approvals and saves time.

-

Is there a cost associated with using the cf411 form on airSlate SignNow?

AirSlate SignNow offers competitive pricing for its services, including the ability to use the cf411 form. Depending on your selected plan, you can access various features, including unlimited signing and document storage, making it a cost-effective solution for businesses.

-

What are the key features of the cf411 form in airSlate SignNow?

Key features of the cf411 form in airSlate SignNow include customizable templates, real-time notifications, and secure storage. Additionally, users benefit from a user-friendly interface that allows for quick access and management of documents, enhancing workflow efficiency.

-

How does airSlate SignNow ensure the security of the cf411 form?

AirSlate SignNow prioritizes security with state-of-the-art encryption protocols for all documents, including the cf411 form. Compliance with stringent security regulations ensures that your sensitive information remains protected throughout the signing process.

-

Can I integrate the cf411 form with other tools?

Yes, airSlate SignNow supports integration with numerous applications, making it easy to incorporate the cf411 form into your existing workflows. Popular integrations include CRM systems, cloud storage services, and project management tools, enhancing productivity and data management.

-

What benefits does using the cf411 form provide for businesses?

Using the cf411 form with airSlate SignNow offers numerous benefits, such as reducing paperwork, speeding up the signing process, and improving organization. It aids in achieving better document management, which can lead to enhanced operational efficiency and cost savings for your business.

-

How can I track the status of my cf411 form after sending?

With airSlate SignNow, you can easily track the status of your sent cf411 form through the dashboard. You'll receive notifications once the document is viewed, signed, or declined, allowing you to stay updated on the process without constant follow-ups.

Get more for Cf411 Form

- 0032a form

- Alberta child health benefit application form

- Ap 225 texas sexually oriented business fee questionnaire pdf form

- Electrical load calculation form

- Medical screening respiratory protection minnesota dept form

- Pdf greater east texas community action program application for form

- Form r 1048 ampquotannual application for exemption from

- Kaiser credentialing application form

Find out other Cf411 Form

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online