Form 33 Nebraska

What is the Form 33 Nebraska

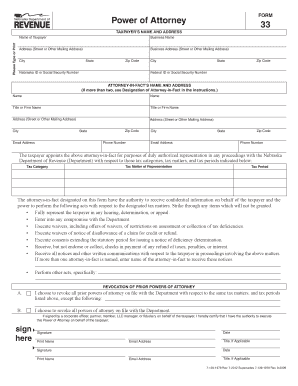

The Form 33 Nebraska is a legal document used primarily for granting power of attorney in the state of Nebraska. This form allows individuals to designate another person to make decisions on their behalf regarding financial and legal matters. The power of attorney can be limited to specific tasks or can be broad, depending on the needs of the individual. Understanding the purpose and implications of this form is crucial for ensuring that your wishes are respected and legally upheld.

How to use the Form 33 Nebraska

Using the Form 33 Nebraska involves several steps to ensure it is completed correctly and legally binding. First, the individual granting power of attorney must fill out the form with accurate information, including their name, the name of the agent, and the specific powers being granted. It's important to review the form thoroughly to ensure all details are correct. Once completed, the form should be signed in the presence of a notary public to validate the document. This notarization is essential for the form to be accepted by financial institutions and other entities.

Steps to complete the Form 33 Nebraska

Completing the Form 33 Nebraska requires careful attention to detail. Here are the steps to follow:

- Obtain the Form 33 Nebraska from a reliable source, ensuring it is the most current version.

- Fill in your personal information, including your full name and address.

- Designate your agent by providing their name and contact information.

- Clearly outline the powers you wish to grant to your agent, specifying any limitations.

- Sign the form in front of a notary public to ensure its legality.

- Provide copies of the signed form to your agent and any relevant institutions.

Legal use of the Form 33 Nebraska

The legal use of the Form 33 Nebraska is governed by state laws that outline the requirements for power of attorney documents. To be considered legally binding, the form must be signed and notarized. It is also essential that the individual granting power of attorney is of sound mind and understands the implications of their decision. This form can be used in various situations, such as managing financial affairs, making healthcare decisions, or handling property transactions.

Key elements of the Form 33 Nebraska

Several key elements must be included in the Form 33 Nebraska for it to be valid:

- Principal Information: The full name and address of the individual granting power of attorney.

- Agent Information: The name and contact details of the person designated to act on behalf of the principal.

- Powers Granted: A clear description of the specific powers being granted to the agent.

- Signatures: The signature of the principal and the notary public.

- Date: The date on which the form is signed.

Examples of using the Form 33 Nebraska

The Form 33 Nebraska can be utilized in various scenarios. For example, an elderly individual may use this form to appoint a trusted family member to manage their financial affairs as they age. Similarly, a business owner might grant power of attorney to a partner to handle transactions when they are unavailable. Each situation may require different specifications in the form, emphasizing the importance of clearly outlining the powers granted.

Quick guide on how to complete form 33 nebraska

Easily Prepare Form 33 Nebraska on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage Form 33 Nebraska across any platform using airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Form 33 Nebraska

- Obtain Form 33 Nebraska and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form queries, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 33 Nebraska to foster exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 33 nebraska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 33 sample and how can it be used?

A form 33 sample is a standardized document template that can be easily customized for various purposes. It facilitates efficient information collection and can be used in legal, financial, or administrative contexts. With airSlate SignNow, you can seamlessly integrate this form into your workflow for faster processing.

-

How does airSlate SignNow enhance the management of form 33 samples?

With airSlate SignNow, managing form 33 samples becomes simple and efficient. Our platform allows you to create, edit, and share these samples in a few clicks, ensuring that your team can collaborate effectively. Plus, you can track the progress and receive notifications when forms are completed.

-

What are the pricing options for using airSlate SignNow with form 33 samples?

airSlate SignNow offers flexible pricing plans tailored to different business needs, allowing you to choose the best option for managing form 33 samples. Each plan provides access to essential features that help streamline your document processes. For detailed pricing information, you can visit our website or contact our sales team.

-

Can I integrate form 33 samples with other applications using airSlate SignNow?

Yes, airSlate SignNow provides seamless integration with various applications, allowing you to enhance your use of form 33 samples. By connecting with your favorite apps like Google Drive, Dropbox, and CRMs, you can automate workflows and improve overall efficiency. Explore our integration options to find what suits your needs best.

-

What is the benefit of using electronic signatures on form 33 samples?

Using electronic signatures on form 33 samples provides numerous benefits, including enhanced security and faster processing times. airSlate SignNow ensures that your signed documents are legally binding and compliant with regulations. This shift to digital not only saves time but also reduces paper waste.

-

Is it easy to customize a form 33 sample in airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to customize a form 33 sample to fit your specific needs. With user-friendly tools, you can add fields, modify layouts, and incorporate branding elements without any technical expertise. Start creating personalized forms in minutes.

-

What security measures does airSlate SignNow implement for form 33 samples?

airSlate SignNow takes the security of your form 33 samples seriously. We utilize high-level encryption protocols to protect your data, ensuring confidentiality during the signing process. Additionally, our platform provides audit trails for every document, offering you peace of mind.

Get more for Form 33 Nebraska

- Agreement general form

- Speaking engagement form

- Agreement letter of understanding regarding terms of proposed contract form

- New pricing policy form

- I recently purchased fifty widgets from your company and upon receiving my shipment i form

- Apology to customer for accounting error form

- Apology for misconduct employee to boss form

- To use this letterhead double click on the your name above form

Find out other Form 33 Nebraska

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe