Ulbhry Form

What is the Ulbhry

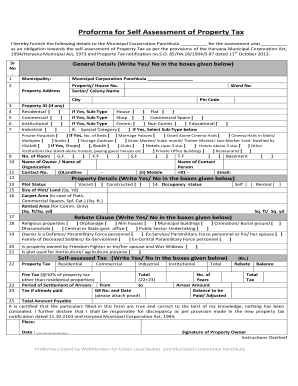

The Ulbhry is a specific form used for the self-assessment of property tax in the United States. It serves as an official document that property owners must complete to report the value of their property for tax purposes. This form is crucial for ensuring that property taxes are calculated accurately based on the current market value of the property. Understanding the Ulbhry is essential for homeowners and real estate investors alike, as it directly impacts their tax obligations.

How to use the Ulbhry

Using the Ulbhry involves several steps to ensure that all required information is accurately reported. First, gather relevant property information, including the property ID, current market value, and any applicable deductions. Next, fill out the form by entering the required details in the designated sections. It is important to double-check all entries for accuracy before submission. Once completed, the Ulbhry can be submitted online, by mail, or in person, depending on local regulations.

Steps to complete the Ulbhry

Completing the Ulbhry requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including previous tax assessments and property appraisals.

- Fill in the property details, including the Ulbhry property ID and the assessed value.

- Include any exemptions or deductions that apply to your property.

- Review the completed form for accuracy and completeness.

- Submit the form according to your local jurisdiction’s requirements.

Legal use of the Ulbhry

The Ulbhry is legally binding when completed and submitted in accordance with state and local laws. It must adhere to the regulations outlined in the relevant tax codes to ensure that it is accepted by tax authorities. Proper use of the Ulbhry not only fulfills legal obligations but also helps protect property owners from potential penalties associated with incorrect or late submissions.

Required Documents

To successfully complete the Ulbhry, certain documents are necessary. These typically include:

- Previous property tax assessments.

- Recent property appraisals or market value assessments.

- Documentation for any exemptions or deductions claimed.

- Identification information, such as a driver's license or Social Security number.

Filing Deadlines / Important Dates

Filing deadlines for the Ulbhry can vary by state and local jurisdiction. It is crucial for property owners to be aware of these deadlines to avoid penalties. Typically, the Ulbhry must be submitted annually, and deadlines may fall on specific dates, such as April fifteenth or June first, depending on local regulations. Keeping track of these dates ensures compliance and helps in effective tax planning.

Quick guide on how to complete ulbhry

Complete Ulbhry effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Ulbhry on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Ulbhry without any hassle

- Obtain Ulbhry and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form searches, or mistakes that necessitate the printing of new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Ulbhry and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ulbhry

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ulbhry and how does it relate to airSlate SignNow?

Ulbhry is a pivotal feature offered by airSlate SignNow that enhances document signing efficiency. With ulbhry, businesses can streamline their workflows and ensure quick turnaround times for important documents. This unique capability sets airSlate SignNow apart as a leading solution for eSigning.

-

What features does airSlate SignNow offer for ulbhry?

AirSlate SignNow provides a variety of features under ulbhry, including customizable templates, real-time tracking, and automated reminders. These features help organizations manage their signing processes more effectively. Utilizing ulbhry helps ensure that you stay organized and on top of all your document needs.

-

How can ulbhry benefit my business?

Utilizing ulbhry can signNowly improve your business's operational efficiency by reducing the time it takes to get documents signed. This leads to faster deal closures and improved client satisfaction. By leveraging ulbhry within airSlate SignNow, you can focus more on your core business activities while ensuring documents are signed promptly.

-

What are the pricing options for airSlate SignNow with ulbhry?

AirSlate SignNow offers competitive pricing tiers for businesses looking to leverage ulbhry features. You can choose from monthly or annual subscriptions, allowing flexibility based on your needs. Each plan provides essential features that enhance your document signing experience, making it a cost-effective investment.

-

Can I integrate airSlate SignNow ulbhry with other applications?

Yes, airSlate SignNow ulbhry can seamlessly integrate with various applications such as CRM systems, payment gateways, and productivity tools. These integrations enhance your workflow by allowing data to flow easily between systems. This interoperability ensures that your document management processes are more streamlined and efficient.

-

Is airSlate SignNow secure when using ulbhry for document signing?

Absolutely, airSlate SignNow prioritizes security when utilizing ulbhry for eSigning. The platform employs advanced encryption technologies to protect your documents and data. This makes airSlate SignNow not just user-friendly, but also a highly secure option for sensitive transactions.

-

How does ulbhry enhance collaboration in the signing process?

Ulbhry enhances collaboration by allowing multiple stakeholders to sign documents effortlessly and in a timely manner. With features such as comments and notes, team members can easily communicate within the platform. This fosters transparency and ensures everyone is on the same page throughout the document signing process.

Get more for Ulbhry

- Australia workers compensation claim form

- Community based economic development cbed technical and financial assistance program application for grant writing technical form

- Pennsylvania high school transcript request form

- Vsc 33 ucf veterans academic resource center form

- Ri unemployment direct deposit form

- Stfx transcript request form

- Republictaxpayer form

- Tender of please or admission and waiver of rights form

Find out other Ulbhry

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe