501 C 3 Determination Letter Sample Form

What is the 501c3 Determination Letter Sample

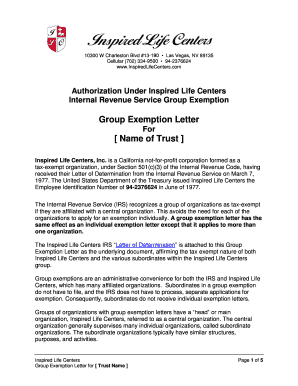

The 501c3 determination letter sample is a crucial document issued by the Internal Revenue Service (IRS) that confirms an organization’s tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This letter serves as official proof that a nonprofit organization is recognized as tax-exempt, allowing it to receive tax-deductible contributions. The letter typically includes the organization’s name, address, and the effective date of the tax-exempt status. It is essential for fundraising, applying for grants, and ensuring compliance with federal regulations.

How to Obtain the 501c3 Determination Letter Sample

To obtain a 501c3 determination letter, an organization must first complete the IRS Form 1023 or Form 1023-EZ, depending on its size and complexity. This application requires detailed information about the organization’s structure, governance, and programs. Once submitted, the IRS reviews the application, which can take several months. If approved, the IRS issues the determination letter, which can be accessed through the organization’s online account or received by mail. It is important to retain this letter for future reference and compliance purposes.

Key Elements of the 501c3 Determination Letter Sample

A 501c3 determination letter sample includes several key elements that validate its authenticity and purpose. These elements typically consist of:

- Organization Name: The legal name of the nonprofit organization.

- Address: The physical address of the organization.

- Effective Date: The date when the tax-exempt status became effective.

- Tax Identification Number (TIN): The unique identification number assigned by the IRS.

- Confirmation of Status: A statement confirming the organization’s eligibility under section 501(c)(3).

These elements are essential for demonstrating the organization’s compliance with IRS regulations and for use in various legal and financial contexts.

Steps to Complete the 501c3 Determination Letter Sample

Completing the 501c3 determination letter sample involves several important steps to ensure accuracy and compliance. These steps include:

- Gather Required Information: Collect all necessary documentation, including the organization’s bylaws, mission statement, and financial statements.

- Fill Out the Application: Complete IRS Form 1023 or Form 1023-EZ with accurate and detailed information about the organization.

- Review for Accuracy: Double-check the application for any errors or omissions that could delay processing.

- Submit the Application: Send the completed form to the IRS, either electronically or by mail, along with the required fee.

- Await Response: Monitor the application status and be prepared to respond to any IRS inquiries during the review process.

Following these steps carefully can help ensure a smooth application process and timely receipt of the determination letter.

Legal Use of the 501c3 Determination Letter Sample

The legal use of the 501c3 determination letter sample is vital for nonprofit organizations operating in the United States. This letter not only serves as proof of tax-exempt status but also plays a significant role in various legal and financial transactions. Organizations may use the letter to:

- Solicit donations and grants from individuals, corporations, and foundations.

- Establish credibility with potential partners and stakeholders.

- File for state and local tax exemptions.

- Comply with federal regulations regarding fundraising and financial reporting.

Maintaining a copy of the determination letter is essential for ongoing compliance and to ensure that the organization continues to meet the requirements set forth by the IRS.

Quick guide on how to complete 501 c 3 determination letter sample

Manage 501 C 3 Determination Letter Sample effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle 501 C 3 Determination Letter Sample on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign 501 C 3 Determination Letter Sample with ease

- Obtain 501 C 3 Determination Letter Sample and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Adjust and eSign 501 C 3 Determination Letter Sample and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 501 c 3 determination letter sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 501c3 letter example?

A 501c3 letter example is a document provided by the IRS that confirms an organization's tax-exempt status under section 501(c)(3). This letter serves as proof for donors that contributions are tax-deductible. Understanding the value of a 501c3 letter example is crucial for nonprofits seeking funding and grants.

-

How can airSlate SignNow help with managing a 501c3 letter example?

airSlate SignNow allows nonprofits to easily create, send, and eSign crucial documents, including a 501c3 letter example. With a user-friendly interface, organizations can streamline their document workflows to ensure compliance and proper management. This efficiency helps save time and reduces errors signNowly.

-

What features does airSlate SignNow offer for nonprofit organizations?

airSlate SignNow offers various features tailored to nonprofit needs, including customizable templates for documents like a 501c3 letter example. It also provides robust eSigning capabilities, document tracking, and secure cloud storage, ensuring that your important documents are always accessible and protected.

-

Is airSlate SignNow cost-effective for nonprofits?

Yes, airSlate SignNow is designed to be a cost-effective solution for nonprofits. With competitive pricing and several plans designed to fit different organizational needs, you can effectively manage your documents without breaking the bank. This makes handling essential documents like a 501c3 letter example more accessible.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow offers integrations with a wide range of popular applications such as Google Drive, Dropbox, and Salesforce. This allows you to seamlessly incorporate your workflow and manage documents, including a 501c3 letter example, within your existing systems, enhancing overall productivity.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a priority for airSlate SignNow. The platform uses advanced security measures, including encryption and compliance with industry regulations, to protect sensitive documents like a 501c3 letter example. Users can have peace of mind knowing that their data is secured and private.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including faster transaction times and reduced paper usage. By adopting digital solutions, nonprofits can streamline their processes, ensuring timely submissions of important documents like a 501c3 letter example. Enjoy enhanced convenience and efficiency in your operations.

Get more for 501 C 3 Determination Letter Sample

- Athletic physical form westland hialeah senior high miami dade

- John bowne high school transcript request form

- Physical consent form richland college richlandcollege

- Lipo lab consent form

- Va form 21 0960m 14 43441188

- Pennsylvania petition change name form

- Hand washing procedures faccm form

- Employee waiver form neighborhood health plan nhp

Find out other 501 C 3 Determination Letter Sample

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation