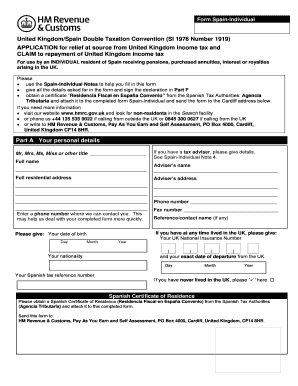

Form Spain Individual

What is the Form Spain Individual

The Form Spain Individual is a crucial document for individuals who are subject to the HMRC double taxation agreement between the United Kingdom and Spain. This form is specifically designed to help taxpayers claim relief from double taxation on income earned in Spain. By filling out this form, individuals can ensure that they are not taxed twice on the same income, which is a common concern for expatriates and those with cross-border income. Understanding the purpose and implications of this form is essential for compliance with tax regulations and for optimizing tax liabilities.

How to use the Form Spain Individual

Using the Form Spain Individual involves several steps to ensure accurate completion and submission. First, individuals must gather all necessary financial documentation, including income statements and proof of residency. Next, the form must be filled out with accurate personal information and details about income earned in Spain. After completing the form, it is important to review all entries for accuracy before submission. This form can be submitted electronically or by mail, depending on the preferences of the taxpayer and the requirements of the HMRC.

Steps to complete the Form Spain Individual

Completing the Form Spain Individual requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents, including income statements and tax identification numbers.

- Fill in personal information, such as name, address, and tax residency status.

- Detail all sources of income earned in Spain, ensuring to include any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form either online through the HMRC portal or by mailing it to the appropriate tax office.

Legal use of the Form Spain Individual

The legal use of the Form Spain Individual is governed by the double taxation agreement between the UK and Spain. This agreement aims to prevent individuals from being taxed on the same income in both countries. To ensure that the form is legally binding, it must be filled out correctly and submitted within the stipulated deadlines. Additionally, the form must comply with relevant tax laws and regulations in both jurisdictions, making it essential for individuals to understand their rights and obligations under the agreement.

Required Documents

When completing the Form Spain Individual, certain documents are required to support the claims made on the form. These typically include:

- Proof of income earned in Spain, such as payslips or tax returns.

- Documentation of residency status, which may include utility bills or rental agreements.

- A copy of the previous year's tax return, if applicable.

- Any additional documents that may support claims for tax relief.

Filing Deadlines / Important Dates

Filing deadlines for the Form Spain Individual are critical to ensure compliance and avoid penalties. Typically, forms must be submitted by specific dates set by the HMRC, which may vary each tax year. It is advisable for individuals to keep track of these deadlines and plan their submissions accordingly. Missing a deadline can result in delays in processing claims and potential tax liabilities.

Quick guide on how to complete form spain individual

Complete Form Spain Individual seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Form Spain Individual on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form Spain Individual with ease

- Obtain Form Spain Individual and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Spain Individual while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form spain individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HMRC double taxation agreement with Spain?

The HMRC double taxation agreement Spain is a treaty that prevents individuals and businesses from being taxed twice on the same income. This agreement outlines which countries have taxing rights over specific types of income, thereby providing relief from double taxation.

-

How can the HMRC double taxation agreement Spain benefit me?

By utilizing the HMRC double taxation agreement Spain, you can ensure that your income is only taxed once, enhancing your overall financial position. It allows you to claim relief on taxes paid in either the UK or Spain, making it easier to invest and manage your finances across borders.

-

What types of income are covered under the HMRC double taxation agreement Spain?

The HMRC double taxation agreement Spain covers various types of income, including salaries, dividends, and interests. Understanding which types of income are covered can help you plan your finances efficiently and maximize tax efficiency.

-

How do I apply the HMRC double taxation agreement Spain for tax relief?

To apply the HMRC double taxation agreement Spain for tax relief, you typically need to fill out tax forms in your country of residence. Consult with a tax professional to ensure that all required documentation and claims are properly submitted to take advantage of the agreement.

-

What is the process for filing taxes under the HMRC double taxation agreement Spain?

The process for filing taxes under the HMRC double taxation agreement Spain involves determining your residence status and calculating your taxable income. You will need to provide relevant documentation to the tax authorities in either country to validate your claims.

-

Are there any specific requirements to benefit from the HMRC double taxation agreement Spain?

Yes, to benefit from the HMRC double taxation agreement Spain, you must meet certain eligibility criteria such as residency status and type of income. It is advisable to consult with tax experts to ensure compliance with all necessary conditions.

-

How does the HMRC double taxation agreement Spain affect expatriates?

The HMRC double taxation agreement Spain plays a crucial role for expatriates by allowing them to avoid double taxation on their income. Expatriates can benefit from reduced tax liabilities, making it more feasible to live and work in Spain while ensuring compliance with UK tax obligations.

Get more for Form Spain Individual

Find out other Form Spain Individual

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT