Crown Castle Property Tax Form

What is the Crown Castle Property Tax Form

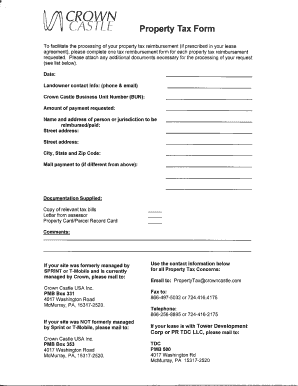

The Crown Castle Property Tax Form is a specific document used for reporting property tax information related to telecommunications infrastructure owned by Crown Castle. This form is essential for ensuring compliance with local and state tax regulations. It typically includes details about the property location, assessed value, and other relevant financial information. Accurate completion of this form is crucial for both the taxpayer and the taxing authority to ensure proper assessment and collection of property taxes.

How to use the Crown Castle Property Tax Form

Using the Crown Castle Property Tax Form involves several straightforward steps. First, gather all necessary information, including property details and financial records. Next, download the form from a reliable source or obtain it from the relevant tax authority. Fill out the form carefully, ensuring that all sections are completed accurately. Once completed, review the form for any errors or omissions before submission. Depending on local regulations, you may need to submit the form online, via mail, or in person.

Steps to complete the Crown Castle Property Tax Form

Completing the Crown Castle Property Tax Form requires attention to detail. Follow these steps for a successful submission:

- Collect all relevant property information, including location and assessed value.

- Access the Crown Castle Property Tax Form from the appropriate source.

- Fill in your personal information, including name and contact details.

- Enter the property details accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Submit the form according to the specified method, ensuring you meet any deadlines.

Legal use of the Crown Castle Property Tax Form

The legal use of the Crown Castle Property Tax Form is governed by state and local tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted within the designated time frame. Electronic submissions are generally accepted, provided they comply with eSignature laws, ensuring that the document is recognized as valid by tax authorities. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Required Documents

When completing the Crown Castle Property Tax Form, certain documents may be required to support your submission. These typically include:

- Proof of property ownership, such as a deed or title.

- Previous property tax assessments, if available.

- Financial statements or appraisals that detail the property's value.

- Any relevant correspondence from local tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Crown Castle Property Tax Form can vary by state and locality. It is crucial to be aware of these dates to avoid penalties. Generally, property tax forms must be submitted annually, with many jurisdictions requiring submission by a specific date in the spring. Check with your local tax authority for the exact deadlines applicable to your situation to ensure timely compliance.

Quick guide on how to complete crown castle property tax form

Complete Crown Castle Property Tax Form seamlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Crown Castle Property Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest approach to modify and electronically sign Crown Castle Property Tax Form effortlessly

- Locate Crown Castle Property Tax Form and click Get Form to commence.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Crown Castle Property Tax Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crown castle property tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Crown Castle Property Tax Form?

The Crown Castle Property Tax Form is a crucial document used by property owners to report taxable properties owned by Crown Castle. This form helps ensure accurate property valuations and compliance with tax regulations. Understanding how to fill out this form correctly is essential for property management.

-

How does airSlate SignNow help with the Crown Castle Property Tax Form?

airSlate SignNow streamlines the process of completing and signing the Crown Castle Property Tax Form. With features like templates and eSigning, it enables users to easily fill out and submit necessary documents. This efficiency saves time and reduces the possibility of errors in submission.

-

What are the pricing options for airSlate SignNow when handling the Crown Castle Property Tax Form?

Pricing for airSlate SignNow is designed to be affordable, ensuring that businesses of all sizes can manage their Crown Castle Property Tax Form efficiently. Various plans are available, tailored to different needs, including essential features for eSigning and document management. Check the website for the latest pricing details.

-

Can airSlate SignNow integrate with other tools for managing the Crown Castle Property Tax Form?

Yes, airSlate SignNow offers seamless integrations with popular tools like Google Drive and Dropbox. This capability enhances your ability to store and manage the Crown Castle Property Tax Form alongside other important documents. Integration makes it easier to collaborate and access necessary files quickly.

-

What security measures does airSlate SignNow implement for the Crown Castle Property Tax Form?

airSlate SignNow prioritizes the security of sensitive documents like the Crown Castle Property Tax Form. The platform employs robust encryption methods and complies with legal standards to protect your information during signing and storage. Users can trust that their data is safe and securely handled.

-

Is there customer support available for issues related to the Crown Castle Property Tax Form on airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any questions regarding the Crown Castle Property Tax Form. Whether you need help with technical issues or guidance on completing the form, expert support is readily available through multiple channels. Users can easily signNow out for assistance.

-

How can I ensure that my Crown Castle Property Tax Form is filed on time using airSlate SignNow?

To ensure timely filing of the Crown Castle Property Tax Form, utilize airSlate SignNow's reminders and notification features. These tools help you stay on track with deadlines and ensure that you complete all necessary steps before submission. Setting up a workflow within the platform can further streamline the process.

Get more for Crown Castle Property Tax Form

- Requirements are referred to as the individuals with disabilities education act idea form

- Complaint form counselor social worker and marriage ampamp family cswmft ohio

- Complaint orm sos tn gov filess3amazonawscom form

- Documents and forms welcome to the city of houston

- 2018 water district consent application form houston

- Free wyoming firearm bill of sale form wordpdfeforms

- Dor form 82162 affidavit of property value arizona

- Dr0026 form

Find out other Crown Castle Property Tax Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online