Form 8880

What is the Form 8880

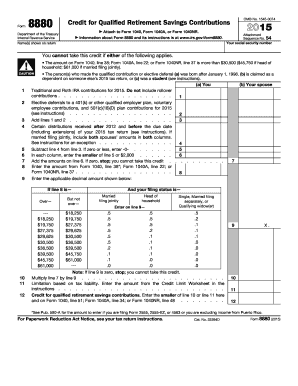

The Form 8880, officially known as the Credit for Qualified Retirement Savings Contributions, is a tax form used by individuals in the United States to claim a tax credit for contributions made to eligible retirement savings accounts. This form is particularly beneficial for low- to moderate-income earners, as it helps reduce their tax liability while encouraging savings for retirement. By completing this form, taxpayers can potentially receive a credit of up to fifty percent of their contributions, depending on their income level and filing status.

How to use the Form 8880

Using the Form 8880 involves several steps to ensure accurate completion and submission. First, determine your eligibility based on your income and filing status. Next, gather documentation of your retirement contributions, such as statements from your financial institution. Fill out the form by providing personal information, including your Social Security number and details about your contributions. After completing the form, you will need to attach it to your tax return when filing. Ensure that you keep a copy for your records.

Steps to complete the Form 8880

Completing the Form 8880 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your tax return and proof of retirement contributions.

- Review the eligibility criteria to confirm that you qualify for the credit.

- Fill out your personal information, including your name, address, and Social Security number.

- Report the amount of your contributions to eligible retirement accounts.

- Calculate the credit amount based on your contributions and income level.

- Attach the completed form to your tax return and submit it to the IRS.

Legal use of the Form 8880

The legal use of the Form 8880 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their contributions and adhere to the eligibility requirements outlined by the IRS. This includes maintaining proper documentation of contributions and ensuring that the amounts claimed on the form are correct. Misrepresentation or errors can lead to penalties or disqualification from claiming the credit.

Eligibility Criteria

To qualify for the tax credit using the Form 8880, taxpayers must meet specific eligibility criteria. These include:

- Filing status: Must be single, married filing jointly, head of household, or married filing separately.

- Income limits: Adjusted gross income must fall below certain thresholds, which vary based on filing status.

- Age: Must be at least eighteen years old by the end of the tax year.

- Retirement accounts: Contributions must be made to eligible retirement plans, such as IRAs or 401(k)s.

Filing Deadlines / Important Dates

When filing the Form 8880, it is crucial to be aware of the relevant deadlines. The form must be submitted along with your annual tax return, typically due on April fifteenth of the following year. If you are unable to meet this deadline, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Additionally, keep an eye on any updates from the IRS regarding changes to tax laws or deadlines that may affect your filing.

Quick guide on how to complete form 8880 10795411

Complete Form 8880 with ease on any device

Managing digital documents has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the required form and securely archivate it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Form 8880 on any device using airSlate SignNow mobile applications for Android or iOS, and enhance any document-driven task today.

How to modify and eSign Form 8880 effortlessly

- Locate Form 8880 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8880 and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8880 10795411

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 form 8880, and who should fill it out?

The 2015 form 8880 is used to claim the Retirement Savings Contributions Credit, which is beneficial for low- to moderate-income taxpayers. If you contributed to a qualified retirement plan during the tax year, you may be eligible to fill out and submit the 2015 form 8880 to receive valuable tax credits.

-

How can airSlate SignNow facilitate the submission of the 2015 form 8880?

With airSlate SignNow, you can easily eSign and send the 2015 form 8880 securely online, streamlining the process. The platform allows you to fill out the form electronically, ensuring accuracy and compliance while providing a hassle-free experience for your tax submission.

-

What are the pricing options for using airSlate SignNow for submitting the 2015 form 8880?

airSlate SignNow offers a variety of pricing plans that cater to both individuals and businesses looking to submit the 2015 form 8880 efficiently. With affordable monthly subscriptions, you can easily choose a plan that fits your needs, ensuring a cost-effective solution for eSigning your documents.

-

Can I save my completed 2015 form 8880 in airSlate SignNow for future reference?

Yes, once you complete and eSign your 2015 form 8880 using airSlate SignNow, it will be securely stored in your account. This allows you to access it whenever needed for future reference or to prepare for subsequent tax filings with ease.

-

What features does airSlate SignNow offer for managing the 2015 form 8880?

airSlate SignNow provides a user-friendly interface and essential features such as document templates, customizable workflows, and secure eSigning options for the 2015 form 8880. These features ensure that the entire process of completing and submitting your form is both efficient and reliable.

-

Are there integrations available to help with the 2015 form 8880 using airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with popular tax software and document management systems, simplifying your process of completing the 2015 form 8880. These integrations allow for seamless data transfer and collaboration, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the 2015 form 8880?

Using airSlate SignNow for the 2015 form 8880 provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's features allow you to fill out, eSign, and store your tax documents securely, ensuring a stress-free tax filing experience.

Get more for Form 8880

- Clean water act model pleadings and discovery from current form

- Assumption agreement mortgage 481379070 form

- Ar pc bl form

- Affidavit of mailing individual form

- Alternative dispute resolution adr statement to the court fam ct procedures alternative dispute resolution adr form

- Request for admission of form

- Litigation interrogatories form

- Production of documents form

Find out other Form 8880

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure