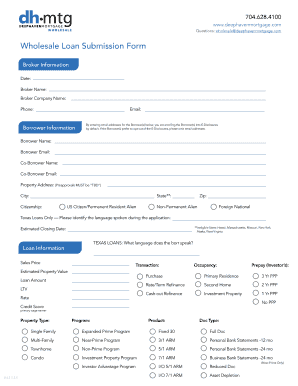

Deephaven Mortgage Form

What is the Deephaven Mortgage

The Deephaven Mortgage is a specialized loan product designed for non-QM (Qualified Mortgage) borrowers. This type of mortgage caters to individuals who may not meet traditional lending criteria due to unique financial situations. Deephaven offers flexible underwriting guidelines, making it an appealing option for self-employed individuals, those with irregular income, or borrowers with lower credit scores. This mortgage aims to provide access to home financing for a broader range of applicants, ensuring that more people can achieve their homeownership goals.

How to Obtain the Deephaven Mortgage

To obtain a Deephaven Mortgage, borrowers should first assess their eligibility based on their financial situation. The application process typically involves the following steps:

- Gather necessary documentation, including proof of income, credit history, and any relevant financial statements.

- Contact a mortgage lender that offers Deephaven products to discuss your specific needs and options.

- Submit your application along with the required documents for review.

- Work with the lender to address any questions or additional information needed during the underwriting process.

- Upon approval, review the loan terms and conditions before finalizing the mortgage.

Steps to Complete the Deephaven Mortgage

Completing the Deephaven Mortgage involves a series of steps that ensure all necessary information is accurately provided. Here’s a streamlined approach:

- Begin by filling out the mortgage application form, ensuring all personal and financial information is complete.

- Provide supporting documents such as tax returns, bank statements, and proof of assets.

- Review the terms of the mortgage, including interest rates and repayment schedules.

- Sign the necessary agreements electronically using a secure eSignature platform, ensuring compliance with legal requirements.

- Submit the completed forms to your lender for processing.

Legal Use of the Deephaven Mortgage

The legal use of the Deephaven Mortgage is governed by various federal and state regulations. It is essential for borrowers to understand that while this mortgage type offers flexibility, it must still comply with the guidelines set forth by the Consumer Financial Protection Bureau (CFPB) and other regulatory bodies. This includes ensuring that all disclosures are made clearly and that borrowers are fully informed of their rights and responsibilities under the mortgage agreement.

Key Elements of the Deephaven Mortgage

Several key elements define the Deephaven Mortgage, making it distinct from traditional mortgage products:

- Flexible Underwriting: Allows for alternative documentation and non-traditional income verification.

- Variety of Loan Options: Offers different loan types, including fixed-rate and adjustable-rate mortgages.

- Competitive Interest Rates: Provides rates that are often competitive with traditional mortgage products.

- Access for Diverse Borrowers: Aims to serve borrowers who may not qualify for conventional loans.

Eligibility Criteria

Eligibility for the Deephaven Mortgage varies based on the specific loan product, but generally includes the following criteria:

- Borrowers may need to demonstrate a minimum credit score, typically around 620.

- Income verification can include bank statements or other non-traditional documentation.

- Debt-to-income ratios are assessed, but there may be more flexibility compared to traditional loans.

- Property types eligible for financing can include primary residences, second homes, and investment properties.

Quick guide on how to complete deephaven mortgage

Complete Deephaven Mortgage effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Handle Deephaven Mortgage on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Deephaven Mortgage seamlessly

- Find Deephaven Mortgage and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Deephaven Mortgage to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Deephaven mortgage?

A Deephaven mortgage is a loan product designed to cater to borrowers who may not fit into traditional lending criteria. It offers a flexible approach to underwriting, allowing for alternative income verification and asset consideration. This can be especially beneficial for self-employed individuals or those with unique financial situations.

-

What are the benefits of a Deephaven mortgage?

The primary benefits of a Deephaven mortgage include greater flexibility in qualifying for a loan, the ability to utilize alternative documentation, and personalized loan options. This can enable prospective borrowers to secure funding that might otherwise be unavailable through conventional lenders. Additionally, it often comes with competitive rates and terms.

-

How does pricing work for a Deephaven mortgage?

Pricing for a Deephaven mortgage typically depends on various factors such as loan amount, property type, and borrower qualifications. Generally, rates may be slightly higher than traditional loans due to the increased risk. However, the flexibility offered by Deephaven allows borrowers to find options that suit their specific financial needs.

-

What features should I look for in a Deephaven mortgage?

When considering a Deephaven mortgage, look for features such as flexible income verification, customizable loan amounts, and favorable terms for self-employed borrowers. Also, ensure the lender provides comprehensive support throughout the application process. These features can signNowly ease the journey to securing a home loan.

-

How does a Deephaven mortgage compare to traditional loans?

A Deephaven mortgage differs from traditional loans in its underwriting approach, allowing for alternative income sources and documentation. Whereas conventional loans may require strict credit scores and income verification, Deephaven mortgages aim to accommodate diverse borrower situations. This makes it a suitable option for those who may struggle to meet conventional criteria.

-

Can I use airSlate SignNow to eSign documents for a Deephaven mortgage?

Yes, you can use airSlate SignNow to easily eSign documents related to your Deephaven mortgage application. Our platform simplifies the document signing process, ensuring you can complete necessary paperwork quickly and securely. This tool enhances the overall experience, allowing you to focus more on your financing journey.

-

What types of properties are eligible for a Deephaven mortgage?

Deephaven mortgages can be applied to a variety of property types, including primary residences, second homes, and investment properties. This flexibility allows many different borrowers to take advantage of these loan products. Be sure to check with your lender for specific eligibility requirements.

Get more for Deephaven Mortgage

Find out other Deephaven Mortgage

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free