City of Dayton Tax Forms

What is the City of Dayton Tax Forms

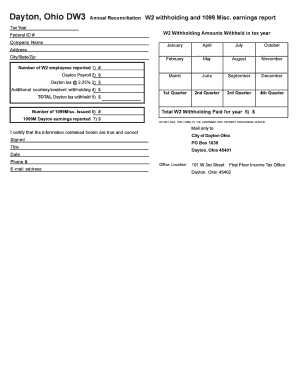

The city of Dayton tax forms are official documents required for local tax filings. These forms are essential for residents and businesses to report income, calculate tax liabilities, and ensure compliance with local tax regulations. The forms vary based on the type of tax being filed, such as income tax, property tax, or business taxes. Understanding these forms is crucial for accurate reporting and to avoid potential penalties.

How to obtain the City of Dayton Tax Forms

To obtain the city of Dayton tax forms, individuals can visit the official city government website or the local tax office. Many forms are available for download in PDF format, allowing users to print and complete them at their convenience. Additionally, forms can often be requested directly from local tax offices or through designated community centers that provide assistance with tax-related matters.

Steps to complete the City of Dayton Tax Forms

Completing the city of Dayton tax forms involves several key steps:

- Gather necessary documentation, including income statements, previous tax returns, and any relevant financial records.

- Download the appropriate tax form from the city’s website or obtain a physical copy from a local office.

- Carefully read the instructions provided with the form to ensure accurate completion.

- Fill out the form, ensuring all required fields are completed and calculations are accurate.

- Review the form for any errors or omissions before submission.

Legal use of the City of Dayton Tax Forms

The city of Dayton tax forms are legally binding documents. When completed and submitted, they serve as official records of an individual's or business's tax obligations. It is important to adhere to local laws and regulations when filling out these forms. Providing false information or failing to submit them on time can result in legal penalties, including fines and interest on unpaid taxes.

Form Submission Methods

Taxpayers in Dayton can submit their completed tax forms through various methods:

- Online: Many forms can be submitted electronically via the city’s tax portal, ensuring a faster processing time.

- Mail: Completed forms can be mailed to the designated tax office address. It is advisable to use certified mail for tracking purposes.

- In-Person: Individuals may also choose to submit their forms in person at local tax offices, where staff can provide assistance if needed.

Filing Deadlines / Important Dates

Filing deadlines for the city of Dayton tax forms are critical for compliance. Typically, individual income tax returns must be filed by April 15 each year. Businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid late fees and penalties. Taxpayers should also be aware of any extensions that may apply to specific forms or situations.

Quick guide on how to complete city of dayton tax forms

Prepare City Of Dayton Tax Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents rapidly without delays. Manage City Of Dayton Tax Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign City Of Dayton Tax Forms with ease

- Locate City Of Dayton Tax Forms and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information carefully and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from your device of choice. Edit and eSign City Of Dayton Tax Forms to ensure excellent communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of dayton tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for city of Dayton tax forms?

Using airSlate SignNow for city of Dayton tax forms streamlines the eSigning process, allowing you to complete your taxes faster and with greater accuracy. The platform offers a user-friendly interface, making it accessible for everyone, regardless of technical expertise. Additionally, it enhances security by providing encryption and authentication features, ensuring sensitive information remains protected.

-

How does airSlate SignNow integrate with existing tax software for city of Dayton tax forms?

airSlate SignNow offers seamless integrations with various tax software platforms, simplifying the process of managing city of Dayton tax forms. By linking your existing software, you can directly send, receive, and eSign documents without switching between applications. This integration increases efficiency and reduces the likelihood of errors during the tax filing process.

-

What is the pricing structure for using airSlate SignNow for city of Dayton tax forms?

airSlate SignNow provides flexible pricing plans designed to accommodate both individuals and businesses filing city of Dayton tax forms. You can choose from monthly or annual subscriptions based on your usage needs. The cost-effectiveness of the platform ensures that you can manage your tax documents without breaking the bank.

-

Is it easy to create and send city of Dayton tax forms with airSlate SignNow?

Yes, creating and sending city of Dayton tax forms with airSlate SignNow is straightforward. The platform allows you to upload your documents, customize them using templates, and add fields for signatures in just a few clicks. This ease of use makes it ideal for users at all levels who need to manage their tax filings efficiently.

-

What features does airSlate SignNow offer for managing city of Dayton tax forms?

airSlate SignNow includes several powerful features for managing city of Dayton tax forms. You can easily eSign documents, track their status in real-time, and send reminders to signers. Additionally, the platform provides storage solutions for all your completed forms, making it easy to access them whenever needed.

-

Can airSlate SignNow help simplify compliance for city of Dayton tax forms?

Absolutely! airSlate SignNow helps simplify compliance for city of Dayton tax forms by ensuring all documents are securely stored and accessible. With features like audit trails and timestamps, you can easily prove compliance during audits or inquiries. This transparency helps you feel confident during tax season.

-

What kind of support does airSlate SignNow provide for city of Dayton tax forms users?

airSlate SignNow offers robust customer support for users of city of Dayton tax forms. Whether you have questions about the platform or need assistance resolving an issue, support is readily available via chat, email, or phone. Additionally, a comprehensive help center provides resources and FAQs to guide you through any challenges.

Get more for City Of Dayton Tax Forms

- In re washington public power supply sys sec lit 779 f form

- Complaint letters that get resultspdf docsharetips form

- Abarca et al vs merck ampampamp co etal form

- Tenantnet getting and keeping gas and electricity form

- Information sheet civil case plaintiff supreme court of

- Notice to landlord inadequacy of heating resources insufficient heat form

- Alabama rules of civil procedure process serving rules form

- Rule 41 service of other process ala r civ p 41casetext form

Find out other City Of Dayton Tax Forms

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement