ASSUMPTION AGREEMENT MORTGAGE Form

What is the assumption agreement mortgage?

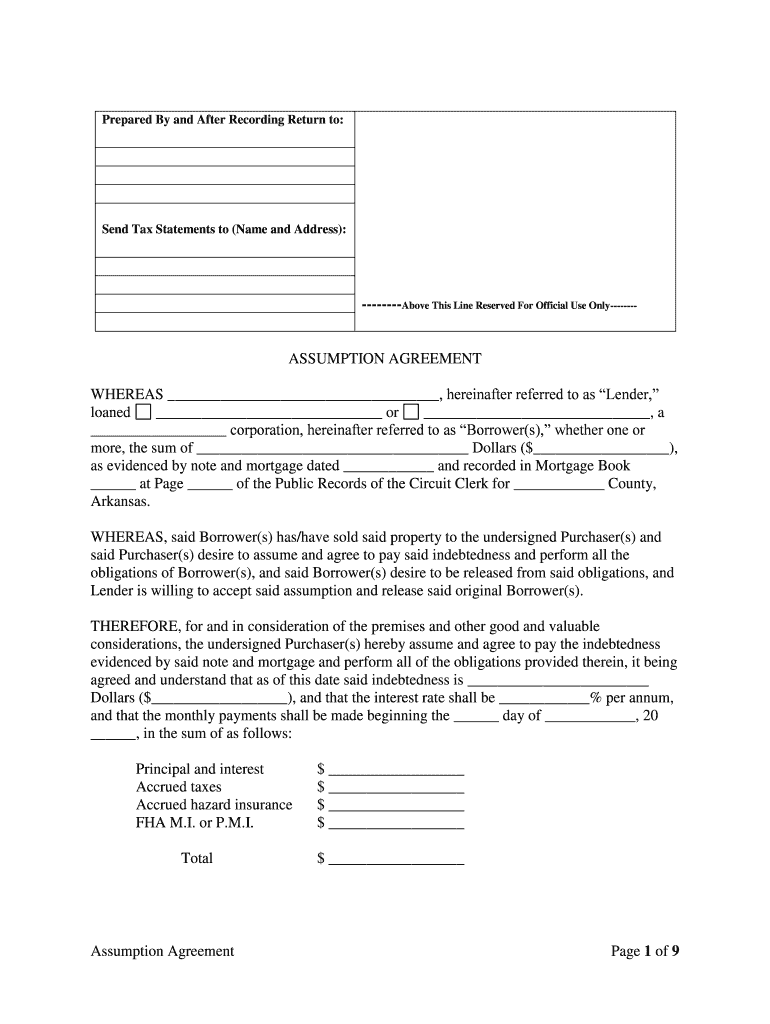

An assumption agreement mortgage is a legal document that allows a buyer to take over the seller's existing mortgage. This agreement typically involves the buyer assuming the remaining balance of the mortgage and adhering to its terms. The original borrower remains liable for the mortgage until it is fully paid off, but the buyer effectively steps into their shoes. This arrangement can be beneficial for buyers who want to take advantage of lower interest rates or favorable loan terms that are no longer available in the current market.

How to use the assumption agreement mortgage

Using an assumption agreement mortgage involves several steps. First, the buyer must express interest in assuming the mortgage to the seller and the lender. The lender will then assess the buyer's creditworthiness and financial situation to determine if they qualify to assume the mortgage. If approved, the buyer and seller will complete the assumption agreement, which outlines the terms of the mortgage assumption. It is essential to ensure that all parties understand their obligations under the agreement, as this will prevent potential disputes in the future.

Steps to complete the assumption agreement mortgage

Completing an assumption agreement mortgage involves a series of steps:

- Review the existing mortgage: Understand the terms and conditions of the current mortgage, including interest rates and payment schedules.

- Obtain lender approval: Contact the lender to confirm that the mortgage is assumable and to initiate the approval process for the buyer.

- Negotiate terms: Discuss and agree on the terms of the assumption with the seller, including any necessary adjustments to the purchase price.

- Draft the assumption agreement: Prepare the legal document that outlines the terms of the mortgage assumption, ensuring it complies with relevant laws.

- Sign the agreement: All parties involved must sign the assumption agreement to make it legally binding.

- Notify the lender: Submit the signed agreement to the lender for their records and to finalize the assumption process.

Key elements of the assumption agreement mortgage

Key elements of an assumption agreement mortgage include:

- Parties involved: The document should clearly identify the seller, buyer, and lender.

- Mortgage details: Include the original loan amount, remaining balance, interest rate, and payment schedule.

- Assumption terms: Outline the conditions under which the buyer will assume the mortgage, including any responsibilities for property taxes and insurance.

- Default provisions: Specify what happens in the event of a default on the mortgage payments.

- Signatures: Ensure all parties sign the document to validate the agreement.

Legal use of the assumption agreement mortgage

The legal use of an assumption agreement mortgage requires adherence to specific regulations. The agreement must comply with federal and state laws governing mortgage assumptions. Additionally, it is crucial to ensure that the lender's policies allow for such assumptions. Proper documentation and signatures are necessary to make the agreement enforceable in a court of law. Failure to comply with these legal requirements may result in disputes or the invalidation of the agreement.

State-specific rules for the assumption agreement mortgage

State-specific rules can significantly affect the use of an assumption agreement mortgage. Each state may have different regulations regarding the assumption of mortgages, including disclosure requirements and the rights of the parties involved. It is essential for both buyers and sellers to familiarize themselves with their state's laws to ensure compliance. Consulting with a legal professional or real estate expert can provide valuable guidance on navigating these regulations effectively.

Quick guide on how to complete assumption agreement mortgage 481379070

Conveniently Prepare ASSUMPTION AGREEMENT MORTGAGE on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage ASSUMPTION AGREEMENT MORTGAGE on every device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign ASSUMPTION AGREEMENT MORTGAGE Effortlessly

- Obtain ASSUMPTION AGREEMENT MORTGAGE and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether via email, SMS, or invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, endless form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign ASSUMPTION AGREEMENT MORTGAGE to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ASSUMPTION AGREEMENT MORTGAGE?

An ASSUMPTION AGREEMENT MORTGAGE allows a buyer to take over the seller's mortgage obligations. This means the buyer assumes the responsibility for the remaining mortgage payments, often at the original interest rate. It's a beneficial option for buyers looking to secure favorable terms without going through the traditional mortgage approval process.

-

How can airSlate SignNow help with my ASSUMPTION AGREEMENT MORTGAGE?

airSlate SignNow provides an easy platform to create and eSign your ASSUMPTION AGREEMENT MORTGAGE documents securely. The user-friendly interface allows you to customize documents and streamline the signing process, ensuring that all parties can quickly and efficiently finalize the agreement without hassle.

-

What are the benefits of using airSlate SignNow for an ASSUMPTION AGREEMENT MORTGAGE?

Using airSlate SignNow for your ASSUMPTION AGREEMENT MORTGAGE streamlines the entire process, saving you time and reducing paperwork. The platform also offers secure digital signing, easy document sharing, and compliance with legal standards, allowing you to focus on what matters most—finalizing the agreement.

-

Is airSlate SignNow cost-effective for managing ASSUMPTION AGREEMENT MORTGAGE documents?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective choice for managing your ASSUMPTION AGREEMENT MORTGAGE documents. With features like unlimited document signing and storage, you can save money compared to traditional methods while enhancing your efficiency.

-

Can I integrate airSlate SignNow with other tools for managing an ASSUMPTION AGREEMENT MORTGAGE?

Absolutely! airSlate SignNow integrates seamlessly with many popular business tools, including CRM systems and cloud storage services. This allows you to manage your ASSUMPTION AGREEMENT MORTGAGE alongside your other workflows, facilitating a more integrated approach to your documentation.

-

What security measures does airSlate SignNow use for ASSUMPTION AGREEMENT MORTGAGE documents?

airSlate SignNow employs advanced security measures to protect your ASSUMPTION AGREEMENT MORTGAGE documents, including encryption and secure access protocols. All documents are stored securely, ensuring that sensitive information remains confidential and protected from unauthorized access.

-

How do I get started with airSlate SignNow for my ASSUMPTION AGREEMENT MORTGAGE?

Getting started with airSlate SignNow for your ASSUMPTION AGREEMENT MORTGAGE is simple. Just sign up for an account, and you can create or upload your documents to begin the eSigning process. Our onboarding resources and customer support are also available to help you along the way.

Get more for ASSUMPTION AGREEMENT MORTGAGE

- Oklahoma form 513 instructions

- F515018 form

- Fcso medicare form

- Head start lesson plan template form

- Cincinnati public schools administration of medication form

- Unrepresented seller compensation agreement form

- Mississippi employeeamp39s withholding exemption certificate form

- Superior court of california county of santa cruz 622949132 form

Find out other ASSUMPTION AGREEMENT MORTGAGE

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors