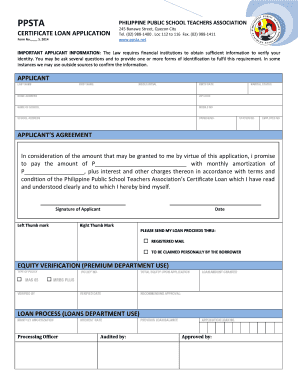

Ppsta Equity Loan Form

What is the Ppsta Equity Loan Form

The Ppsta equity loan form is a crucial document used in the process of applying for an equity loan. This form allows homeowners to leverage the equity in their property to secure additional funding. It typically requires detailed information about the property, the borrower's financial situation, and the desired loan amount. The form serves as a formal request to lenders, initiating the evaluation process for loan approval.

How to Use the Ppsta Equity Loan Form

Using the Ppsta equity loan form involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant financial documents, including income statements and property assessments. Next, fill out the form with precise details regarding your property and financial status. It is essential to review the completed form for accuracy before submission to avoid delays in processing. Once filled out, the form can be submitted electronically or via traditional mail, depending on the lender's requirements.

Steps to Complete the Ppsta Equity Loan Form

Completing the Ppsta equity loan form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including name, address, and contact details.

- Provide details about your property, such as its address, current market value, and any existing liens.

- Include your financial information, including income, debts, and credit score.

- Specify the amount of equity you wish to borrow and the purpose of the loan.

- Review the form for completeness and accuracy before submitting it to the lender.

Key Elements of the Ppsta Equity Loan Form

The Ppsta equity loan form includes several key elements that are vital for processing your application. These elements typically consist of:

- Borrower Information: Personal details of the applicant.

- Property Details: Information about the property being used as collateral.

- Financial Information: Income, debts, and assets of the borrower.

- Loan Amount: The specific amount of equity being requested.

- Purpose of the Loan: Explanation of how the funds will be used.

Legal Use of the Ppsta Equity Loan Form

The legal use of the Ppsta equity loan form is governed by various regulations that ensure the validity of the loan agreement. To be legally binding, the form must be completed accurately and signed by all parties involved. Additionally, the electronic submission of the form must comply with the ESIGN and UETA acts, which validate electronic signatures in the United States. It is essential to retain a copy of the signed form for personal records and potential future reference.

Eligibility Criteria

Eligibility for a Ppsta equity loan typically depends on several factors. Borrowers must generally meet the following criteria:

- Ownership of the property being used as collateral.

- A minimum amount of equity in the property, often at least twenty percent.

- A satisfactory credit score, usually above a certain threshold.

- Stable income and a manageable debt-to-income ratio.

Quick guide on how to complete ppsta equity loan form

Prepare Ppsta Equity Loan Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents rapidly without delays. Manage Ppsta Equity Loan Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ppsta Equity Loan Form with ease

- Find Ppsta Equity Loan Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of the documents or redact confidential information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ppsta Equity Loan Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ppsta equity loan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ppsta equity loan form?

The ppsta equity loan form is a specialized document designed to simplify the process of applying for equity loans. This form allows users to provide necessary details about their financial situation and property value. With airSlate SignNow, you can easily fill out and eSign this form to streamline your loan application.

-

How do I fill out the ppsta equity loan form using airSlate SignNow?

Filling out the ppsta equity loan form with airSlate SignNow is straightforward. Simply access the form through our platform and enter all required information. The user-friendly interface guides you through the process, ensuring all necessary fields are completed for a smooth application.

-

What are the costs associated with using the ppsta equity loan form?

Using the ppsta equity loan form through airSlate SignNow is part of a cost-effective subscription plan. Pricing varies based on your needs, but our plans are designed to offer value while providing essential eSignature capabilities. Be sure to check our pricing page for details on our affordable subscription options.

-

Are there any special features of the ppsta equity loan form?

The ppsta equity loan form comes with several features that enhance user experience, including templates for easy editing and the ability to add optional fields. Additionally, airSlate SignNow ensures secure storage and encrypted data transmission for peace of mind. These features make the loan application process efficient and reliable.

-

What are the benefits of using airSlate SignNow for my ppsta equity loan form?

By using airSlate SignNow for your ppsta equity loan form, you gain access to a seamless eSigning experience that saves time and enhances productivity. Our platform simplifies document management and ensures compliance with legal standards. Furthermore, you can track the status of your form in real-time, ensuring transparency throughout the process.

-

Can the ppsta equity loan form be integrated with other tools?

Yes, the ppsta equity loan form can be easily integrated with various business tools and platforms through airSlate SignNow. This enhances your workflow by allowing for seamless data transfer and centralized document management. Popular integrations include CRM systems and cloud storage services, making it convenient to manage your documents.

-

Is the ppsta equity loan form legally binding?

Absolutely, the ppsta equity loan form created and eSigned through airSlate SignNow is legally binding. Our platform complies with eSignature laws, ensuring that your documents meet all necessary legal requirements. This gives you confidence that your agreements are enforceable and recognized by legal entities.

Get more for Ppsta Equity Loan Form

- Deephaven mortgage form

- Teach grant appeal form

- Berkeley tb medical clearance form

- Overseas registration application request form

- Septic addendum form

- Mycase securepa form

- Arizona personal representative appointment form

- Cbp form 4609 petition for remission or mitigation of forfeitures and penalities incurred

Find out other Ppsta Equity Loan Form

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online