Canadian Income Tax Form for

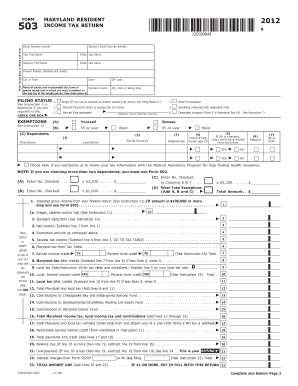

Understanding the Maryland 503 Tax Form

The Maryland 503 tax form is a crucial document for residents who need to report their income for state tax purposes. This form is specifically designed for individual income tax returns and is essential for calculating the amount of tax owed or the refund due to taxpayers. It is vital for Maryland residents to understand the details of this form to ensure compliance with state tax regulations.

Steps to Complete the Maryland 503 Tax Form

Filling out the Maryland 503 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Next, carefully enter your personal information, such as your name, address, and Social Security number. Then, report your income by completing the relevant sections of the form, including adjustments and deductions. Finally, review your entries for accuracy before submitting the form either electronically or by mail.

Legal Use of the Maryland 503 Tax Form

The Maryland 503 tax form is legally binding when filled out and submitted correctly. It must comply with state tax laws and regulations. When submitting electronically, ensure that you use a secure and compliant platform to maintain the integrity of your submission. The form serves as a declaration of your income and tax obligations, and any inaccuracies could lead to penalties or audits by the Maryland Comptroller's office.

Filing Deadlines for the Maryland 503 Tax Form

It is important to be aware of the filing deadlines for the Maryland 503 tax form. Typically, the due date for filing is April 15th of each year, coinciding with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may need to file, which must be requested before the original due date.

Required Documents for the Maryland 503 Tax Form

To complete the Maryland 503 tax form accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother filing process and help ensure all income is reported correctly.

Form Submission Methods for the Maryland 503 Tax Form

The Maryland 503 tax form can be submitted in various ways. Taxpayers can file electronically using approved e-filing software, which often provides a more efficient and secure method of submission. Alternatively, the form can be printed and mailed to the appropriate state office. It is essential to choose a submission method that aligns with your preferences and ensures timely filing.

Quick guide on how to complete canadian income tax form for

Easily Prepare Canadian Income Tax Form For on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmental alternative to traditional printed and signed documents, allowing for the correct form to be obtained and securely stored online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Canadian Income Tax Form For on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Canadian Income Tax Form For with Ease

- Obtain Canadian Income Tax Form For and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Canadian Income Tax Form For and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canadian income tax form for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland 503 tax form?

The Maryland 503 tax form is used by corporations to report their income and calculate the taxes owed to the state. It is essential for ensuring compliance with Maryland tax laws. By accurately filling out the Maryland 503 tax form, businesses can manage their tax obligations effectively and avoid penalties.

-

How can airSlate SignNow assist with the Maryland 503 tax form?

airSlate SignNow simplifies the process of completing and submitting the Maryland 503 tax form by providing a secure platform for electronic signatures. With its user-friendly interface, you can easily fill out the form and get it signed by all necessary parties. This ensures that your documents are processed quickly and efficiently.

-

What are the pricing options for airSlate SignNow when filing the Maryland 503 tax form?

airSlate SignNow offers various pricing plans tailored to suit different business needs. Whether you are a small business or a larger corporation, you can choose a plan that includes features ideal for managing your Maryland 503 tax form and other documents effectively. Check our website for detailed pricing information.

-

Is there a trial period available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial period that allows you to explore all features, including those for handling the Maryland 503 tax form. This trial gives you an opportunity to evaluate how the platform can streamline your document management processes before committing to a subscription.

-

Can I integrate airSlate SignNow with other software for filing the Maryland 503 tax form?

Absolutely! airSlate SignNow can easily integrate with various accounting and tax software, making it convenient to manage the Maryland 503 tax form alongside your other financial documents. This seamless integration enhances productivity and ensures all necessary data is synchronized across platforms.

-

What benefits does airSlate SignNow offer for businesses submitting the Maryland 503 tax form?

Utilizing airSlate SignNow for your Maryland 503 tax form needs offers several benefits, including time savings and improved accuracy. The electronic signing feature reduces the turnaround time for document approval, while templates can help ensure you include all necessary information on the form. Overall, it enhances your tax filing experience.

-

Is airSlate SignNow secure for handling sensitive information like the Maryland 503 tax form?

Yes, airSlate SignNow takes security very seriously and employs industry-standard encryption to protect your sensitive information, including the Maryland 503 tax form. Our platform ensures that your documents remain confidential and secure during transmission and storage, giving you peace of mind while managing your tax documents.

Get more for Canadian Income Tax Form For

- Ezispeak telephone interpreter booking form

- Af cp 01pdf form

- Legal draft memorandum of understanding between the opc and nsira fradocx form

- Fafsa verification what to do if youre selected usnewscom form

- What is a health maintenance organization hmo gets money form

- Form 7 sections 12 and 13 certificate of involuntary

- Ch02c newid manylion cyfarwyddwr corfforaetholchange of corporate directors details cewch ddefnyddior ffurflen hon i newid form

- Australia release medical information form

Find out other Canadian Income Tax Form For

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter