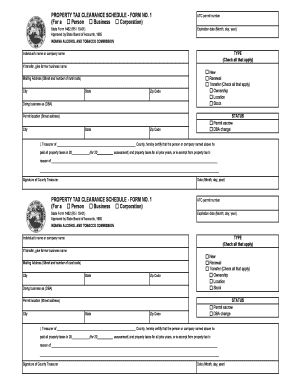

Property Tax Clearance Schedule Double Indiana Tippecanoe in Form

What is the property tax clearance form in Indiana?

The property tax clearance form in Indiana is a crucial document that certifies that all property taxes have been paid in full. This form is often required during real estate transactions, ensuring that the property being sold does not have any outstanding tax liabilities. It serves to protect both buyers and sellers by confirming that the property is free from tax-related encumbrances. Understanding the significance of this form is essential for anyone involved in property transactions in Indiana.

How to obtain the property tax clearance form in Indiana

To obtain the property tax clearance form in Indiana, individuals typically need to contact their local county auditor's office. Each county may have its own procedures for issuing this form. Generally, the process involves providing proof of property ownership and confirming that all taxes have been settled. Some counties may offer the option to request the form online, while others may require in-person visits or mail requests. It is advisable to check with the specific county for detailed instructions and any associated fees.

Steps to complete the property tax clearance form in Indiana

Completing the property tax clearance form in Indiana involves several important steps:

- Gather necessary documentation, including proof of property ownership and payment receipts for property taxes.

- Contact the local county auditor's office to request the form and understand any specific requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Submit the completed form along with any required documentation to the county auditor's office.

- Keep a copy of the submitted form and any correspondence for your records.

Legal use of the property tax clearance form in Indiana

The property tax clearance form in Indiana holds legal significance, particularly in real estate transactions. It is often required by lenders, title companies, and buyers to ensure that the property is not burdened by unpaid taxes. Failure to provide this form can lead to complications in closing a sale or securing financing. Therefore, understanding its legal implications is essential for all parties involved in property dealings.

Key elements of the property tax clearance form in Indiana

The property tax clearance form typically includes several key elements:

- Property identification details, such as the address and parcel number.

- Owner's name and contact information.

- A statement confirming that all property taxes have been paid.

- Signature of the county auditor or authorized representative.

- Date of issuance.

Required documents for the property tax clearance form in Indiana

When applying for the property tax clearance form in Indiana, certain documents are generally required:

- Proof of property ownership, such as a deed or title.

- Receipts or statements showing that property taxes have been paid.

- Identification, such as a driver's license or state ID, to verify the applicant's identity.

Quick guide on how to complete property tax clearance schedule double indiana tippecanoe in

Effortlessly Prepare Property Tax Clearance Schedule Double Indiana Tippecanoe In on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Property Tax Clearance Schedule Double Indiana Tippecanoe In on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Alter and Electronically Sign Property Tax Clearance Schedule Double Indiana Tippecanoe In Without Difficulty

- Locate Property Tax Clearance Schedule Double Indiana Tippecanoe In and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Choose your preferred method for sending your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign Property Tax Clearance Schedule Double Indiana Tippecanoe In and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax clearance schedule double indiana tippecanoe in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS 1462 notice example?

An IRS 1462 notice example is a communication from the IRS informing taxpayers of potential discrepancies or issues related to their tax returns. Understanding this notice can help you take prompt action to resolve any tax-related concerns. It's essential to review the details carefully and consult with a tax professional if needed.

-

How can airSlate SignNow help with managing IRS 1462 notices?

With airSlate SignNow, you can seamlessly eSign and send tax-related documents, including responses to IRS 1462 notices. Our platform provides a streamlined solution for managing important paperwork, ensuring that you can address notices quickly and efficiently. This capability helps maintain compliance and reduces stress during tax season.

-

Is there a cost associated with using airSlate SignNow for IRS 1462 notice examples?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, which include features for managing IRS 1462 notice examples. We provide a cost-effective solution ensuring you only pay for what you need. Our transparent pricing structures make it easy for businesses to choose the right plan for their requirements.

-

What features does airSlate SignNow offer for handling IRS notices?

airSlate SignNow provides robust features for managing IRS notices, including templates for IRS 1462 notice examples, electronic signatures, and document storage. These features enhance collaboration and ensure that all communication is secure and compliant. Additionally, our platform allows for easy integration with other business tools.

-

Can airSlate SignNow integrate with my existing tax software?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various tax software applications, making it easier to manage IRS 1462 notice examples alongside your tax documentation. This integration streamlines your workflow and provides a comprehensive approach to tax management, ensuring no detail is overlooked.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents allows for greater efficiency, security, and organization. You can handle IRS 1462 notice examples and other critical documents electronically, signNowly reducing paper waste. The platform also provides a reliable audit trail, which is crucial when dealing with sensitive IRS communications.

-

How quickly can I get started with airSlate SignNow?

Getting started with airSlate SignNow is incredibly quick and easy. You can sign up for an account, choose your plan, and begin using features for managing IRS 1462 notice examples within minutes. Our user-friendly interface also ensures that you won’t need extensive training to navigate the platform.

Get more for Property Tax Clearance Schedule Double Indiana Tippecanoe In

- Mortgagors to mortgagee and recorded form

- Contract documents and specifications for demolition city of ottawa form

- Lien statement contractor individual form

- Correct way to address a business envelopechroncom form

- Subcontractors affidavit of warning form

- County kansas declare this as a codicil to my will dated form

- Quotcontractorquot and form

- Specific propertyfree legal forms

Find out other Property Tax Clearance Schedule Double Indiana Tippecanoe In

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile