Rpt7833 Form

What is the Rpt7833 Form

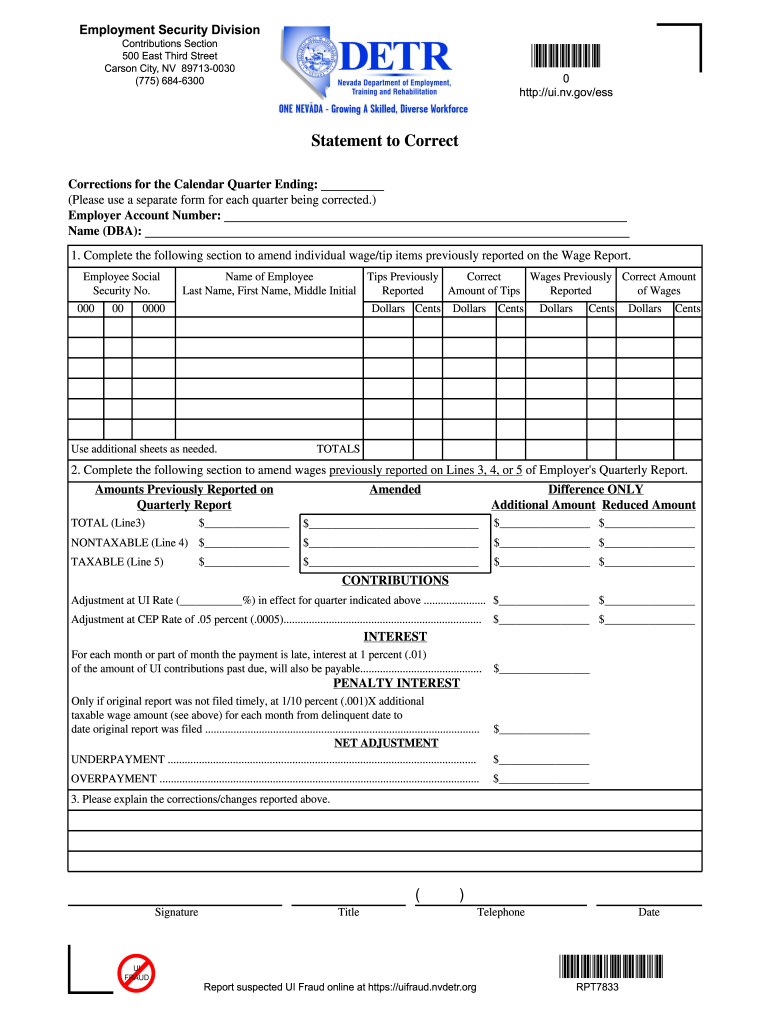

The Rpt7833 form, officially known as the Nevada Rpt7833 form, is a document used primarily for reporting wage information in the state of Nevada. This form is essential for employers to accurately report employee wages, taxes withheld, and other relevant payroll information to the Nevada Department of Employment, Training and Rehabilitation (DETR). It serves as a critical tool for ensuring compliance with state labor laws and regulations.

Steps to Complete the Rpt7833 Form

Completing the Rpt7833 form involves several important steps to ensure accuracy and compliance. First, gather all necessary employee information, including names, Social Security numbers, and wage details. Next, fill in the required fields on the form, ensuring that all figures are accurate and reflect the correct pay periods. After completing the form, review it for any errors or omissions. Finally, sign and date the form before submission to ensure its validity.

Legal Use of the Rpt7833 Form

The legal use of the Rpt7833 form is crucial for maintaining compliance with state regulations. Employers must ensure that the form is filled out accurately and submitted on time to avoid potential penalties. The form serves as a legal document that can be used in disputes or audits, making it essential for employers to adhere to all guidelines and requirements set forth by the state of Nevada.

Form Submission Methods

The Rpt7833 form can be submitted through various methods, providing flexibility for employers. Options include online submission through the Nevada DETR website, mailing a physical copy to the appropriate state office, or delivering it in person. Each method has its own guidelines and deadlines, so it is important for employers to choose the one that best fits their operational needs while ensuring timely compliance.

Required Documents

When completing the Rpt7833 form, certain documents may be required to support the information provided. Employers should have employee wage records, tax withholding information, and any other relevant payroll documentation readily available. These documents help ensure that the information reported is accurate and can be verified if necessary.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Rpt7833 form can result in significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for employers to understand the importance of timely and accurate submissions to avoid these consequences and maintain good standing with state authorities.

Examples of Using the Rpt7833 Form

Employers may encounter various scenarios where the Rpt7833 form is applicable. For instance, a business may need to report wages for newly hired employees or submit corrections for previously reported information. Additionally, seasonal businesses may use the form to report wages for temporary workers. Understanding these examples can help employers recognize the importance of the form in different contexts and ensure compliance with state reporting requirements.

Quick guide on how to complete contributions section

Enhance your HR functions with Rpt7833 Form Template

Every HR professional recognizes the importance of keeping employee records organized and tidy. With airSlate SignNow, you gain access to an extensive collection of state-specific employment templates that greatly streamline the location, administration, and storage of all job-related documents in a single location. airSlate SignNow assists you in managing Rpt7833 Form from start to finish, providing robust editing and eSignature capabilities whenever necessary. Boost your accuracy, document safety, and eliminate minor manual mistakes in just a few clicks.

Steps to modify and eSign Rpt7833 Form:

- Locate the appropriate state and search for the form you need.

- Open the form page and click on Get Form to start working on it.

- Wait for Rpt7833 Form to load in the editor and follow the instructions that highlight mandatory fields.

- Enter your information or add more fillable fields to the document.

- Utilize our tools and features to customize your form as required: annotate, redact sensitive information, and create an eSignature.

- Review your form for errors before proceeding with its submission.

- Click on Done to save changes and download your document.

- Alternatively, send your document directly to recipients and collect signatures and data.

- Safely store completed forms in your airSlate SignNow account and access them whenever you wish.

Employing a versatile eSignature solution is crucial when handling Rpt7833 Form. Simplify even the most complicated workflow as much as possible with airSlate SignNow. Begin your free trial today to discover what you can achieve with your team.

Create this form in 5 minutes or less

FAQs

-

What are some brain hacks that a neuroscientist or a psychologist knows that most people don't?

You can rewire your brain!This is possible due to Neuroplasticity.Neuroplasticity refers to changes in neural pathways and synapses which are due to changes in behavior, environment and neural processes, as well as changes resulting from bodily injury To be honest, the brain is a dynamic entity undergoing changes all the time. As you read this innocent sentence, some neurons in your brain have fired and some synapses have become stronger. Voila! Your brain has been rewired a bit. But I am not talking about these sort of 'boring' changes which occur all the time.What if I told you, your actions can physically alter your brain? Some parts become larger than usual while some parts begin performing tasks they normally don't?László Polgár is the father of the famous "Polgár sisters": Judit, Susan and Sofia. He is an expert in chess and believed that "geniuses are made, not born". Before he had any children, he wrote a book entitled Bring Up Genius!, and sought a wife to help him carry out his experiment. He found one in Klara, a schoolteacher. He home-schooled their three daughters, primarily in chess, and all three went on to become strong players. Susan Polgar became the first female to earn the Grandmaster title.Because of her intense training, her brain had encoded chess board configurations and she was able to not only recognize these configurations but also what moves she had to do from there to win. Show her a random chess board setup that is infrequent her brain is just as slow as normal chess players. So what was happening? A scan of her brain activity showed she was using the part of the brain that recognizes faces to identify chess board configurations. This part of the brain is really developed in humans and face recognition is something humans are really good at. The hours of practice she had put in playing and studying chess had radically changed ho she used her brain to play it.Some of you might be thinking that it was because she got her training from childhood that she was able to become an expert and this fact is useless to someone older.Not really. Recent studies have shown although neuroplasticity declines it still can be made use of in older ages.The Sea Gypsies are a seafaring people who spend a great deal of their time in boats off the coast of Myanmar and Thailand, have unusual underwater vision -- twice as good as Europeans. This has enabled Mokens to gather shellfish at great depths without the aid of scuba gear. How do the Moken do this? They constrict their pupils by 22 percent. The brain orders the body to adapt to suite its needs. Another example of neuroplasticity has been found in London taxi drivers. A cab driver's hippocampus -- the part of the brain that holds spatial representation capacity -- is measurably larger than that of a bus driver. [from Neuroplasticity: You Can Teach An Old Brain New Tricks ]As children we have lots of free time and our brain is really quick to grasp new skills and ideas. To make signNow changes to the brain as grown ups one needs to exercise it regularly and focus on really specific tasks like learning to play the guitar or solve spatial puzzles. Because of the constraints of being social and other reasons, people miss out on this. It has been observed that spiritual leaders and prisoners of war have been able to develop extra-cognitive skills simply because of the immense amount of time they put in meditation, mental exercises and thought experiments. Plasticity can also be observed in the brains of bilinguals (Mechelli et al., 2004). It looks like learning a second language is associated with structural changes in the brain: the left inferior parietal cortex is larger in bilingual brains than in monolingual brains.I'll end with some interesting bits from The Brain that Changes ItselfLearning and brain exercises slow age-related mental declines. For example, education necessitates extra branches among neurons to accommodate the new information; new branching increases the volume and thickness of the brain that would otherwise decline with age.Physical exercise promotes the creation of new neurons in the brain. Yet another reason to start that walking program.Specifically designed brain exercises have been shown to improve brain function in children and adults with learning disabilities.The brain undergoes measurable, physical changes as we think. Computer technology can now use these measurements and changes to allow paralyzed people to moves objects with their thoughts.Researchers at UCSD have used imagination and illusion to restructure brain maps and ‘trick” the brain into managing phantom pain and some forms of chronic pain.Performance can be improved through visualization because action and imagination can activate the same parts of the brain. People have learned to play the piano or achieve greater results in athletic endeavors through mental practice. Is it time to visualize eating a nice salad?[from Neuroplasticity Research Shows “Old Dogs” Can Learn New Tricks!]

-

What is it that we as Indians are collectively doing wrong?

Taking Ola Share and Uber Pool for granted.Yes! All of us take these pooled rides for granted, and there are many people who consider the cab drivers their personal chauffers!We like understanding through examples, don’t we? So here’s a small story:I booked an Uber Pool some time ago in Kolkata. My destination was Quest Mall and there was another rider whom we had to pick up at the Kali Temple, Kalighat. Coincidentally, the Driver himself was the owner of a fleet of 13 cars which he was exclusively running for Ola & Uber. He came to fill in for one of his Drivers who had a medical emergency. Before the next pickup at Kalighat he narrated his story, we had a brilliant conversation on how he went on to start his Taxi Business and now one of his children is doing his M. Tech at IIT-Kharagpur and the other child is doing his Bachelors in NYSU. (I’ll reserve this rags-to-riches story for another question)He then told me about the how irritating it was to operate Uber Pool. When I asked him what exactly the issue was, he politely asked me to wait and told me what I told you guys: “I’ll give you a live demonstration”Within no time, he got a call from my fellow traveller whom we were supposed to pick up. The phone was on speaker, and the traveller was speaking in Hindi:T: “Hello Bhaiyya. Where are you?”D: “Sir, I’ve just crossed xyz road. Navigation says I should be picking you up in 7 mins”T: “What were you doing until now?! It’s been 10 mins that we’ve booked our cab”D: “I understand sir. But I’ve had another passenger to pickup. Plus a lot of traffic because it’s the weekend”T: “Why is there another passenger?”D: “You booked an Uber Pool sir!”T: “OK OK. Fine. Just come fast”And then the driver looked at me, gave me a smile and said: “This is part-1 of the movie. More action after the interval” and both of us burst out into laughter. He then politely asked me: “Sir, I understand you might be a bit late. But if you want to understand the true Indian rider mind set, would you mind sitting in the cab for a little longer?”“Absolutely not an issue”, I said.“Then you’ll have a great learning today. Part-2 begins”, he said and picked up his phone, asked the Traveller for directions.T, without hesitation: “Take a left there, then take a right. You’ll find a narrow lane that should fit a Chevy. Beat. Take that lane. Come down to the end, and then take a left”D: “I understand sir. But if you can just walk for 50m, I can avoid all those narrow lanes and pick you straight at the main road. And your co-passenger won’t be discomforted as well”T: “But you have to come to the pickup point. How dare you ask me to walk for 50m? Is that why we booked the cab? You either tell me whether you are coming to pick me up or not”D: “Sir, all I’m asking you is to just walk for 1 minute. And both of you won’t have any unnecessary delays. Also I can save some time avoiding U-turns, so it’ll be mutually beneficial”T: “I don’t care if you’re saving time of your other passenger. I booked a cab so that you can serve me well, so that you can pick me up from my home. If you can’t, then so be it. I’ll cancel my booking”D: “No no sir. Please don’t do that. I’ve almost signNowed your location. I will have to go all the way around and waste the time of multiple people. On my way sir”This is what we’re all collectively doing wrong. We don’t care if it’s a regular Ola/Uber or if it’s a Pool. We are only concerned about our pickup.In case of a Pool ride, it’s supposed to be symbiotic, where all passengers are supposed to understand each others’ constraints and proceed to the nearest pickup point that will minimise hassles for all the co-riders.But alas! Not many people do that.Plus there are people who abuse & insult the Drivers as though they are salaried chauffers working for them. To all such people: NO BOSS. You don’t have any authority over them. They are working to feed their own families just like you might be. It’s just a difference of profession: You might be a Businessman. He/She’s a Driver. In the end, both of you earn the same money. It’s only a difference in magnitude.I hope my answer will help sensitise people on very simple issues of collaboration and Dignity of Labor.Cheers.EDIT:The other side of the coin is misbehaviour from Drivers, ride cancellations etc. I couldn’t agree more with the comments. I guess almost every Ola/Uber rider has faced these situations. But having said this, I believe we should uphold our end of the responsibility. Just because some Driver was not good enough, does not mean that all others are bad too. There are some things we can’t change in a short time. We can only hope that by us being responsible, we can instill the same sense of responsibility in others as well - not instantly, but gradually at leastI did forget about the waiting times. The “Bhaiyya bas 1 minute” (Brother, just 1 minute) and then taking 15 minutes, making the other passengers wait - is another headache indeed.Really humbled by the no. of upvotes. Thank you.

-

What will be the appropriate section to choose while filling out the ITR 1 form online?

Please find details of return filed under sectionSection 139(1) – Original return filed before the last due date for filing returnOriginal returnfiling for the first time in an assessment yearSection 139(4) – Belated returnOriginal returnFiling for the first time after the due date of filing the return for the assessment yearSection 139(5) – Revised returnRevised return filed subsequent to original returnThis will be revised returnVoluntarily filing the revised returnInfo needed is:Acknowledgement numberdate of filing originalSection 139(9) – Defective returnWhen due to an error, the return is considered as defective (as if no return has been filed)The department may issue notice to correct the errors and file the returnSo the return filed subsequent to the intimation u/s 139(9) will be original returnYou have to provide following info while filing the return in response to noticeReceipt No: i.e Acknowledgement number of Original (Defective in this case) returnDate of filing the original (Defective in this case) returnNotice no. (Eg. CPC/1415/G5/1421417689)Date of NoticeSection 142(1) – Notice to assessee for filing the returnWhen a person has not filed the return, he may receive notice u/s 142(1) asking him to file the returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 142(1)Section 148 – Issue of notice for reassessment (Income escaping assessment)Department can issue a notice to a person for filing the income tax return u/s 148This will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 148Section 153A – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153A to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153ASection 153C – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153C to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153CBe Peaceful !!!

-

Are final year students eligible to fill out the Railway Recruitment Board (RRB) Senior Section Engineer form?

you have to complete your Degree first to give Railway Recruitment Board (RRB) Senior Section Engineer Exam.As the Indian Railways is one known to be as one of the biggest employers in India. It releases it a high number of vacancies every year for a various number of fields. One amongst them is the RRB Senior Section Engineer.Eligibility CriteriaMust be in age between 20-34 years.Educational Qualification RequiredDegree in Civil Engineering from a recognized university or Institution.For more information you can also read here, RRB Recruitment Notification, Jobs, ExamsCheck Here, RRB(Railway Recruitment Board) latest Notification.

-

Does the IRS require unused sheets of a form to be submitted? Can I just leave out the section of a form whose lines are not filled out?

This is what a schedule C I submitted earlier looks like :http://onemoredime.com/wp-conten... So I did not submit page 2 of the schedule C - all the lines on page 2 (33 through 48) were blank.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the contributions section

How to create an eSignature for the Contributions Section online

How to create an eSignature for your Contributions Section in Google Chrome

How to make an eSignature for putting it on the Contributions Section in Gmail

How to make an eSignature for the Contributions Section right from your smart phone

How to generate an eSignature for the Contributions Section on iOS devices

How to generate an electronic signature for the Contributions Section on Android OS

People also ask

-

What is the Rpt7833 Form and why is it important?

The Rpt7833 Form is a critical document used in various business transactions, allowing for efficient record-keeping and compliance. Utilizing airSlate SignNow, you can easily create, send, and eSign the Rpt7833 Form, ensuring that your documents are securely signed and stored.

-

How can airSlate SignNow help with the Rpt7833 Form?

airSlate SignNow streamlines the process of managing the Rpt7833 Form by providing a user-friendly platform to create and eSign documents. With its powerful features, you can customize the Rpt7833 Form, track its status, and ensure that all signatures are captured legally and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Rpt7833 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan allows you to utilize the platform for managing documents like the Rpt7833 Form, ensuring a cost-effective solution for your signing needs.

-

Can I integrate airSlate SignNow with other applications for the Rpt7833 Form?

Absolutely! airSlate SignNow supports integrations with numerous applications, enhancing your workflow when handling the Rpt7833 Form. Whether you need to connect with CRMs, cloud storage, or other business tools, airSlate SignNow makes it easy to incorporate the Rpt7833 Form into your existing processes.

-

What features does airSlate SignNow offer for the Rpt7833 Form?

airSlate SignNow provides a host of features for the Rpt7833 Form, including customizable templates, advanced signing options, and real-time tracking. These features empower businesses to manage their documents efficiently and ensure that the Rpt7833 Form is completed accurately and promptly.

-

How secure is the Rpt7833 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform protects your Rpt7833 Form with bank-level encryption and secure storage, ensuring that your sensitive information remains confidential and compliant with legal standards.

-

Can I access the Rpt7833 Form from mobile devices?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to access and manage the Rpt7833 Form on-the-go. This flexibility ensures that you can eSign documents anytime, anywhere, making it easier to stay productive.

Get more for Rpt7833 Form

Find out other Rpt7833 Form

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form