Dtf 801 Form

What is the DTF 801 Form

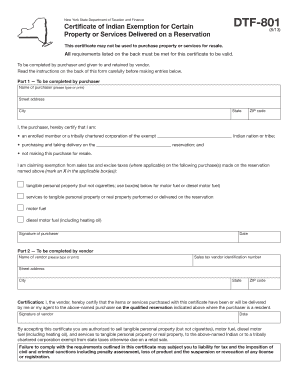

The DTF 801 form is a tax document used in the state of New York, specifically designed for claiming a refund of sales and use tax. This form is essential for businesses and individuals who have overpaid sales tax or who are eligible for a refund due to various exemptions. Understanding the purpose and requirements of the DTF 801 form is crucial for ensuring compliance and maximizing potential refunds.

How to use the DTF 801 Form

Using the DTF 801 form involves several key steps. First, gather all necessary documentation that supports your claim for a refund. This may include receipts, invoices, and any relevant tax exemption certificates. Next, accurately fill out the form, ensuring that all information is complete and correct. It is important to double-check calculations and ensure that all required fields are filled. Finally, submit the completed form to the appropriate tax authority, either online or through traditional mail, depending on your preference.

Steps to complete the DTF 801 Form

Completing the DTF 801 form requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your personal or business information at the top of the form.

- Detail the sales tax amounts you are claiming for refund, ensuring accuracy in calculations.

- Attach any supporting documents that validate your claim.

- Review the form for completeness and accuracy before submission.

- Sign and date the form to certify that the information provided is true and correct.

Legal use of the DTF 801 Form

The DTF 801 form is legally recognized as a valid method for claiming sales tax refunds in New York. To ensure that your submission is compliant with state tax laws, it is important to adhere to all guidelines provided by the New York State Department of Taxation and Finance. This includes understanding eligibility criteria and maintaining proper documentation to support your refund claim.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for successfully submitting the DTF 801 form. Generally, claims for refunds must be submitted within three years from the date of the overpayment. Specific deadlines may vary based on the nature of the claim, so it is advisable to check the New York State Department of Taxation and Finance website for the most current information regarding deadlines and any changes to filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The DTF 801 form can be submitted through various methods, providing flexibility for users. The online submission option is often the fastest and most efficient, allowing for immediate processing. Alternatively, you can mail the completed form to the designated address provided by the New York State Department of Taxation and Finance. In-person submissions may also be possible at certain tax offices, but it is recommended to check ahead for availability and any necessary appointments.

Quick guide on how to complete dtf 801 form

Prepare Dtf 801 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Dtf 801 Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Dtf 801 Form with ease

- Locate Dtf 801 Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Dtf 801 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 801 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dtf 801 and how does it work?

The dtf 801 is an advanced document signing solution that streamlines the process of eSigning. Leveraging airSlate SignNow, it allows businesses to send, track, and manage documents efficiently. With an intuitive interface, the dtf 801 minimizes the time spent on paperwork, enabling you to focus on what really matters.

-

How much does the dtf 801 cost?

Pricing for the dtf 801 varies depending on the features and package you choose. airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can find detailed pricing information on our website to help you choose the right plan for your needs.

-

What are the key features of the dtf 801?

The dtf 801 comes equipped with a variety of features including customizable workflows, document templates, and real-time notifications. It also supports multiple file formats for added convenience. These features ensure that your document signing process is efficient and easy to manage.

-

What are the benefits of using the dtf 801 for my business?

Using the dtf 801 enhances productivity by speeding up the document signing process and reducing the need for physical signatures. This leads to quicker transaction times and improved customer satisfaction. Additionally, it allows for better tracking and management of documents, ensuring compliance and security.

-

Does the dtf 801 integrate with other software?

Yes, the dtf 801 easily integrates with a variety of popular business software, including CRM systems, project management tools, and cloud storage solutions. This interoperability enhances your workflow and allows you to manage documents across multiple platforms effortlessly. Explore our integration options to see how it can fit into your existing processes.

-

Is the dtf 801 user-friendly for non-technical users?

Absolutely! The dtf 801 is designed with user-friendliness in mind, making it accessible for non-technical users. With a simple interface and straightforward instructions, anyone can navigate the platform and execute document signing without hassle.

-

What type of support is available for dtf 801 users?

airSlate SignNow provides robust support for dtf 801 users, including live chat, email support, and an extensive knowledge base for self-help. Our dedicated support team is available to address any queries you may have, ensuring you get the most out of your document signing experience.

Get more for Dtf 801 Form

- Political party affiliation declaration form

- Multi purpose loan mpl hqp slf 065 application form

- Online payroll services for small businesses quickbooks form

- Wwwbankofamericacom pdf docreponon federal direct deposit enrollment request form

- Fillable online bill payee registration form kiwibank

- Share transfer form 1054 ausiex

- Residency reclassification application ampamp affidavit form

- Navy power of attorney form

Find out other Dtf 801 Form

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure