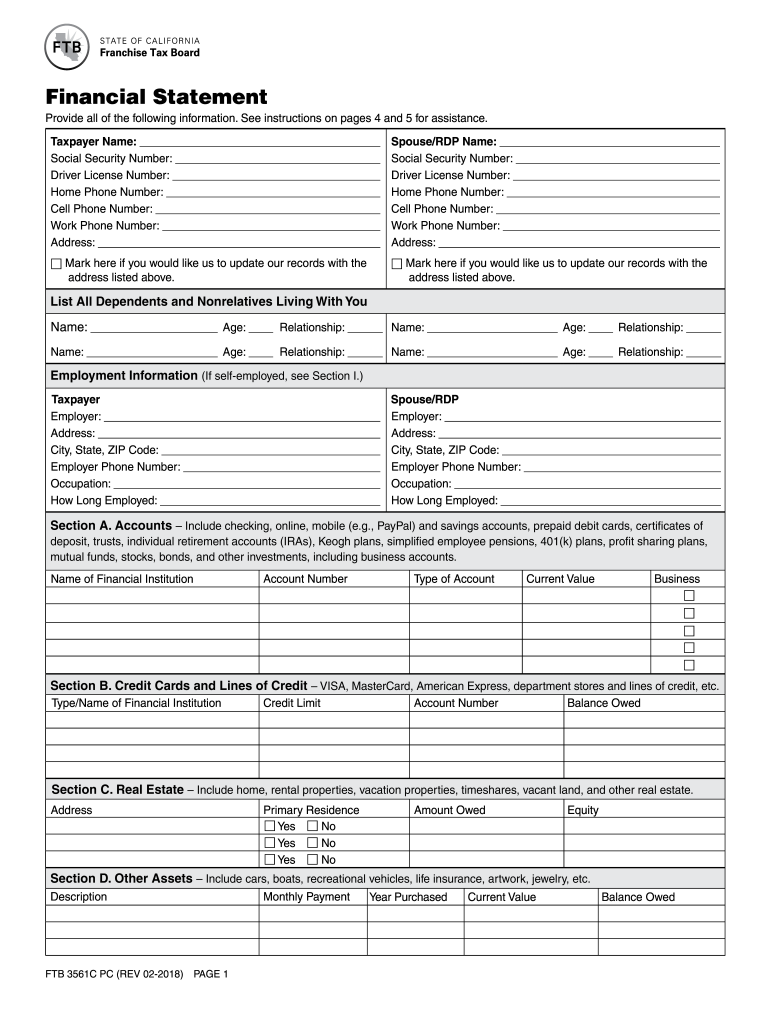

Ftb 3561c Form

What is the FTB 3561C?

The FTB 3561C is a California state tax form used primarily for claiming a credit for taxes paid to other states. This form is essential for individuals and businesses that have income sourced from multiple states, allowing them to avoid double taxation on the same income. The FTB 3561C is specifically designed to streamline the process of reporting and claiming these credits, ensuring compliance with California tax laws.

Steps to Complete the FTB 3561C

Completing the FTB 3561C involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements from other states and any relevant tax returns. Next, accurately fill out the form by providing details about the income earned in other states and the taxes paid. It is crucial to double-check all entries for accuracy. After completing the form, it should be signed and dated. Finally, submit the FTB 3561C along with your California tax return by the designated deadline.

Legal Use of the FTB 3561C

The legal use of the FTB 3561C is governed by California tax laws, which stipulate that taxpayers must report income earned in other states and claim appropriate credits to prevent double taxation. To ensure the form is legally binding, it is essential to provide accurate information and maintain compliance with all relevant tax regulations. Additionally, utilizing a reliable eSignature solution can enhance the legal validity of the form when submitted electronically.

How to Obtain the FTB 3561C

The FTB 3561C can be obtained directly from the California Franchise Tax Board's official website. Taxpayers can download the form in PDF format for easy access. It is also available at various tax preparation offices and libraries throughout California. Ensuring you have the most current version of the form is important, as tax regulations may change from year to year.

Form Submission Methods

Submitting the FTB 3561C can be done through various methods, including online submission, mailing a physical copy, or delivering it in person. For online submissions, taxpayers can use the California Franchise Tax Board's e-file system, which allows for a streamlined and secure process. If opting for mail, ensure that the form is sent to the correct address as specified by the FTB. In-person submissions can be made at designated FTB offices, where assistance may also be available.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the FTB 3561C to avoid penalties. Typically, the form should be submitted along with your California tax return, which is generally due on April 15th of each year. However, if April 15th falls on a weekend or holiday, the deadline may be extended. Keeping track of these dates ensures that taxpayers remain compliant and avoid unnecessary fees.

Quick guide on how to complete ftb 3561c

Complete Ftb 3561c seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Ftb 3561c on any system with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Ftb 3561c effortlessly

- Obtain Ftb 3561c and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Ftb 3561c and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 3561c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3561 and how does it relate to airSlate SignNow?

Form 3561 is a document used in international shipping for customs declarations. airSlate SignNow streamlines the process of filling out and electronically signing Form 3561, ensuring you can complete your customs paperwork efficiently and securely.

-

How can airSlate SignNow help me complete Form 3561?

With airSlate SignNow, you can easily create, edit, and sign Form 3561 online. The platform provides templates and tools to ensure that your Form 3561 is filled out correctly, reducing errors and saving time.

-

Is there a cost associated with using airSlate SignNow for Form 3561?

Yes, airSlate SignNow offers various pricing plans depending on your needs. You can leverage cost-effective solutions that offer robust features essential for managing your Form 3561 and other documents.

-

Are there any integrations available with airSlate SignNow for Form 3561?

airSlate SignNow integrates seamlessly with many popular applications and platforms. This makes it easy to import data directly into your Form 3561, enhancing efficiency and workflow.

-

What are the benefits of using airSlate SignNow for Form 3561?

Using airSlate SignNow for Form 3561 allows you to automate and digitize the signing process, which improves turnaround times and reduces paper waste. Additionally, its secure features ensure that your Form 3561 is protected and compliant with regulations.

-

Can I track the status of my Form 3561 when using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features for your Form 3561. You can receive notifications about document status, ensuring you are always up to date on your submission.

-

Is it easy to use airSlate SignNow to modify my Form 3561?

Yes, airSlate SignNow has a user-friendly interface that makes modifying your Form 3561 a breeze. You can easily edit fields, add signatures, and save changes without any technical expertise.

Get more for Ftb 3561c

- City staff is ready to assist you in the business license process form

- Feline questionnaire form

- Mvd 10021 affidavit of new mexico form

- Il cook circuit court form

- Seguro social choferil form

- Notice of parent withdrawal for school use only form

- Clinic self survey form

- Note in order for form w 8ben e to be complete you must complete the highlighted fields and all other

Find out other Ftb 3561c

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free