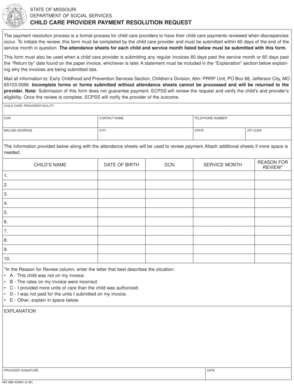

Missouri Child Care Provider Payment Form

What is the Missouri Child Care Provider Payment?

The Missouri Child Care Provider Payment is a financial assistance program designed to support eligible families in accessing child care services. This program helps cover the costs associated with child care, making it more affordable for working parents and guardians. The payments are typically issued to licensed child care providers who serve eligible children, ensuring that families can secure quality care while they work or pursue education.

Steps to Complete the Missouri Child Care Provider Payment

Completing the Missouri Child Care Provider Payment involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information about the child and the provider, including names, addresses, and contact details.

- Complete the payment resolution request form, ensuring all fields are filled out accurately.

- Include any required documentation, such as proof of eligibility or income verification.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, depending on your preference and the guidelines provided.

Legal Use of the Missouri Child Care Provider Payment

The Missouri Child Care Provider Payment is legally binding when completed in accordance with state regulations. To ensure legal compliance, it is essential to follow the outlined procedures for filling out and submitting the payment resolution request. This includes obtaining necessary signatures and maintaining records of all communications and submissions related to the payment request.

Required Documents

When submitting the Missouri Child Care Provider Payment, certain documents are essential to validate the request. These typically include:

- Proof of child care eligibility, such as a letter from a caseworker or eligibility notice.

- Documentation of income, if applicable, to verify financial need.

- Identification and licensing information for the child care provider.

Who Issues the Form?

The Missouri Child Care Provider Payment form is issued by the Missouri Department of Social Services. This agency oversees the administration of child care assistance programs and ensures that providers and families meet the necessary criteria for participation. It is important to refer to their guidelines for the most current information regarding the form and its requirements.

State-Specific Rules for the Missouri Child Care Provider Payment

Each state has specific rules governing child care payments. In Missouri, these rules include eligibility criteria, payment limits, and documentation requirements. Understanding these regulations is crucial for both providers and families to navigate the payment process effectively. Compliance with state guidelines helps ensure that payments are processed smoothly and that families receive the support they need.

Quick guide on how to complete missouri child care provider payment

Effortlessly Prepare Missouri Child Care Provider Payment on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Missouri Child Care Provider Payment from any device using the airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

The Easiest Way to Modify and Electronically Sign Missouri Child Care Provider Payment Stress-Free

- Obtain Missouri Child Care Provider Payment and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it onto your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Missouri Child Care Provider Payment to ensure clear communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri child care provider payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Missouri child care payment resolution request?

A Missouri child care payment resolution request is a formal process for addressing payment issues related to child care services. This request can help you resolve discrepancies or disputes efficiently, ensuring that financial obligations are met. Using airSlate SignNow, you can manage and sign these requests easily and securely.

-

How can airSlate SignNow help with my Missouri child care payment resolution request?

airSlate SignNow streamlines the process of submitting a Missouri child care payment resolution request by enabling electronic signatures and document management. You can quickly gather necessary approvals and track the status of your requests. This saves you time and reduces administrative hassles.

-

What are the pricing options for using airSlate SignNow for payment resolution requests?

airSlate SignNow offers various pricing tiers, allowing you to choose a plan that fits your business needs. Each plan provides access to features that make handling Missouri child care payment resolution requests efficient and affordable. You can opt for a monthly or annual subscription based on your usage requirements.

-

What features does airSlate SignNow offer for handling payment resolution requests?

With airSlate SignNow, you can utilize features like eSignature, document templates, and real-time tracking for your Missouri child care payment resolution request. The platform also supports collaboration, allowing multiple users to review and sign documents simultaneously. These features enhance efficiency and accuracy in your payment resolution process.

-

Can I integrate airSlate SignNow with other systems for my payment resolution requests?

Yes, airSlate SignNow offers integrations with various applications and platforms, making it easy to incorporate it into your existing workflow. Whether you use CRM systems, accounting software, or document management tools, integrating with airSlate SignNow can simplify your Missouri child care payment resolution requests. This ensures seamless communication and data transfer across platforms.

-

Is airSlate SignNow suitable for individuals or only for businesses handling payment resolution requests?

airSlate SignNow is designed to cater to both individuals and businesses managing Missouri child care payment resolution requests. Its user-friendly interface makes it accessible for anyone needing to send, receive, and sign documents. Whether you’re an individual caregiver or a large organization, airSlate SignNow can meet your needs effectively.

-

How secure is airSlate SignNow when processing payment resolution requests?

Security is a top priority for airSlate SignNow. When processing your Missouri child care payment resolution request, the platform uses advanced encryption and compliance measures to protect your sensitive information. You can trust airSlate SignNow to safeguard your data throughout the entire document signing and management process.

Get more for Missouri Child Care Provider Payment

- Vermilionparishlasitesthrillsharecom o des2022 2023 domicile affidavit verifying student residence 2022 form

- Rhode island renewal license form

- Piedmont assistance form

- Harford county sheriffs officebel airlegal company form

- Wwwetccmueducmu2013 student handbookgraduate student handbook carnegie mellon university form

- Application for compassionate assistance loan nn0991e complete this form to apply for a compassionate assistance loan from

- Afrimat ltd company profilewestern cape western cape form

- Wwwrentwhidbeycomapplication guidelinesrental application policies and guidelines windermere form

Find out other Missouri Child Care Provider Payment

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy